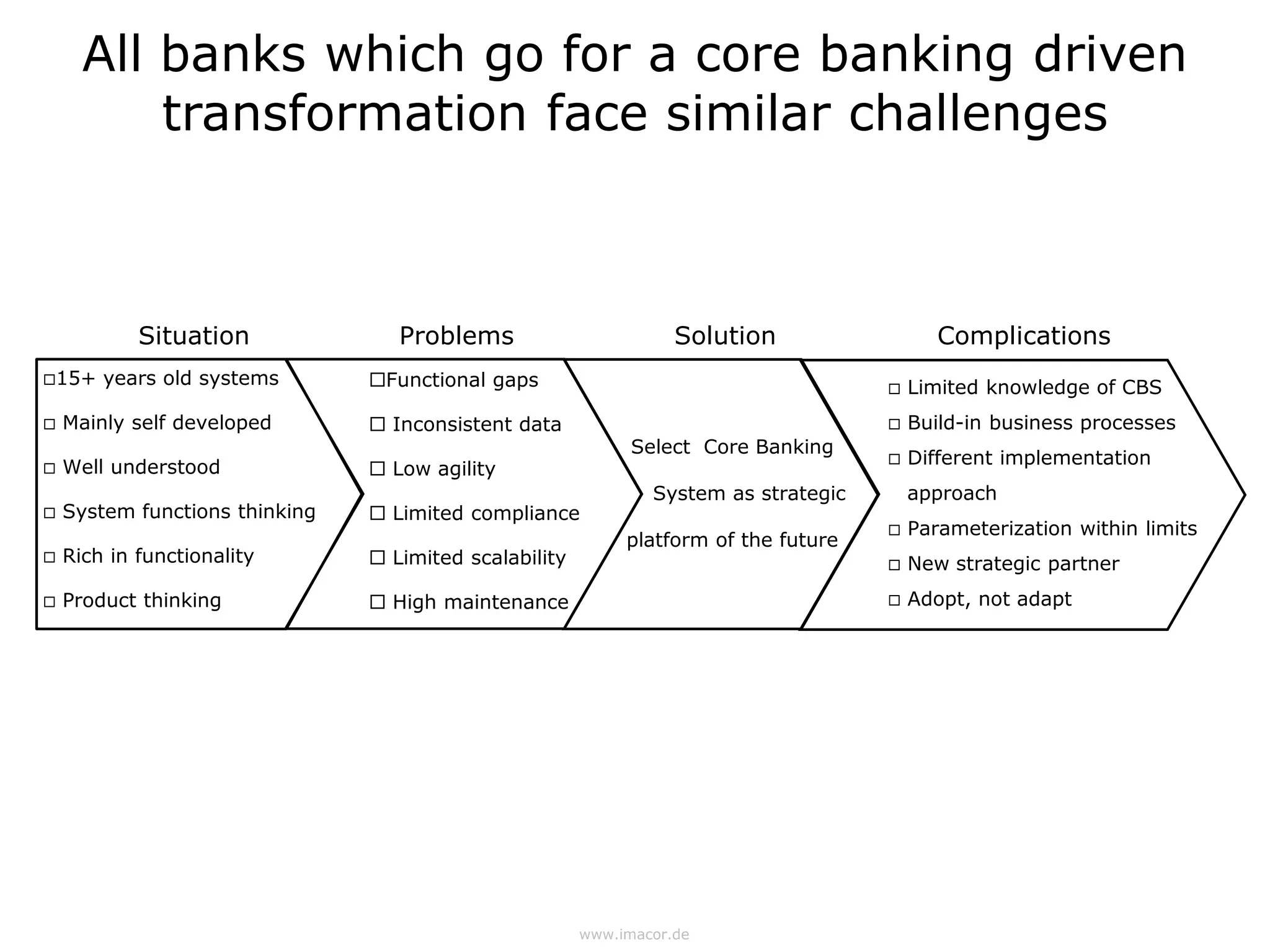

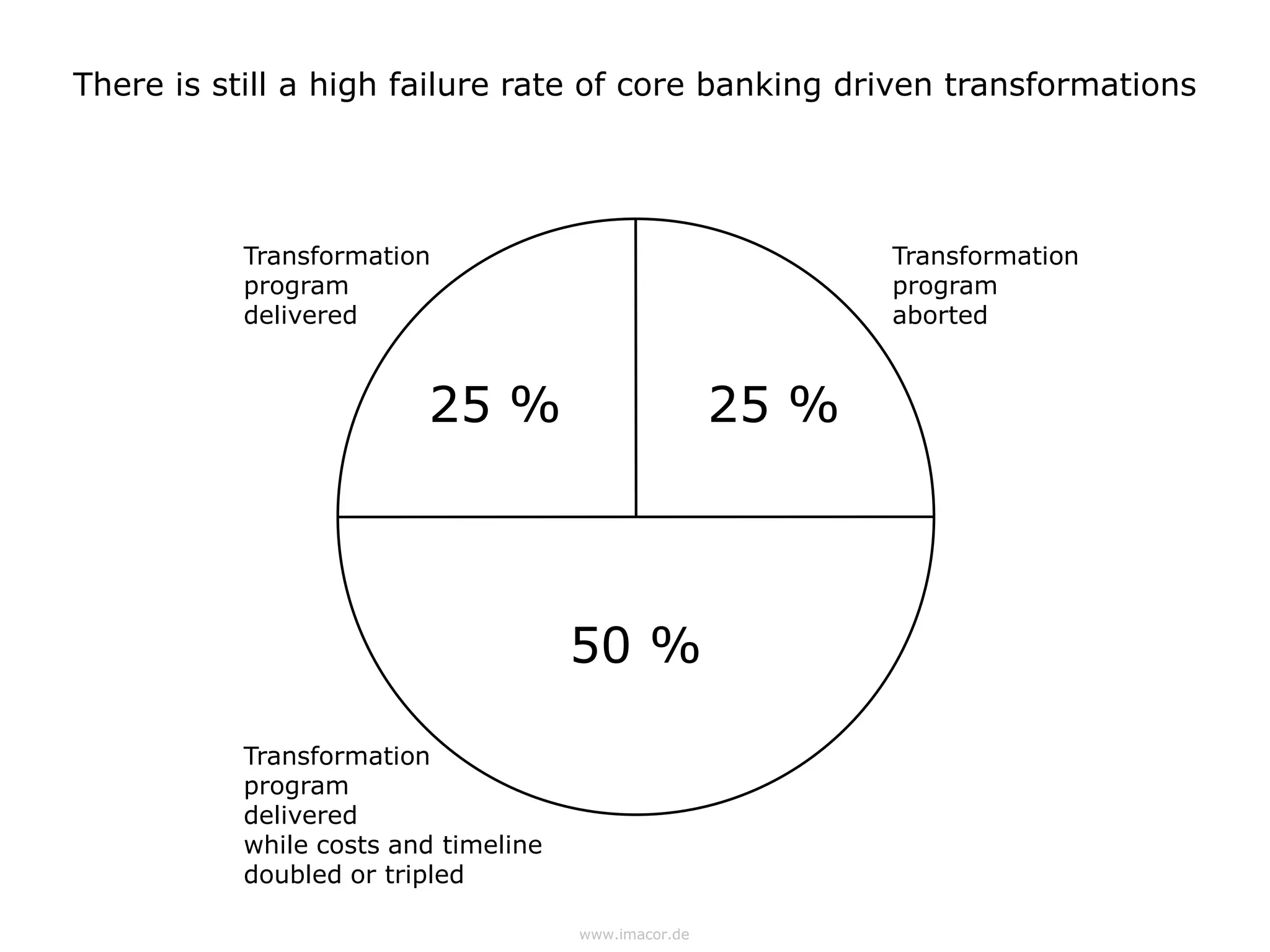

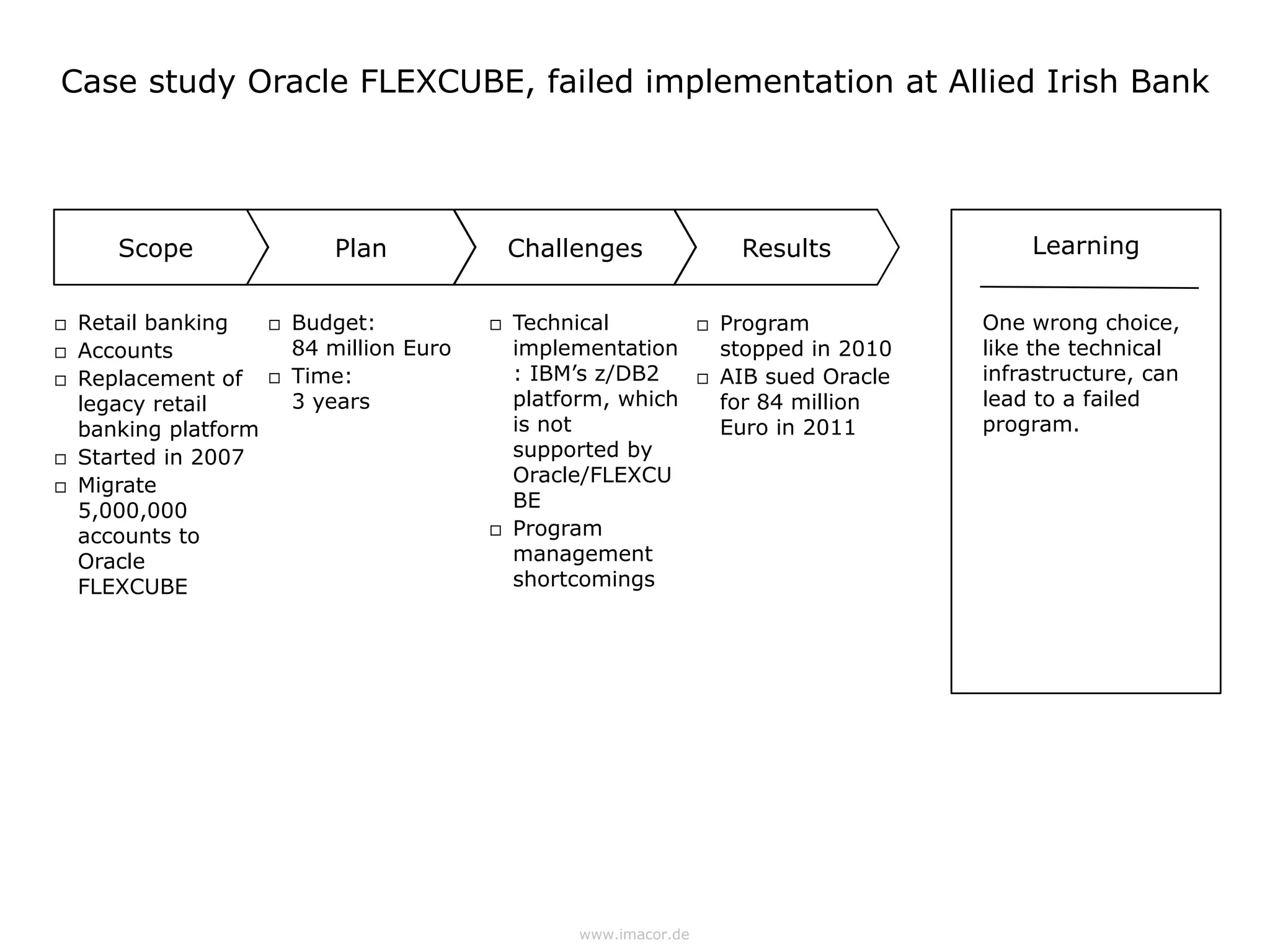

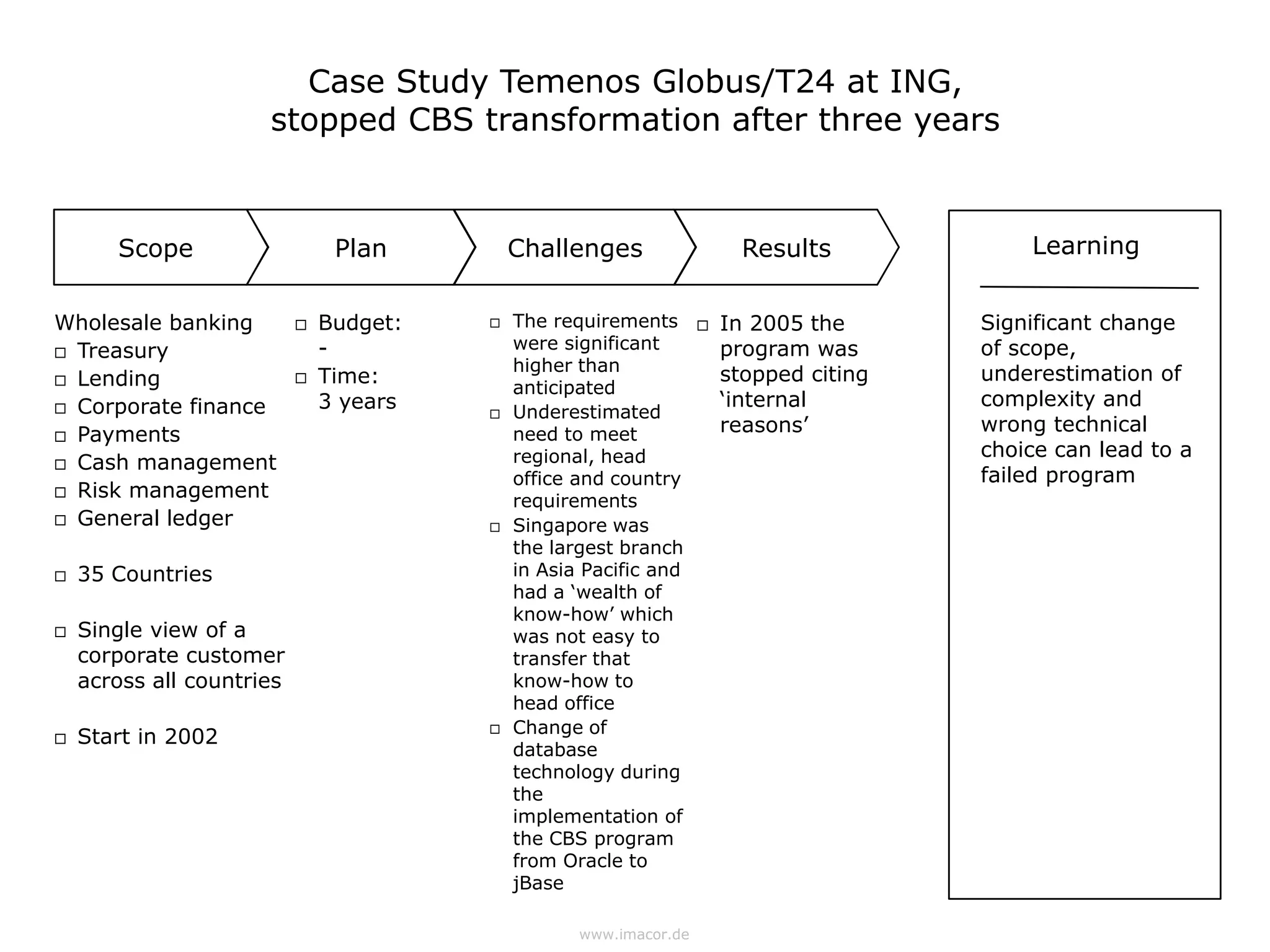

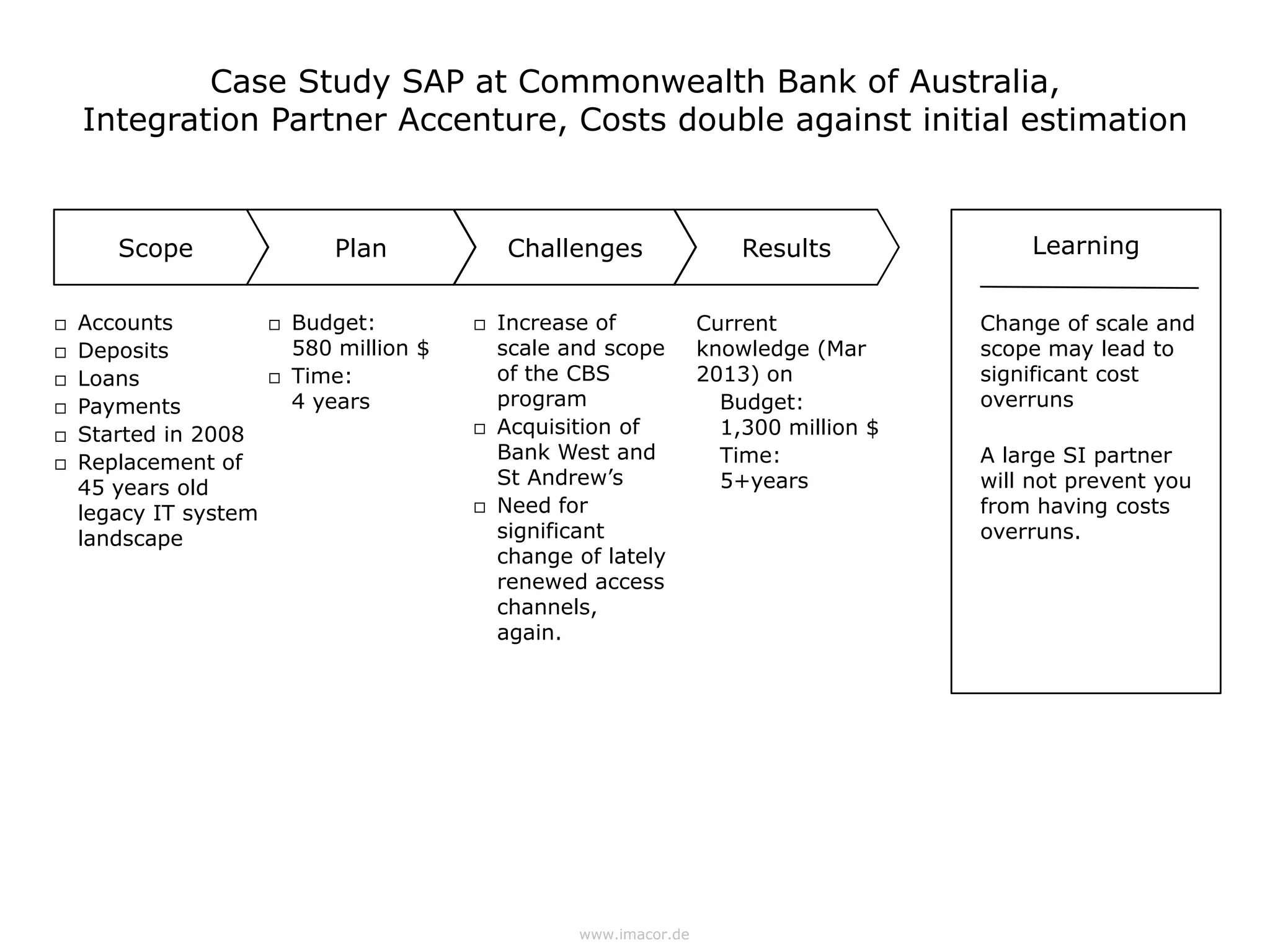

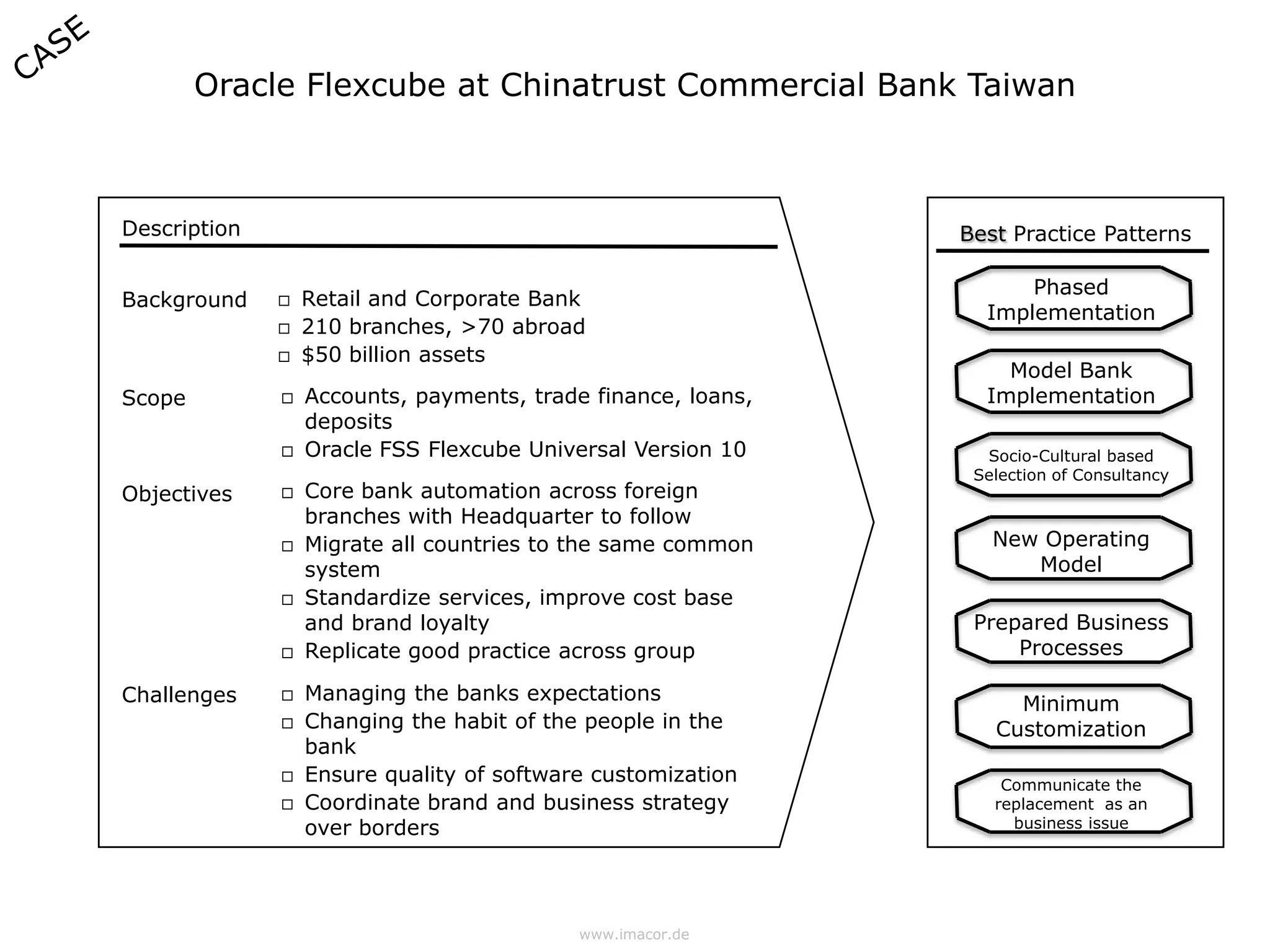

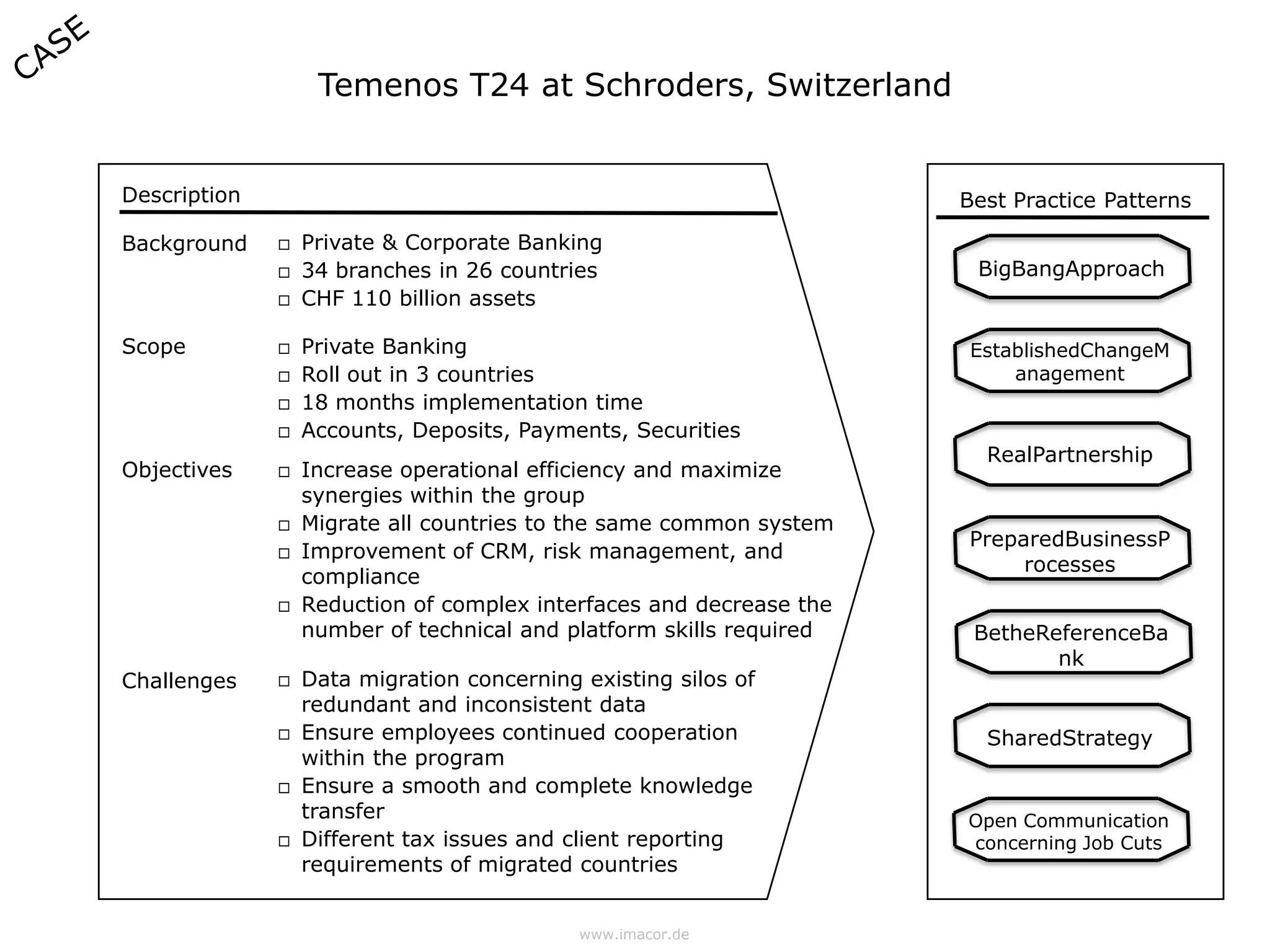

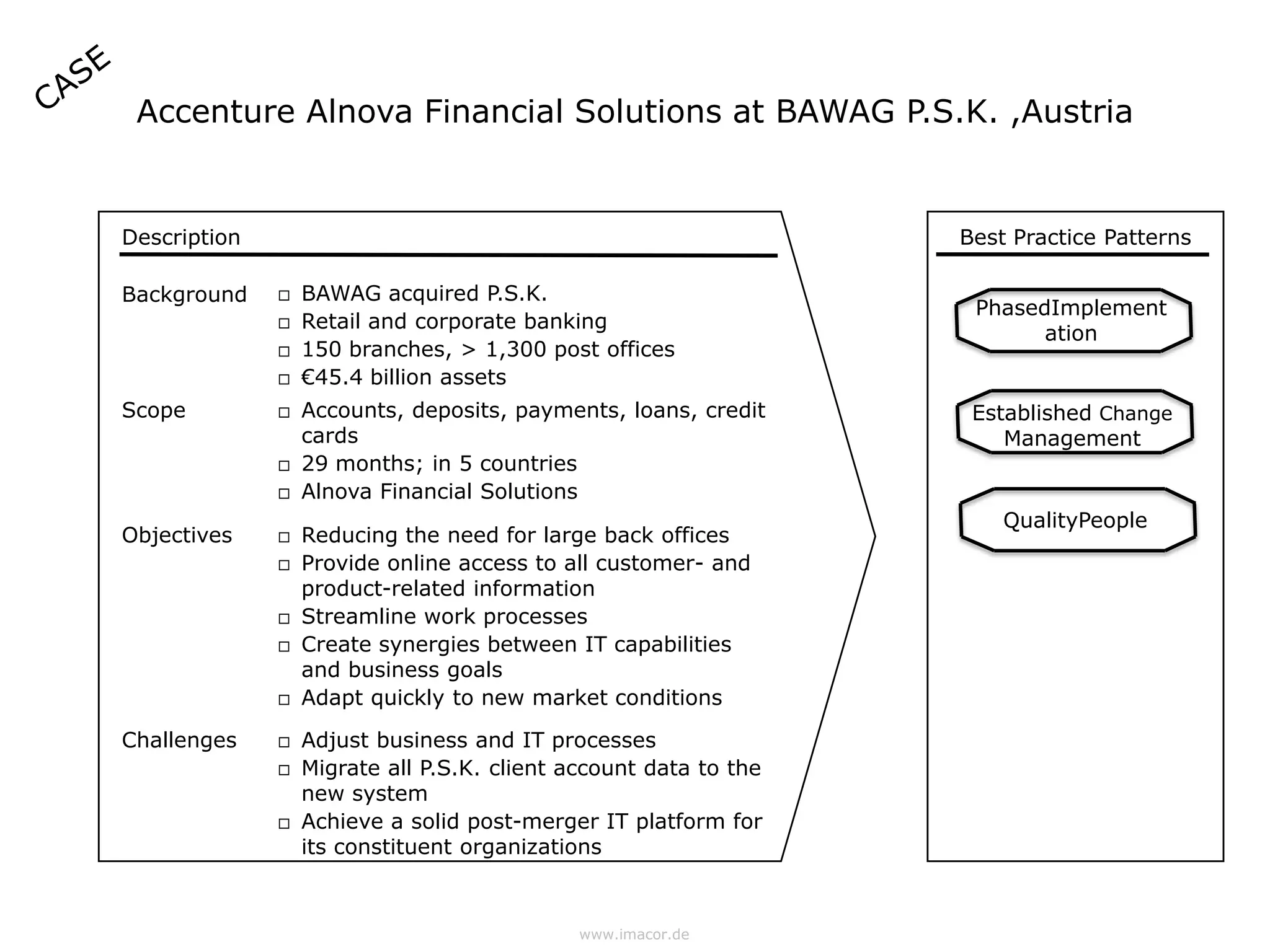

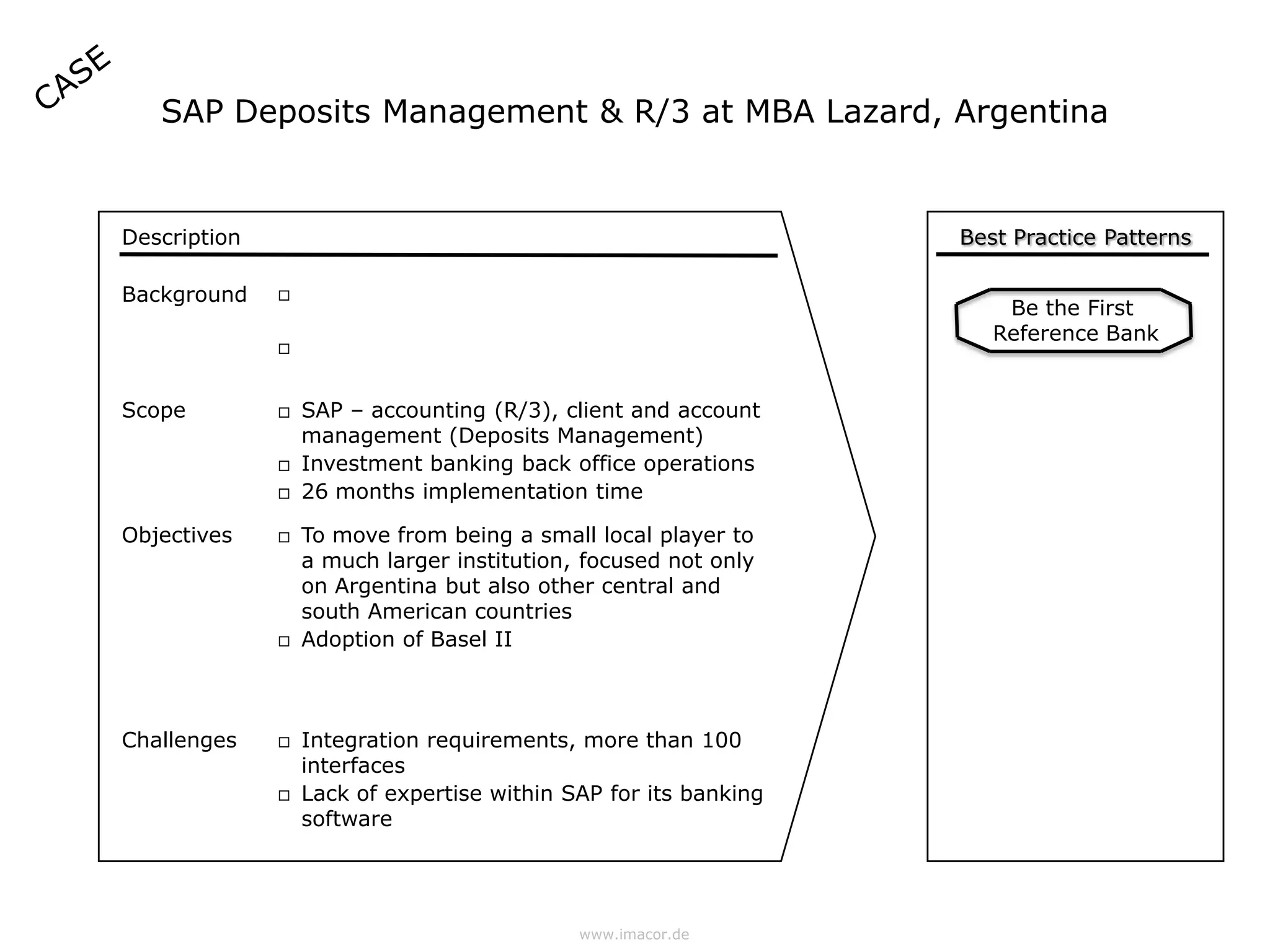

All banks face similar challenges when undergoing a core banking transformation, including legacy systems over 15 years old, functional gaps, inconsistent data, and limited scalability. There is still a high failure rate of around 50% for these transformations. Case studies of failed transformations provide lessons - one wrong choice like technical infrastructure can lead to failure, as was the case for Oracle FlexCube at Allied Irish Bank. Underestimating requirements, complexities, and changes in scope can also cause costs to double and timelines to extend, as seen with SAP at Commonwealth Bank of Australia. Successful transformations demonstrate best practices like phased implementations, model bank approaches, minimum customization, and ensuring replacement is seen as a business priority.