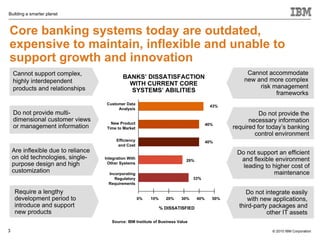

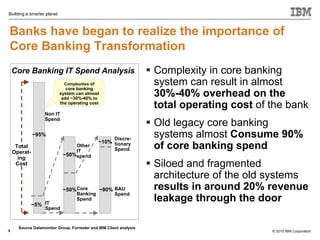

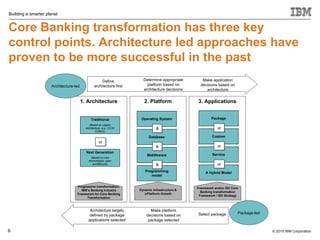

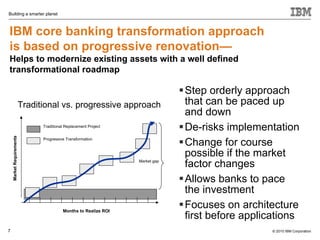

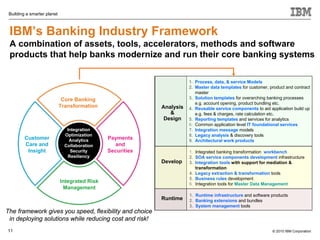

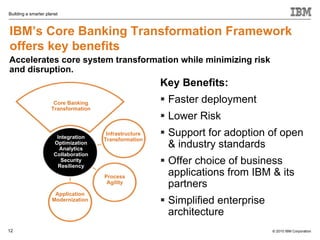

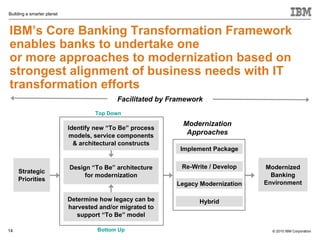

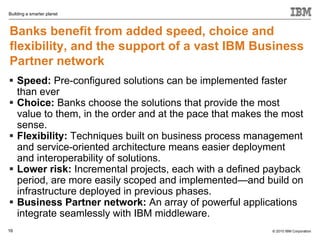

The document outlines the necessity for core banking transformation, highlighting the inefficiencies and high costs associated with outdated banking systems. It presents IBM's progressive renovation strategy, which focuses on modernizing existing core banking architectures while minimizing risk and ensuring flexibility for banks. The framework offers various benefits, including faster deployment, lower risks, and integration of innovative technologies to meet current market demands.