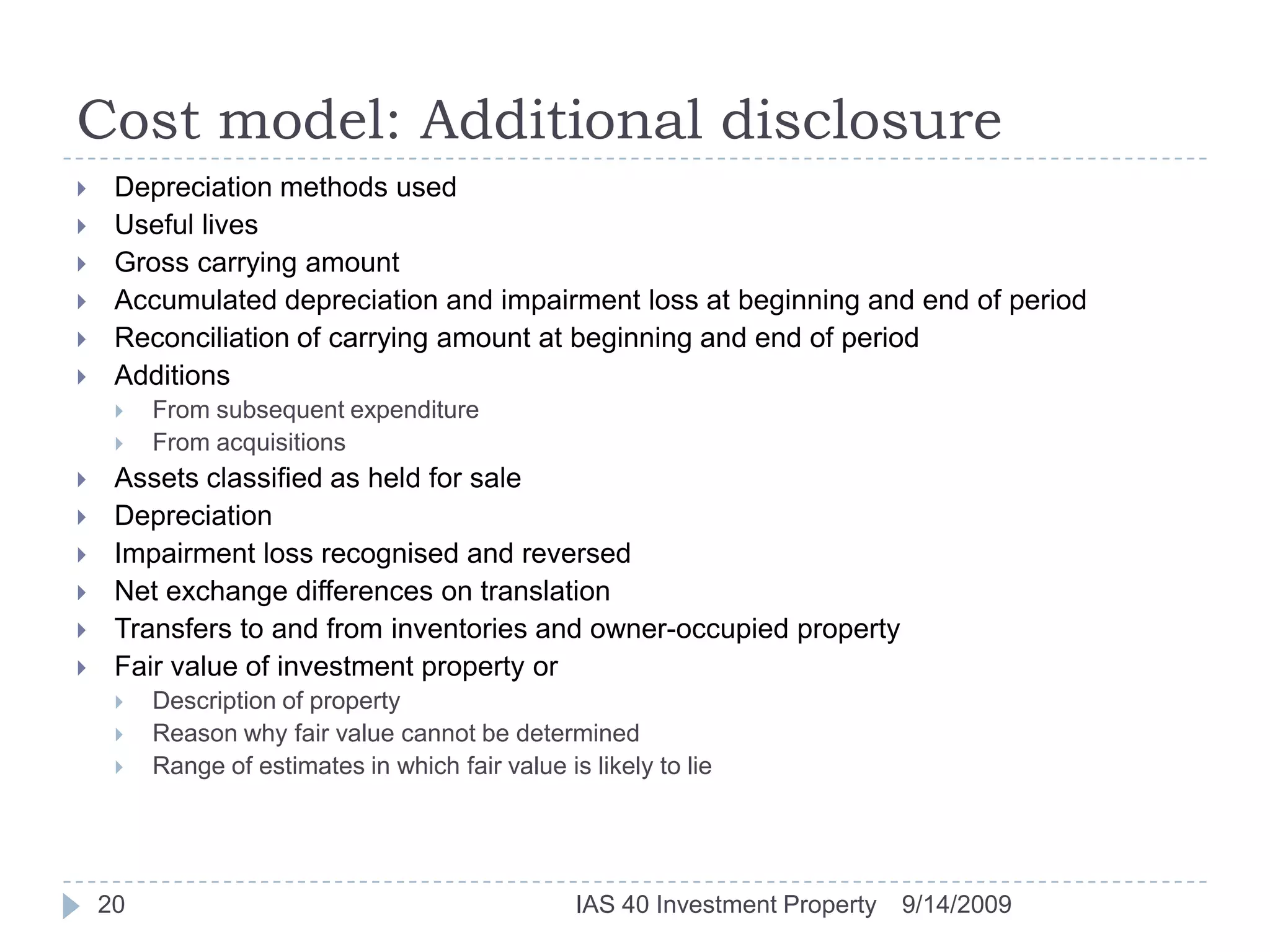

IAS 40 provides guidance on accounting for investment property, which is property held to earn rentals or for capital appreciation rather than for use in production. It requires investment property to be initially measured at cost and then either at fair value or cost model after initial recognition. Under the fair value model, all changes in fair value are recognized in profit or loss for the period. The standard also provides guidance on transfers, disposals, disclosures and transitional provisions for investment property.