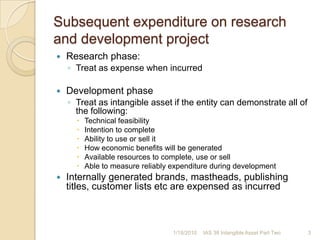

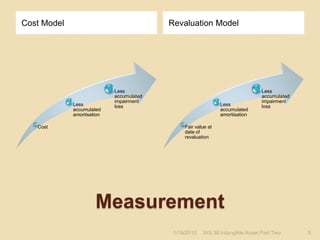

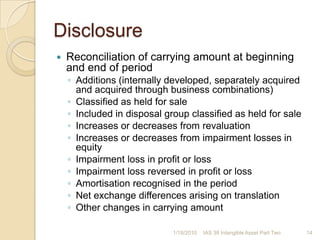

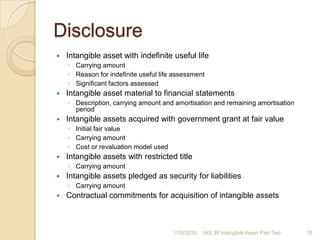

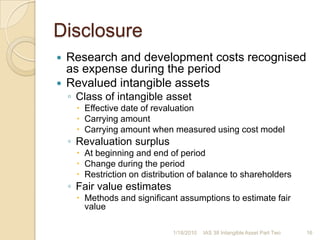

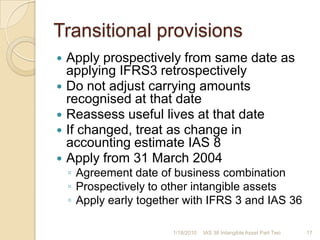

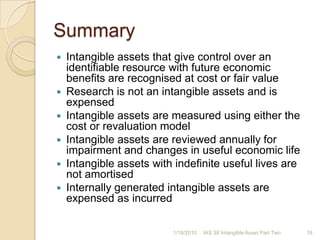

IAS 38 provides guidance on accounting for intangible assets. An intangible asset must be identifiable and controlled by the entity with probable future economic benefits to be recognized initially at cost. Expenditure on research must be expensed while development costs may be recognized as an asset if certain criteria are met. Intangible assets are subsequently measured using either the cost or revaluation model and are reviewed annually for impairment and changes in useful life. Disclosures include distinguishing between internally generated and other intangible assets, amortization methods used, and reconciliation of carrying amounts.