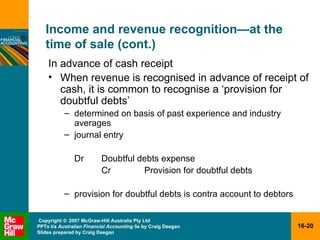

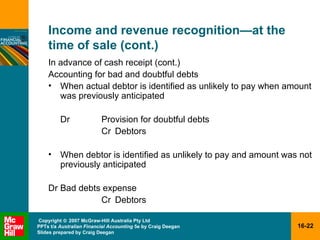

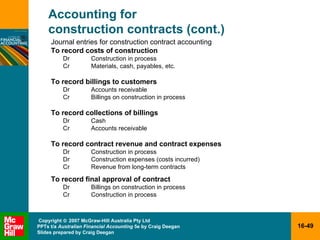

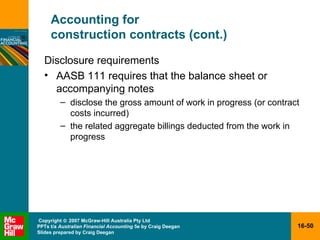

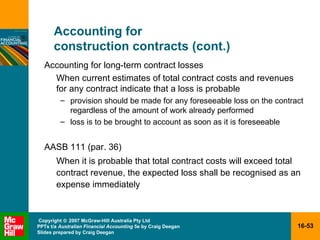

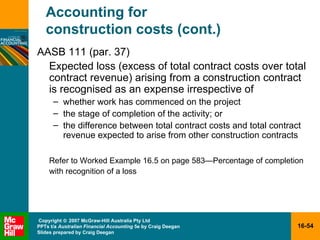

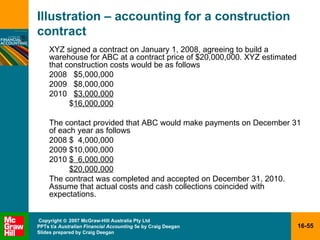

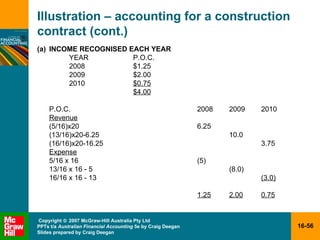

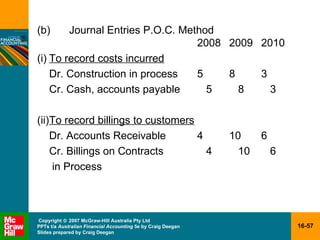

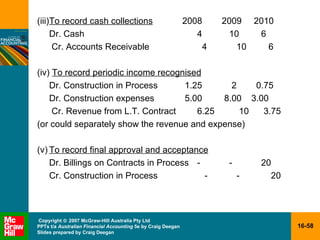

The document discusses various concepts related to revenue recognition including definitions of income, revenue, and gains according to accounting standards. It explains that revenue can be recognized at different points in a company's operating cycle such as during production, delivery of goods, or receipt of cash/orders. The timing of revenue recognition depends on factors like transfer of risks/rewards of ownership and reliability of measurement. Revenue from long-term construction contracts is recognized using the percentage-of-completion method under certain conditions.