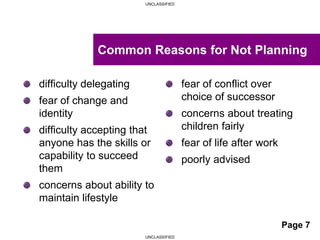

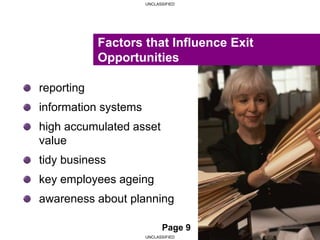

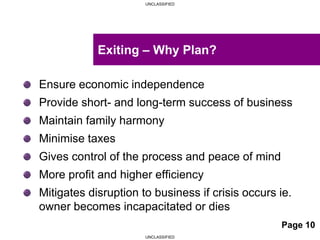

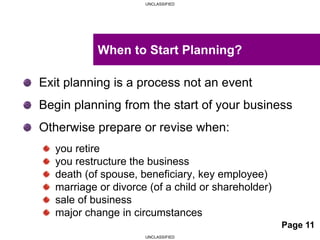

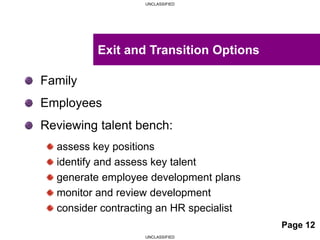

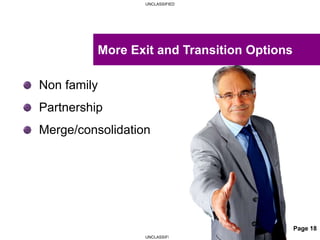

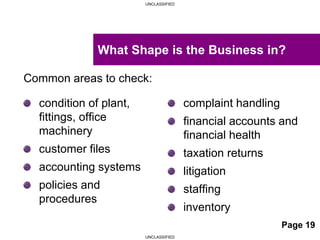

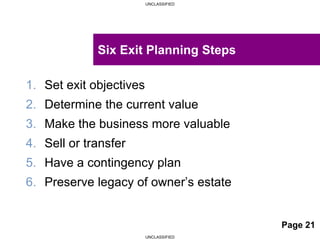

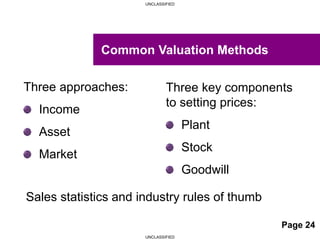

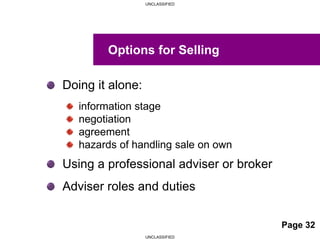

The document outlines the importance of succession and exit planning for business owners, particularly those over 50. It highlights the need for a systematic approach to prepare for business transition, assess succession options, and ensure economic independence while maintaining family harmony. Additionally, it provides guidance on evaluating business value and exploring various exit strategies to maximize the outcomes of a sale or transfer.