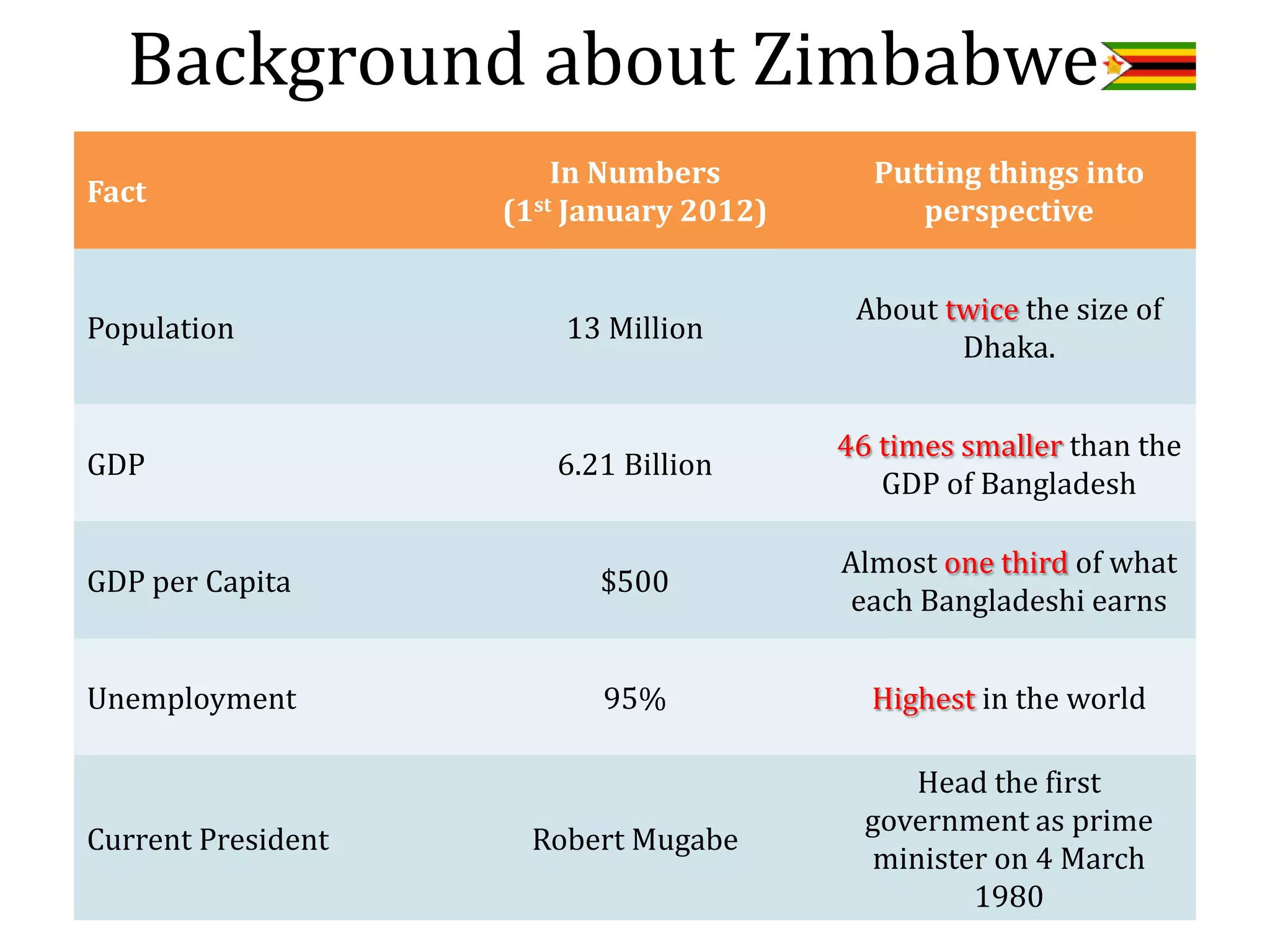

The document discusses hyperinflation in Zimbabwe, detailing its causes, the current inflation situation, and potential solutions. Major contributing factors include controversial land reforms, drought, and HIV/AIDS, leading to severe economic challenges and rampant inflation rates. Proposed solutions include dollarization, freezing government spending, and halting currency printing to stabilize the economy.