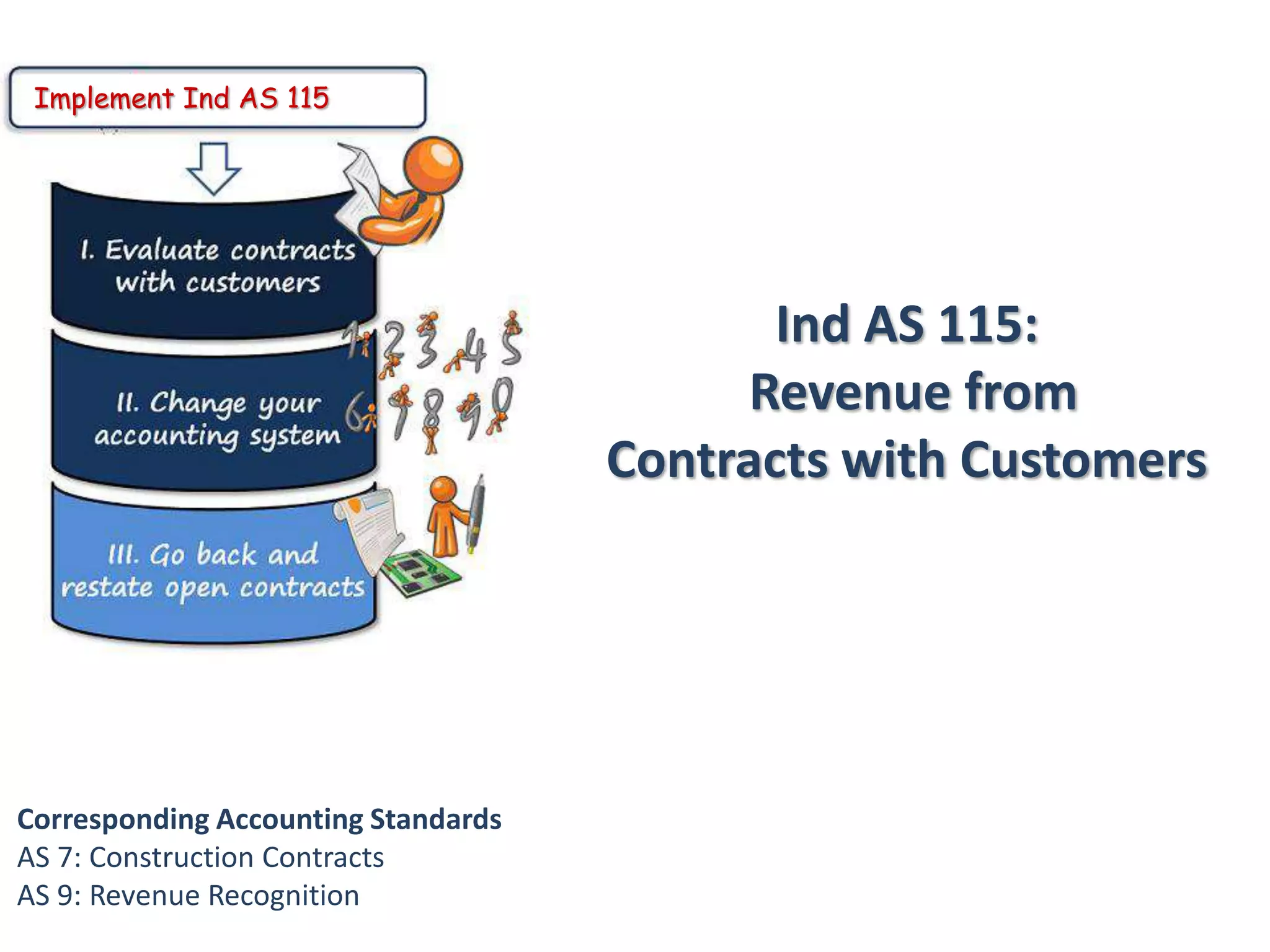

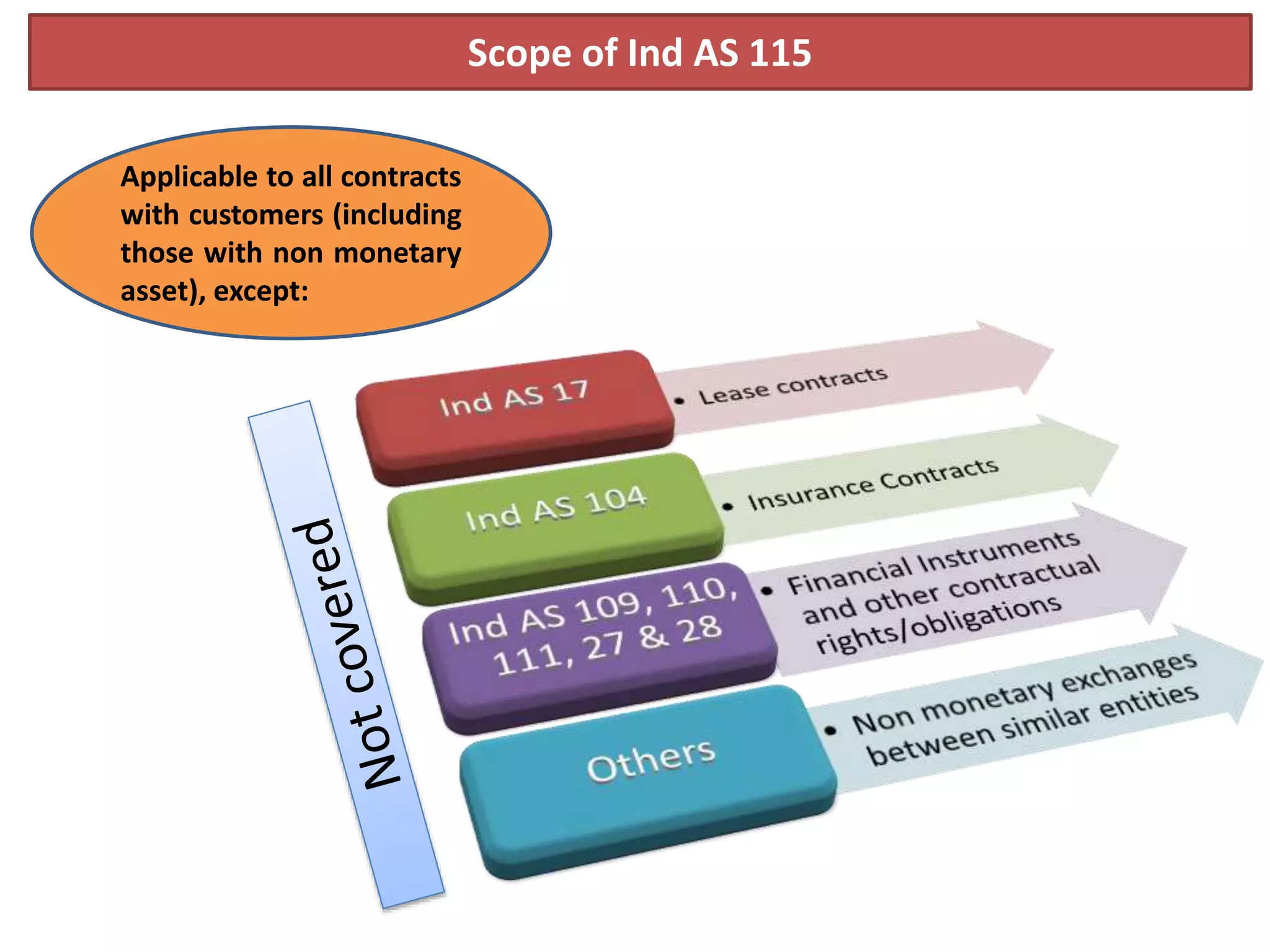

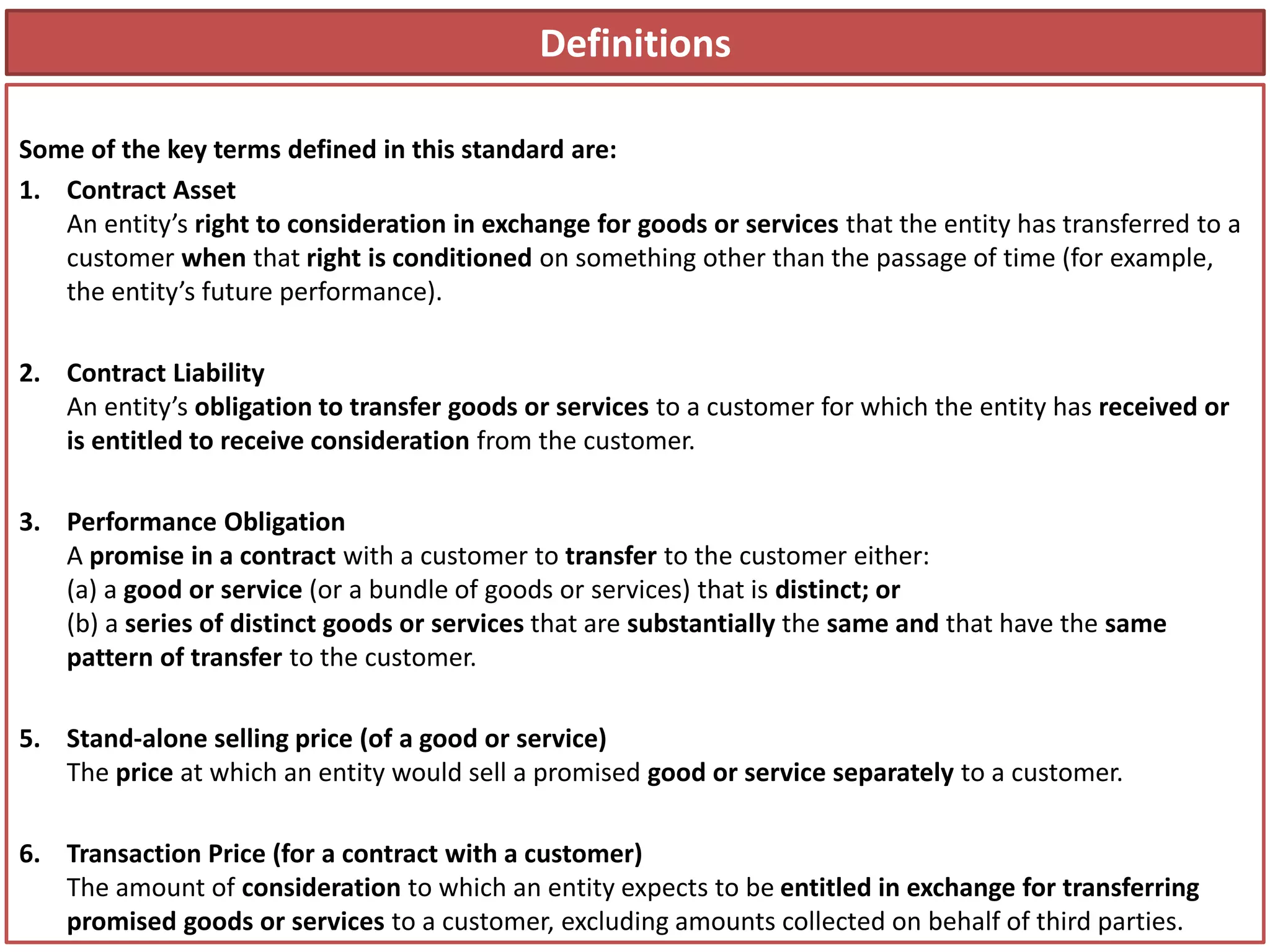

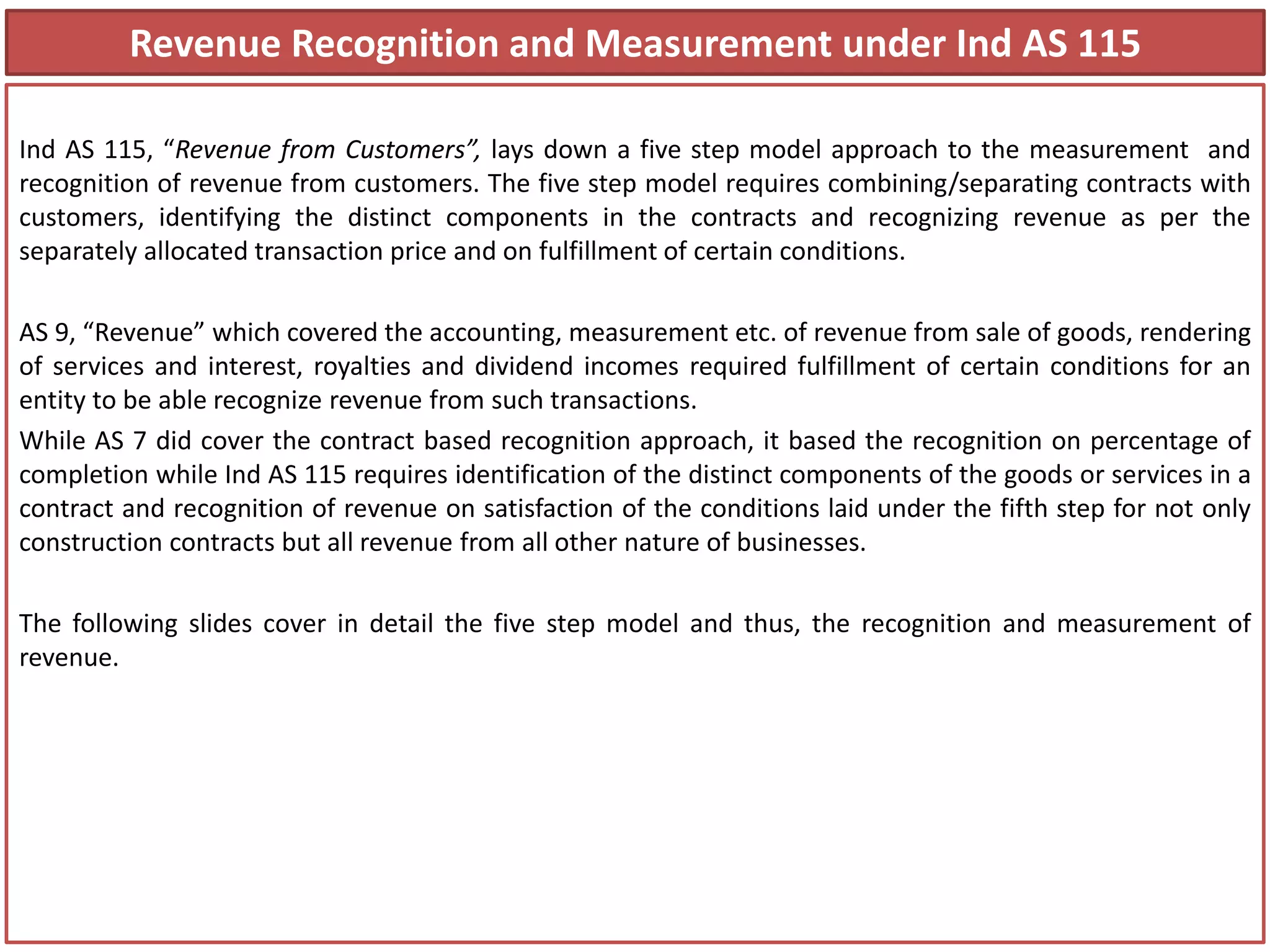

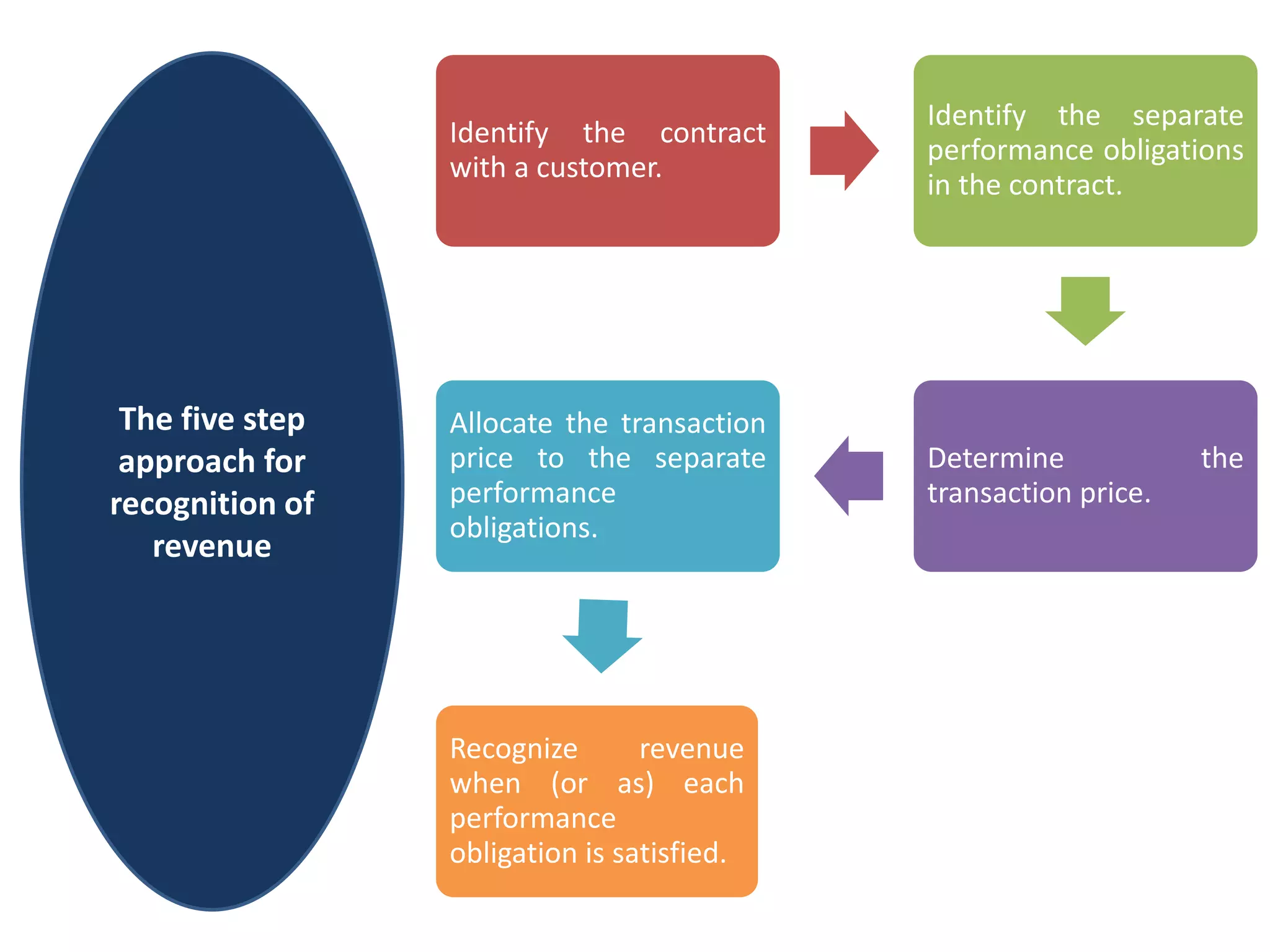

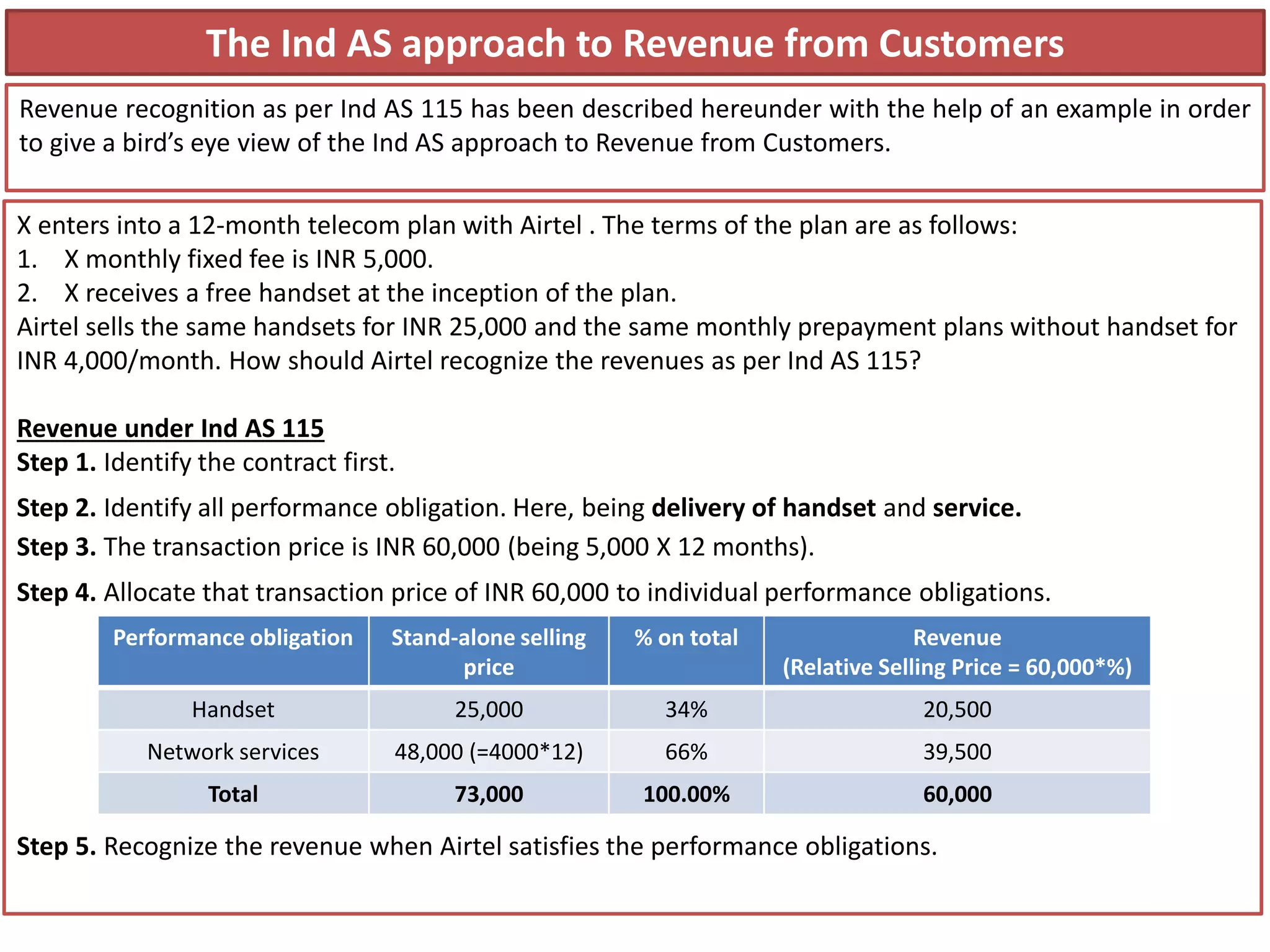

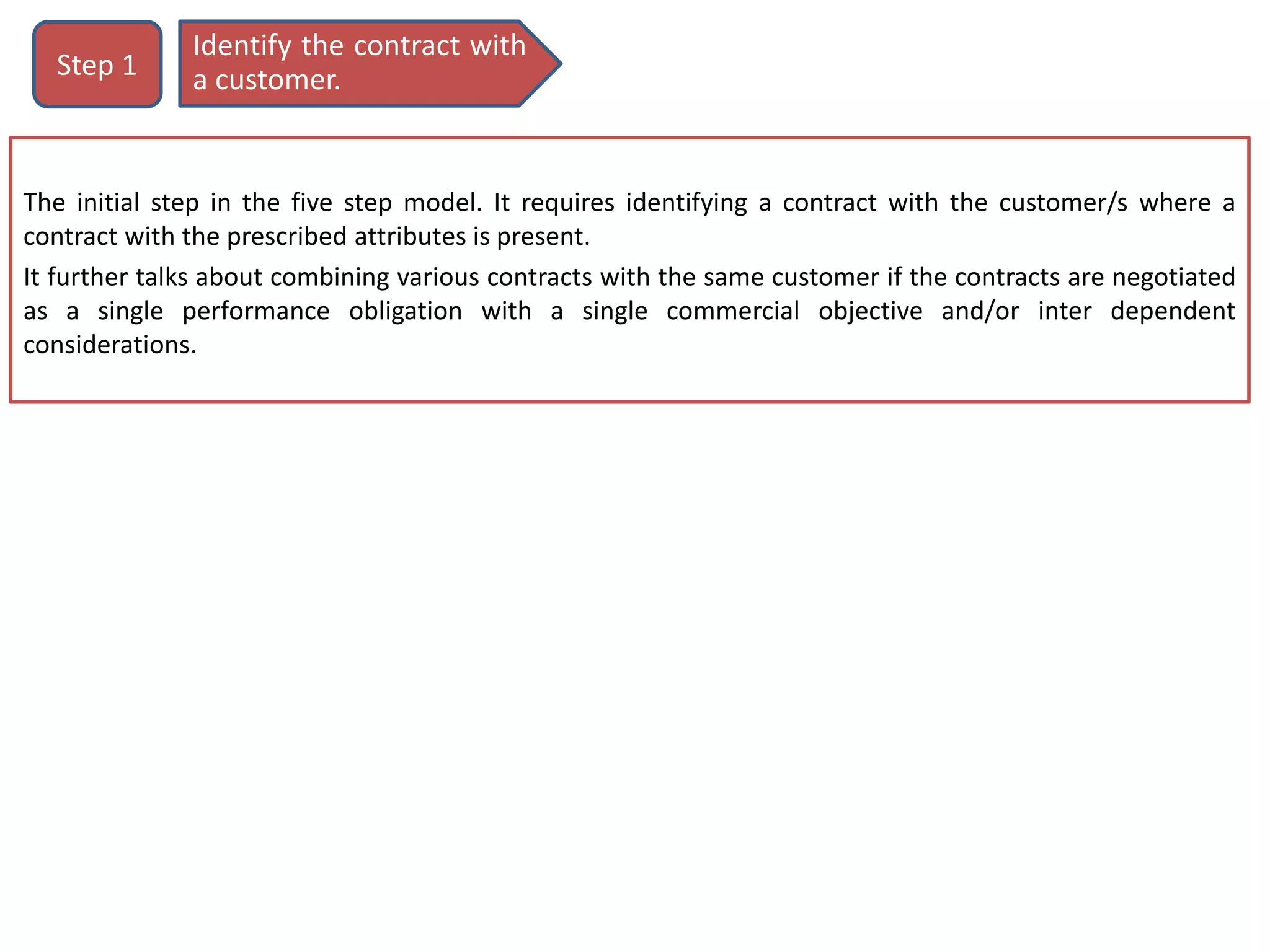

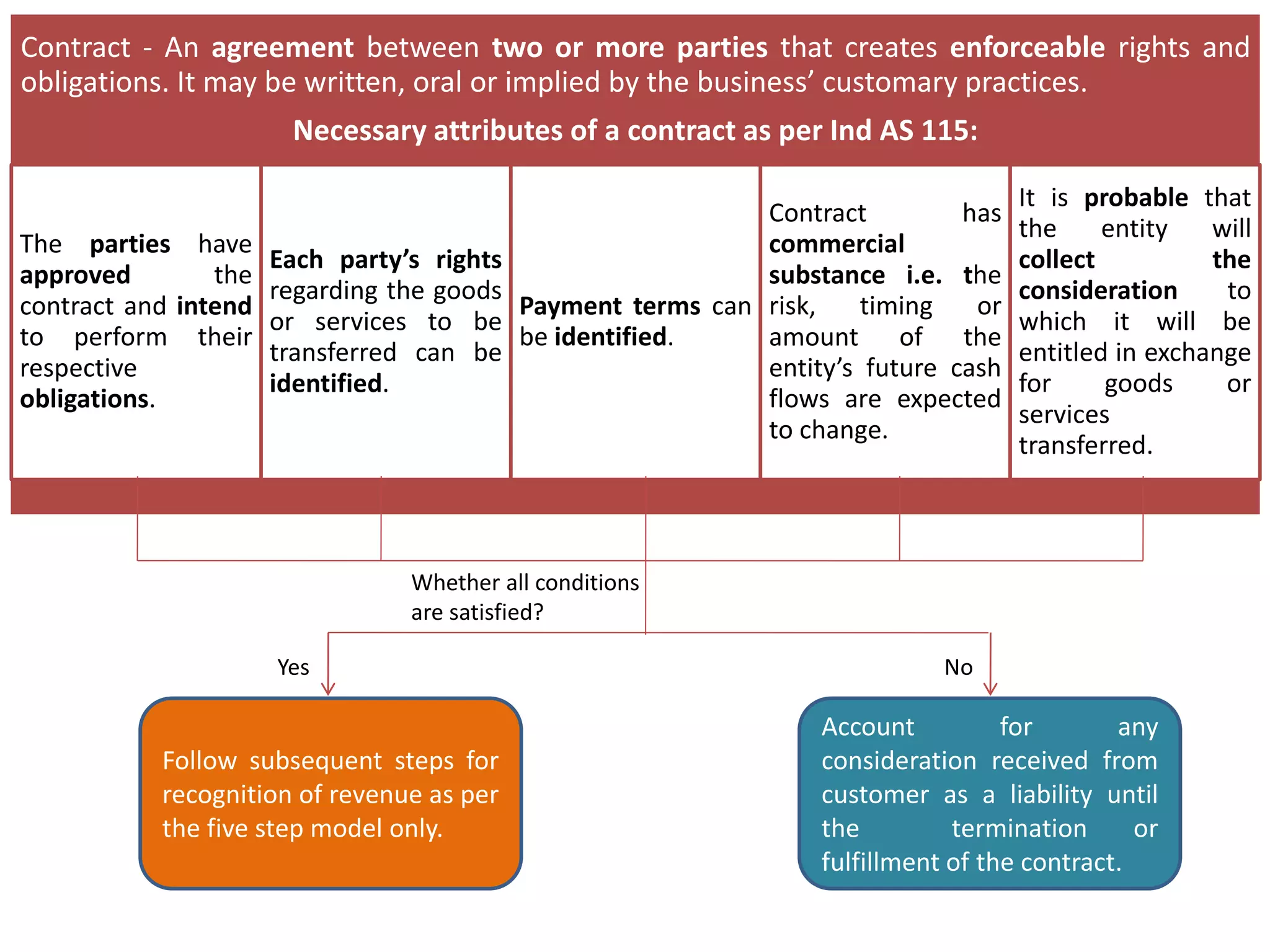

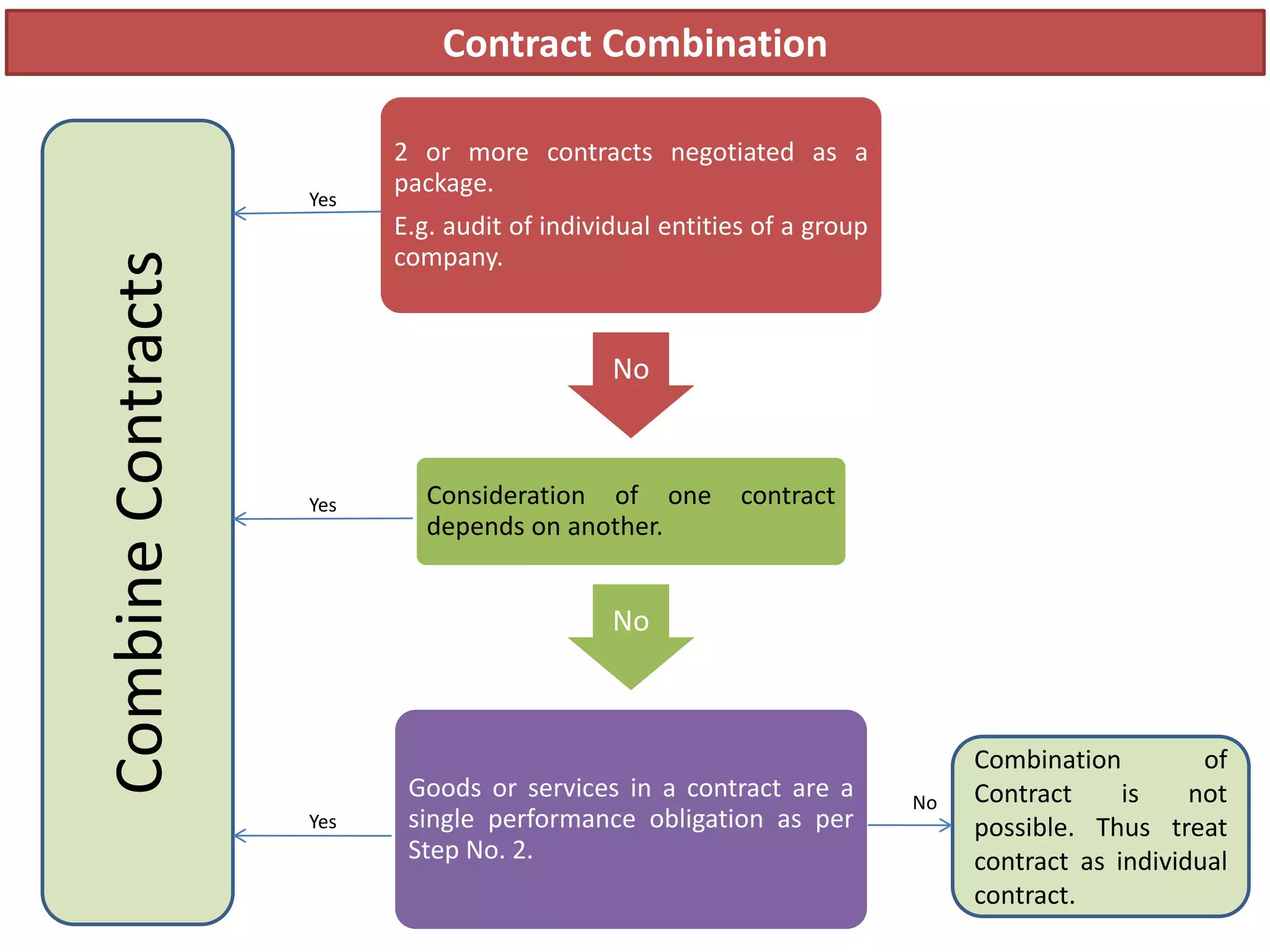

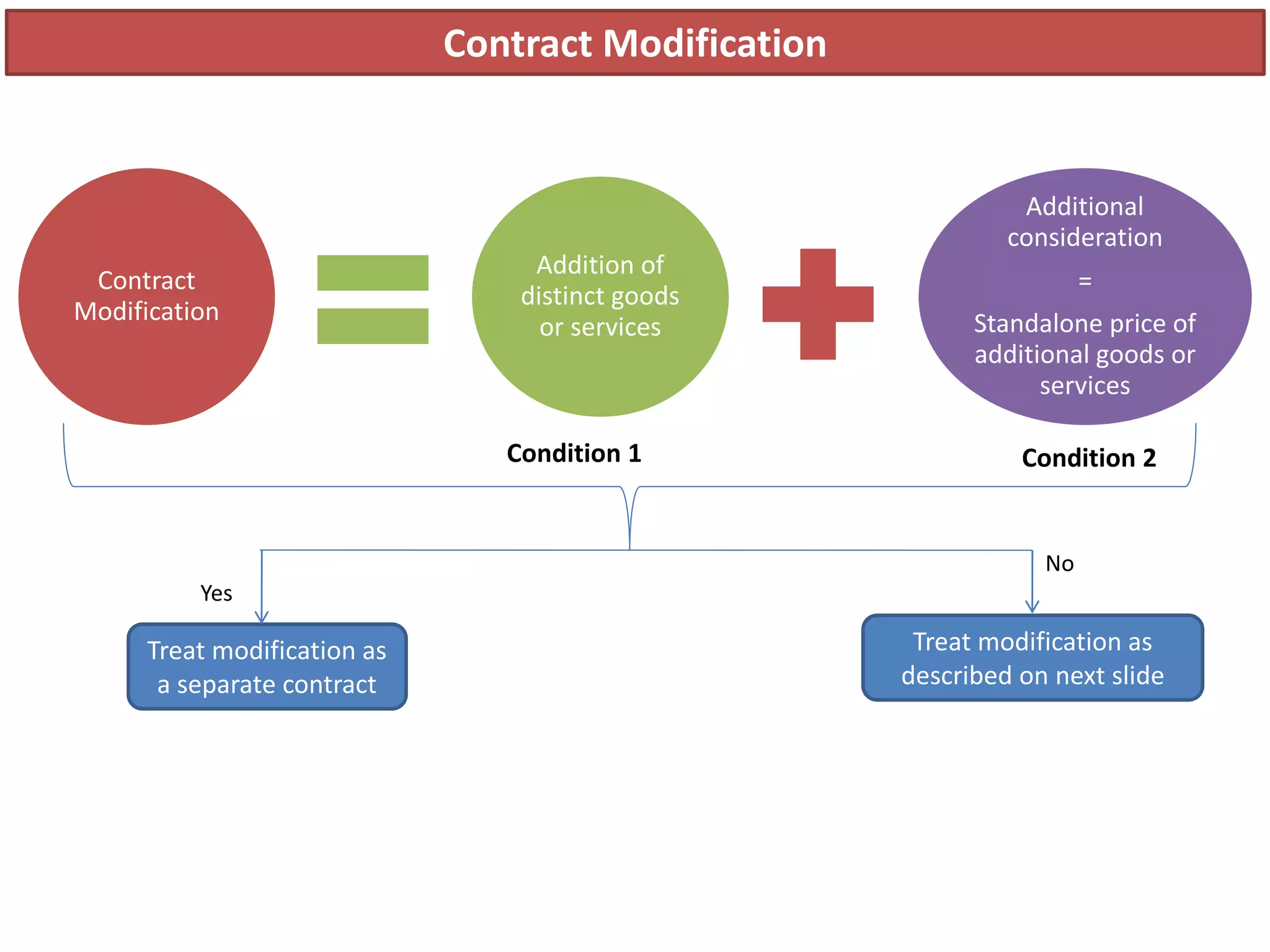

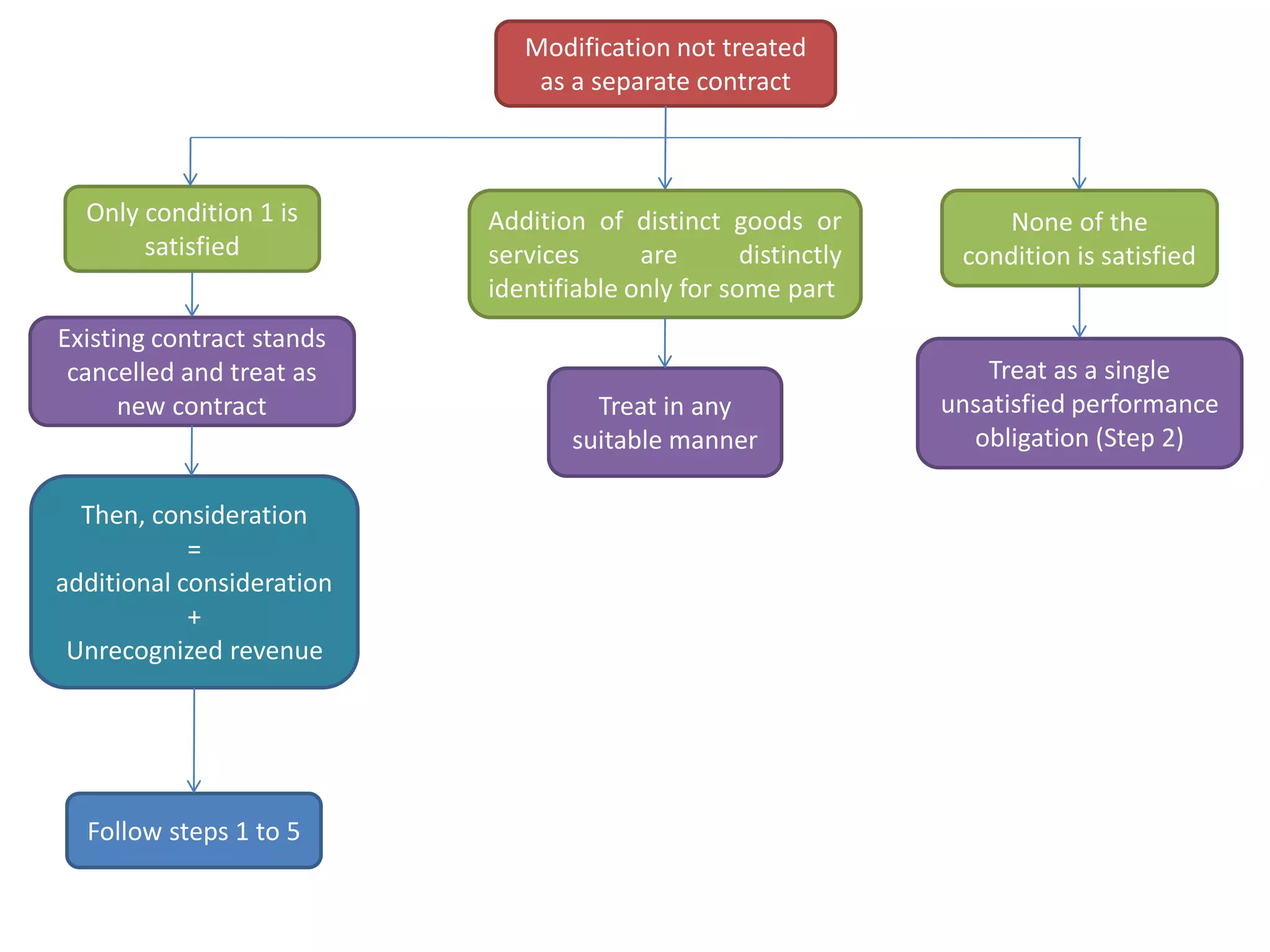

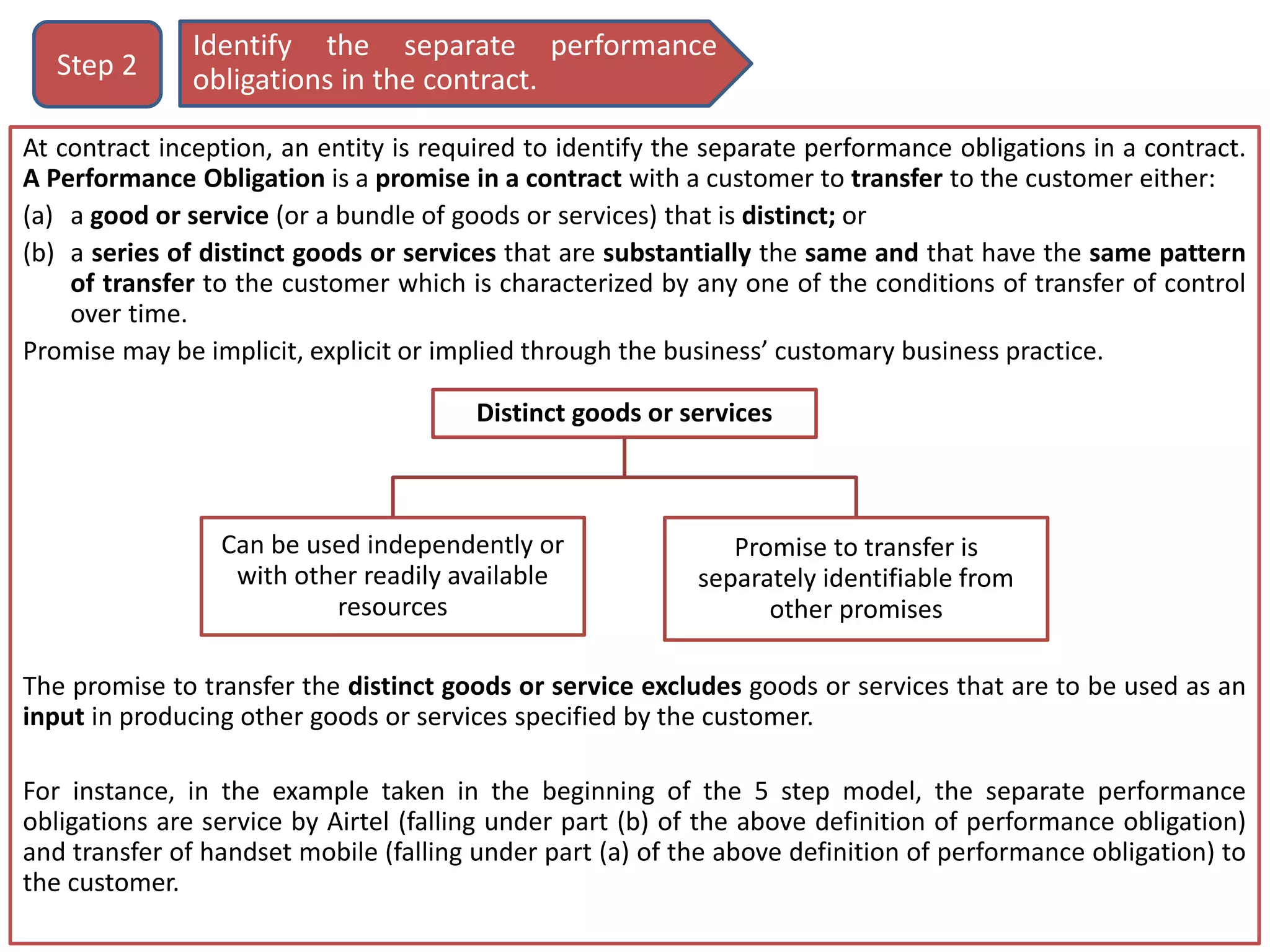

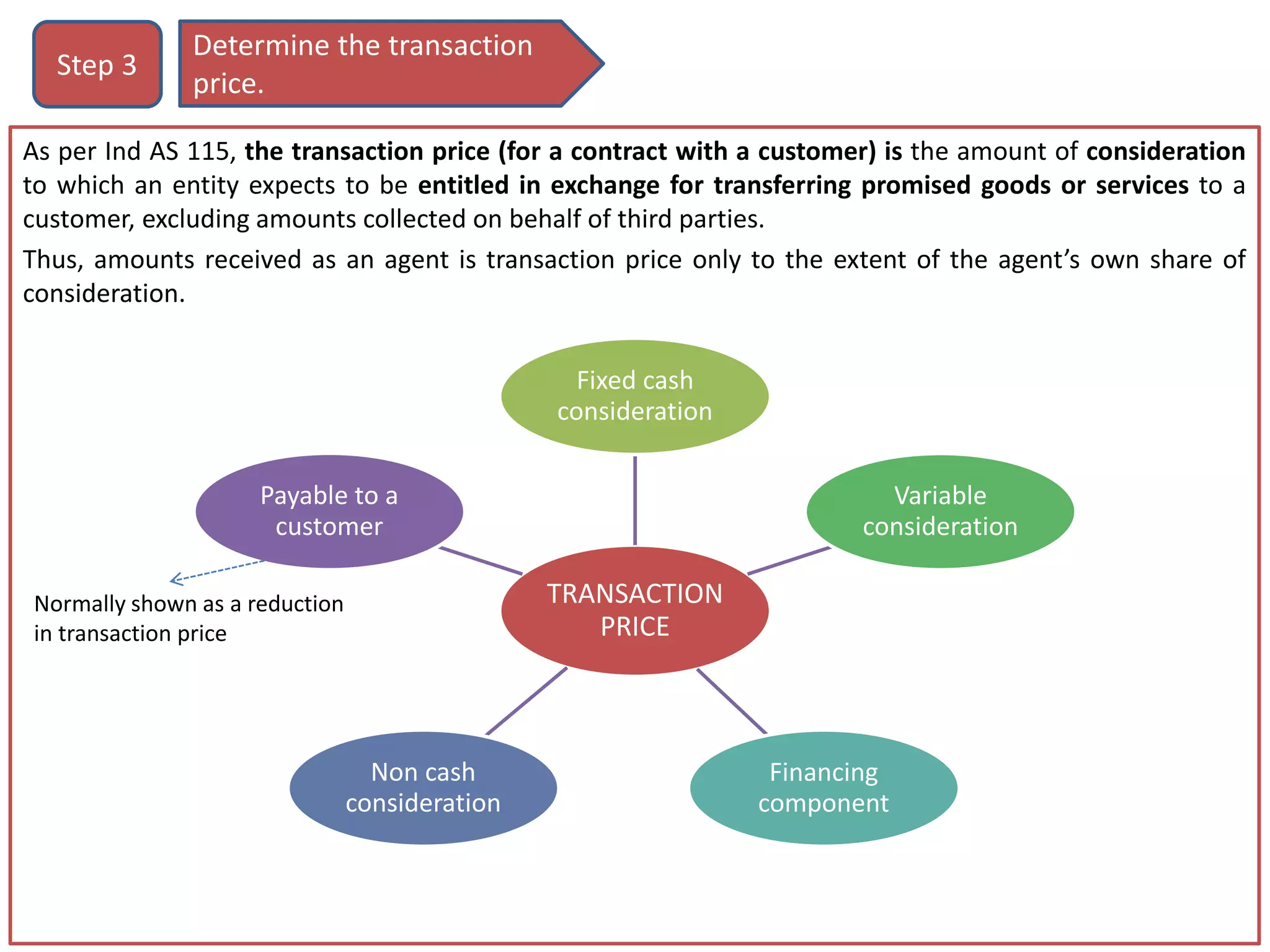

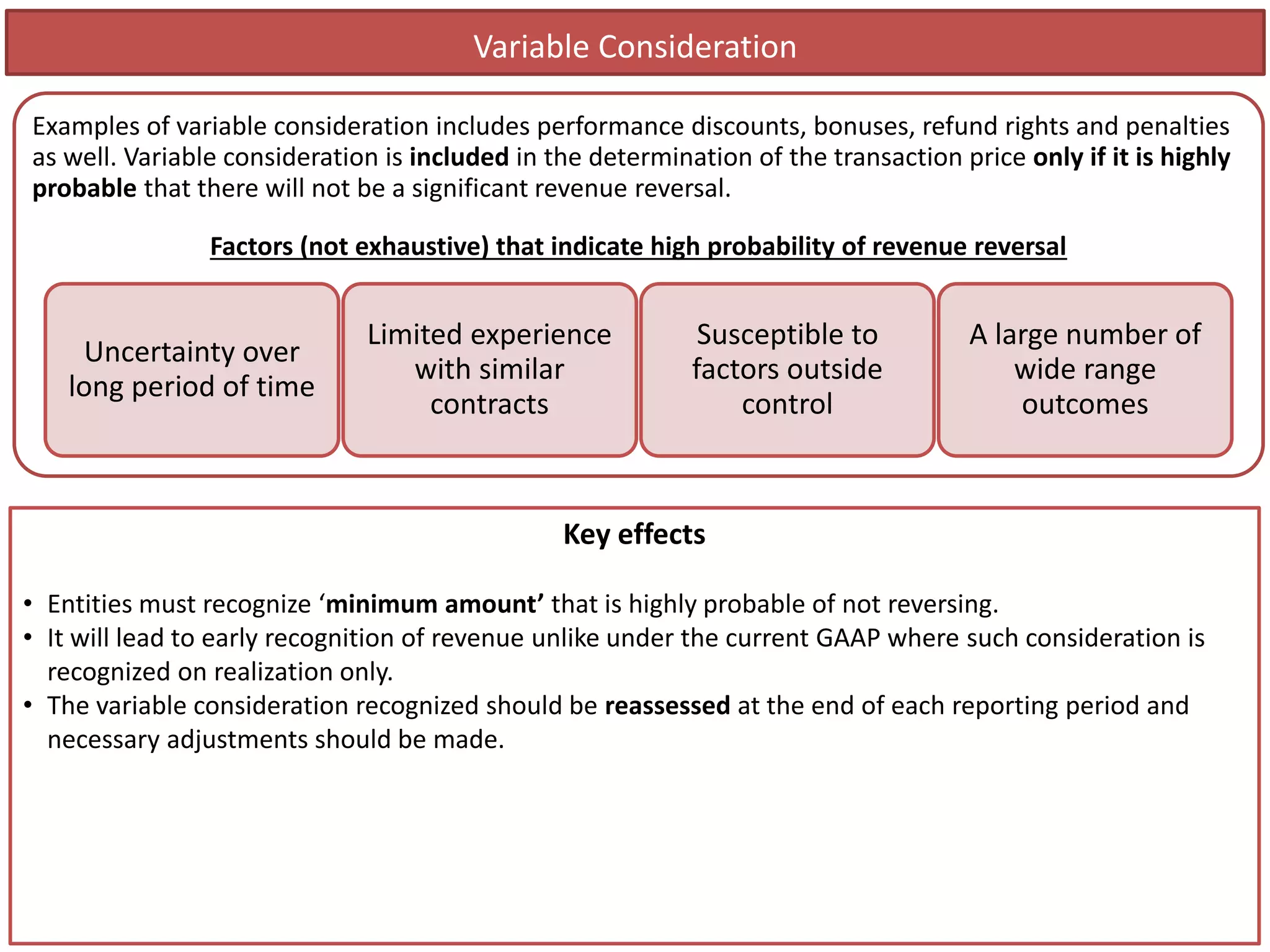

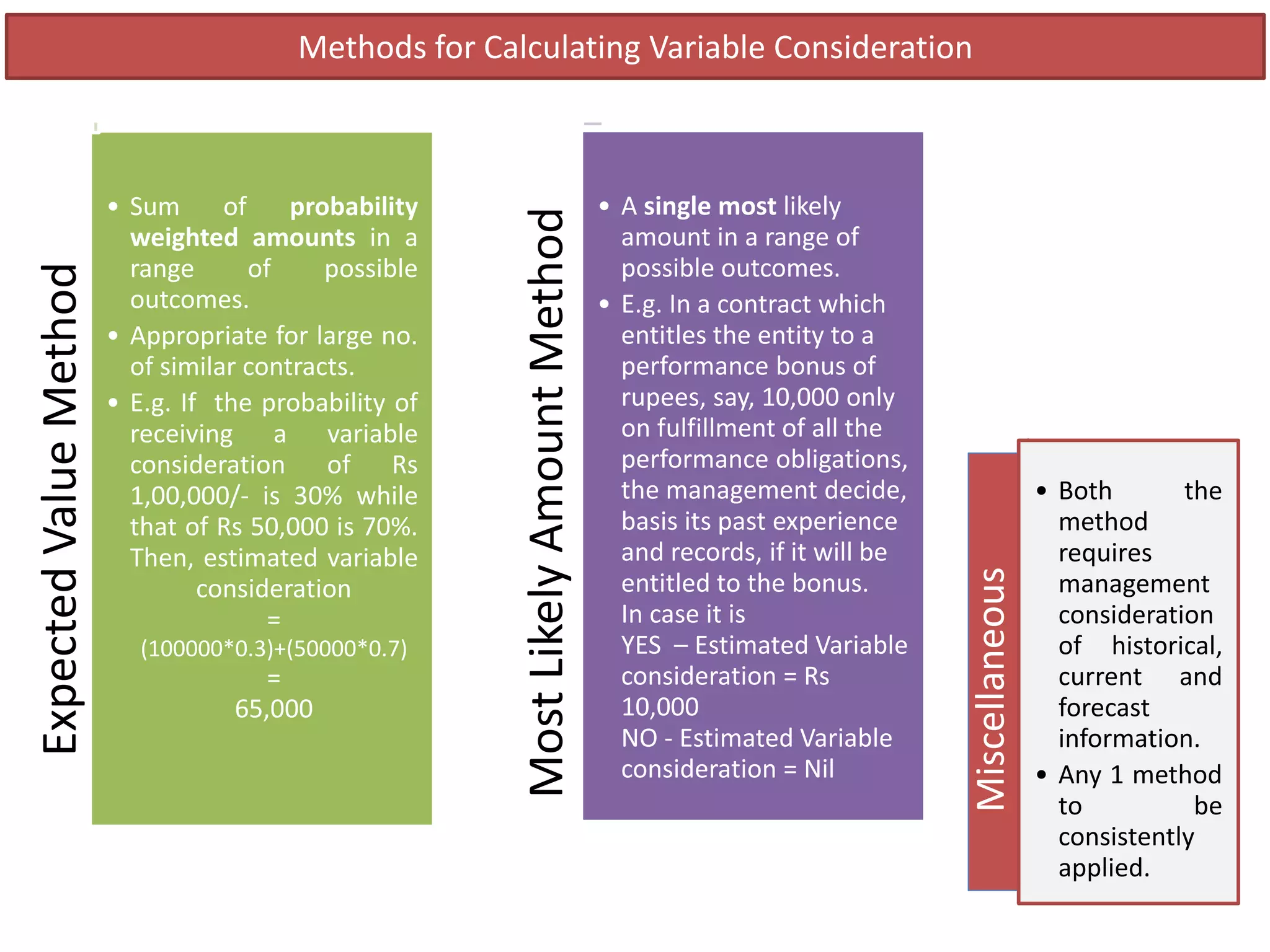

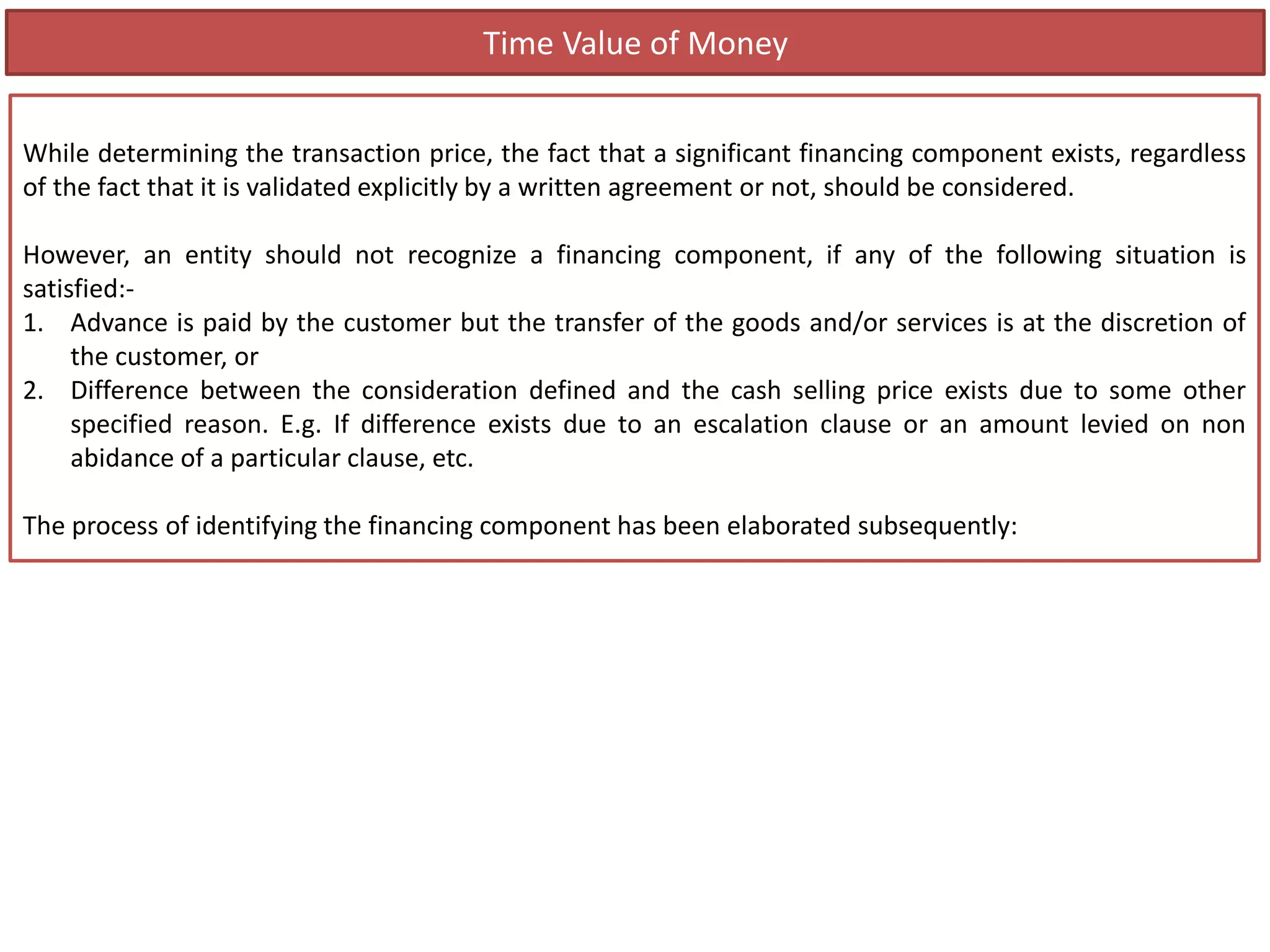

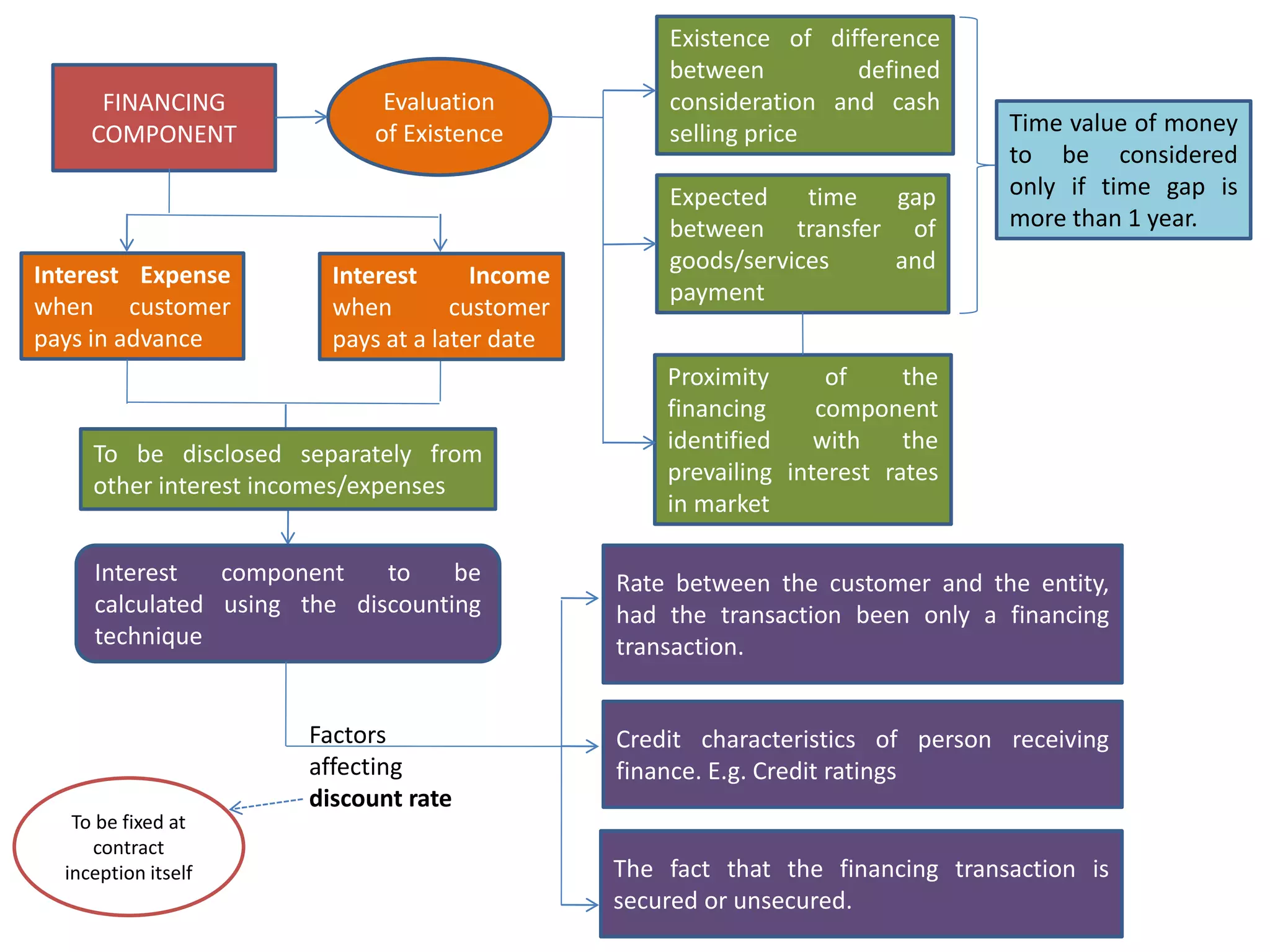

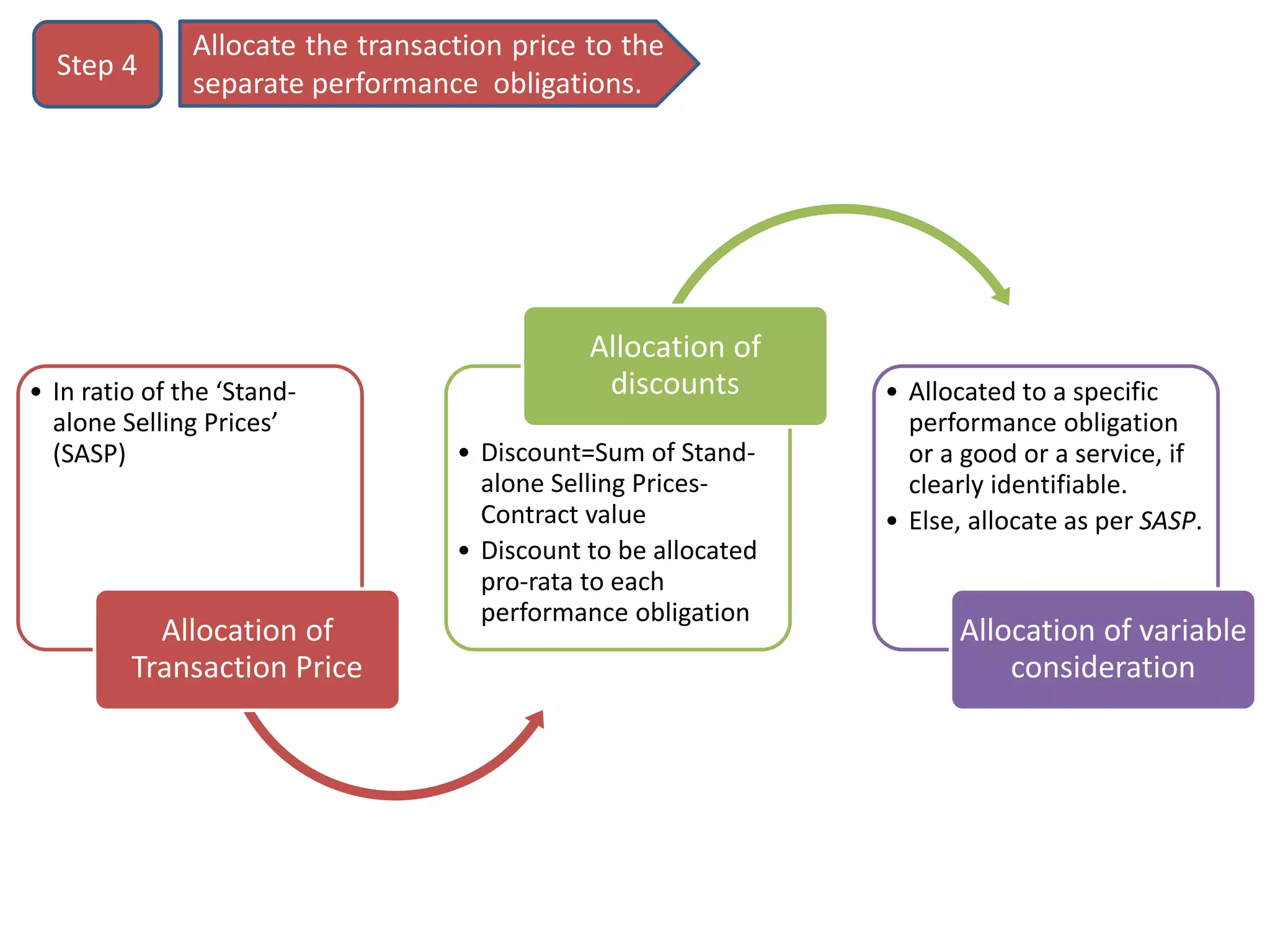

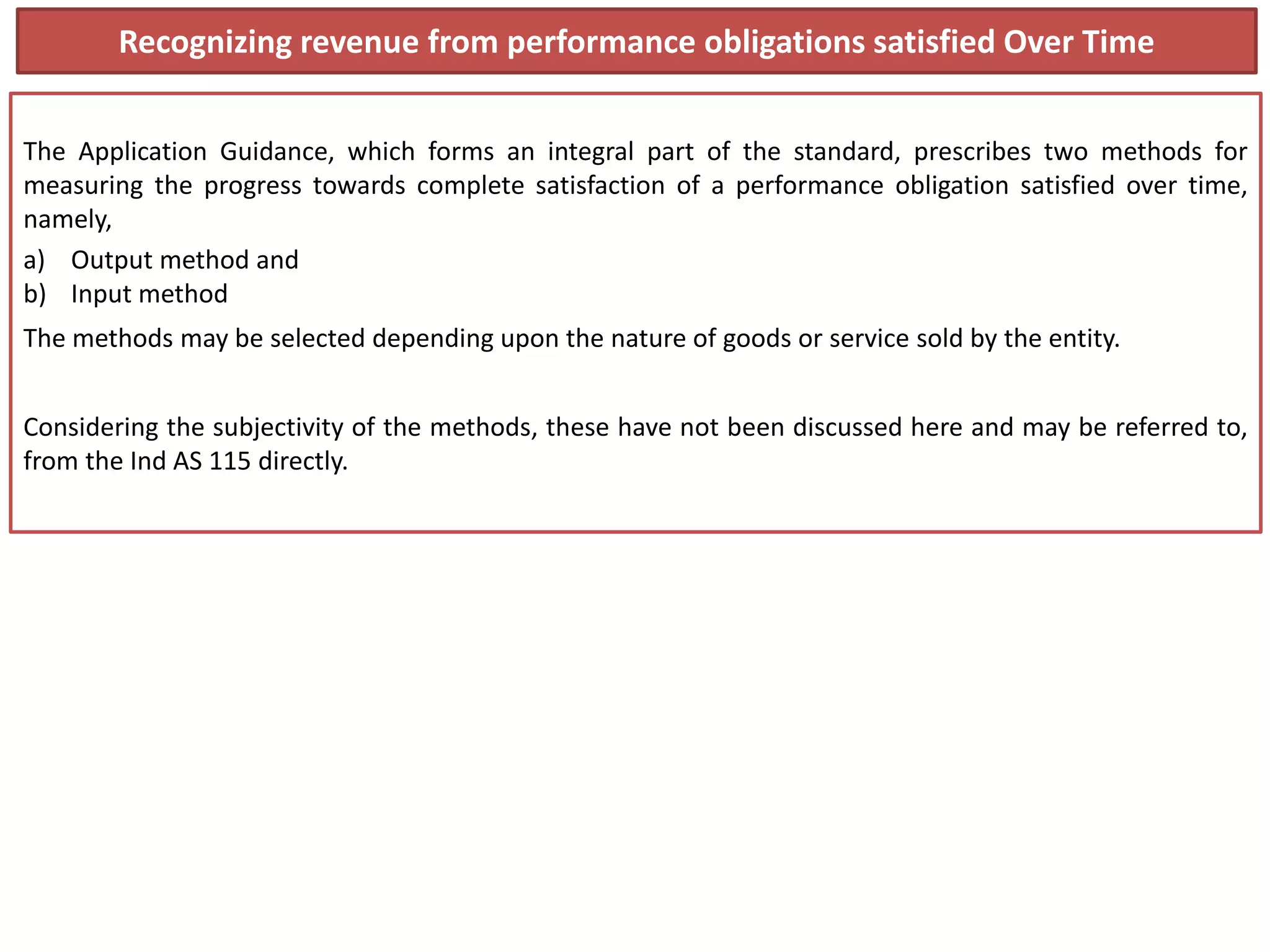

Ind AS 115 provides principles for recognizing revenue from contracts with customers and will supersede Ind AS 11 and Ind AS 18. It outlines a five-step model for recognizing revenue that includes identifying the contract with the customer, identifying separate performance obligations, determining the transaction price, allocating the transaction price, and recognizing revenue when performance obligations are satisfied. The standard provides more specific guidance and requires significantly more disclosures. Technology and telecom companies are expected to be most impacted as it will change how they recognize revenue from bundling of services. India is considering deferring adoption of Ind AS 115 to allow more time for consultation and clarification.