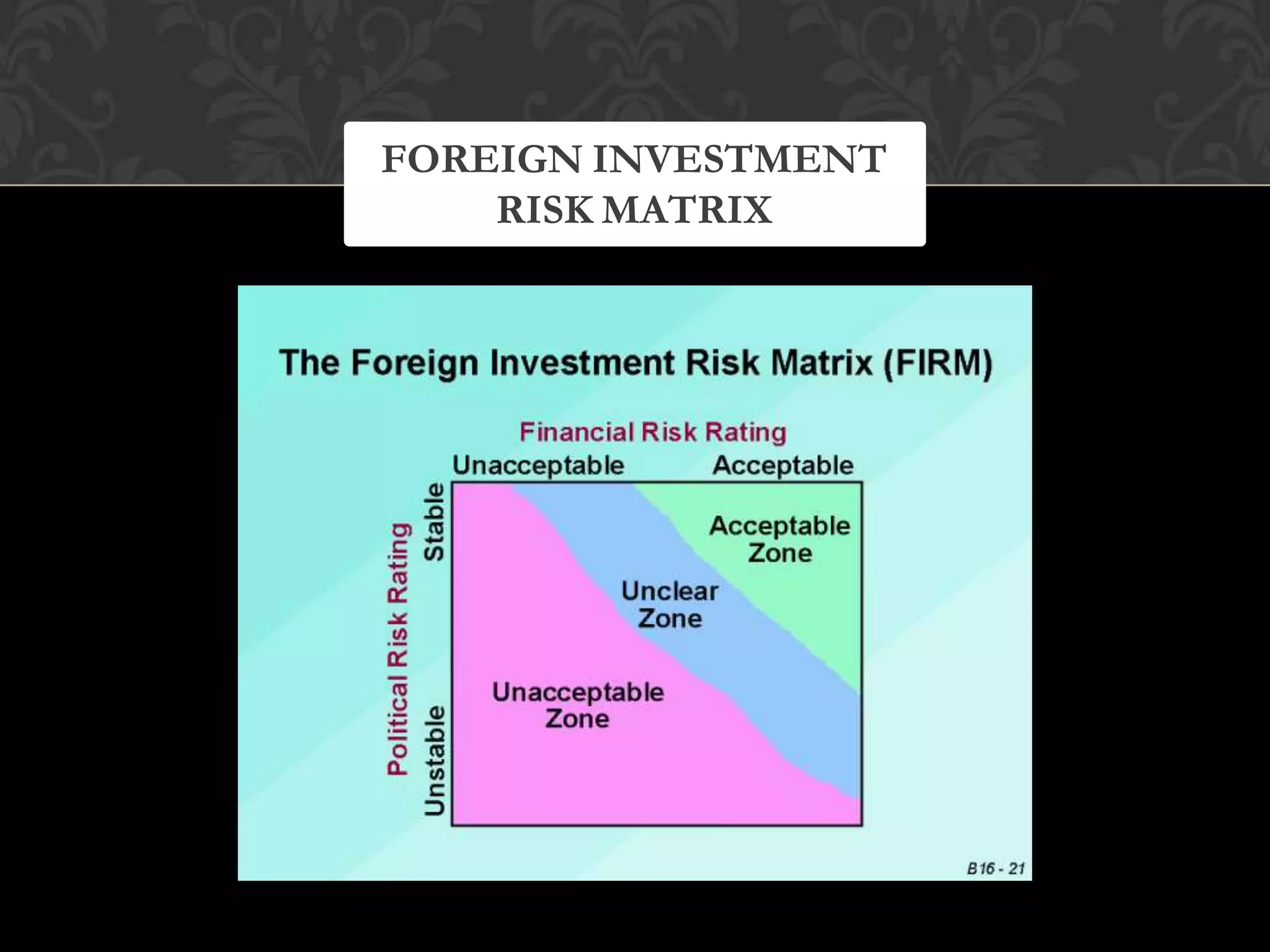

The document discusses country risk analysis. It defines country risk as risks arising from changes in a country's business environment that may negatively affect profits or asset values. Country risk includes factors like currency controls, devaluation, political instability, and terrorism. The document outlines various factors used to analyze country risk, such as political, economic, location, sovereign, transfer, exchange rate, and financial risks. It also discusses techniques for assessing country risk like using checklists, ratings, and the foreign investment risk matrix. Country risk is an important consideration for multinational companies in decisions like capital budgeting.