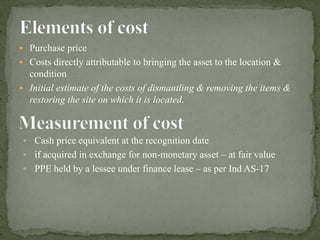

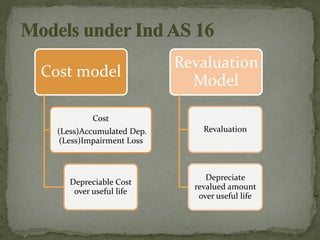

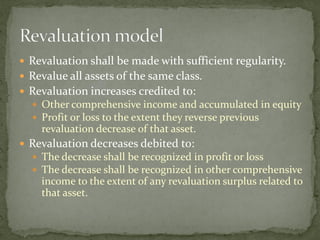

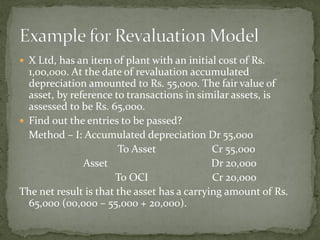

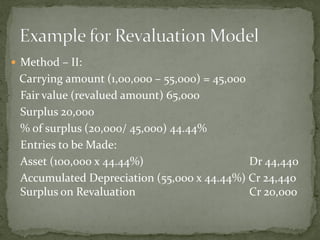

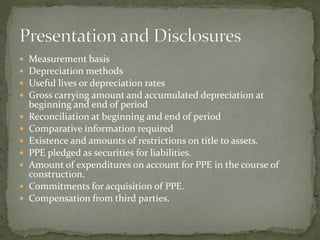

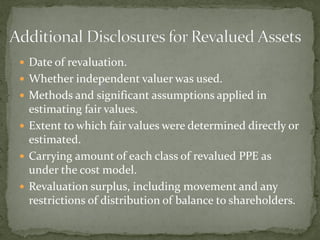

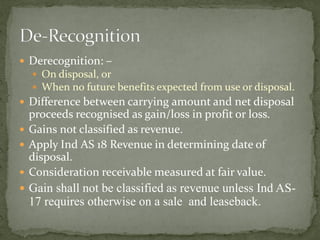

This document discusses accounting for property, plant, and equipment (PPE) under Indian Accounting Standard (Ind AS) 16. It covers topics such as the initial recognition and measurement of PPE, the cost model and revaluation model for subsequent measurement, depreciation, and impairment. It also provides examples of accounting entries for revaluation of PPE and disclosure requirements related to PPE under Ind AS 16.