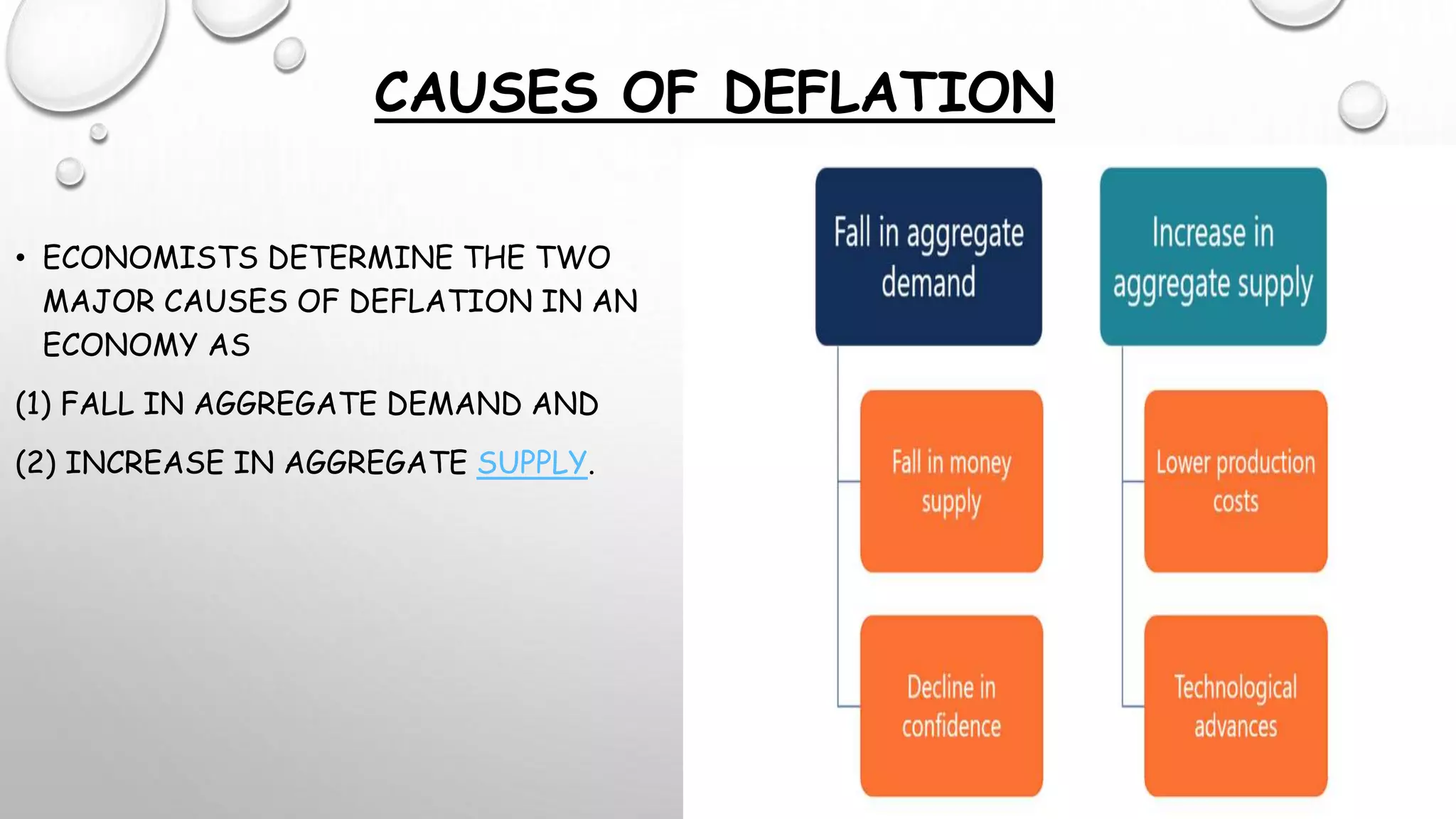

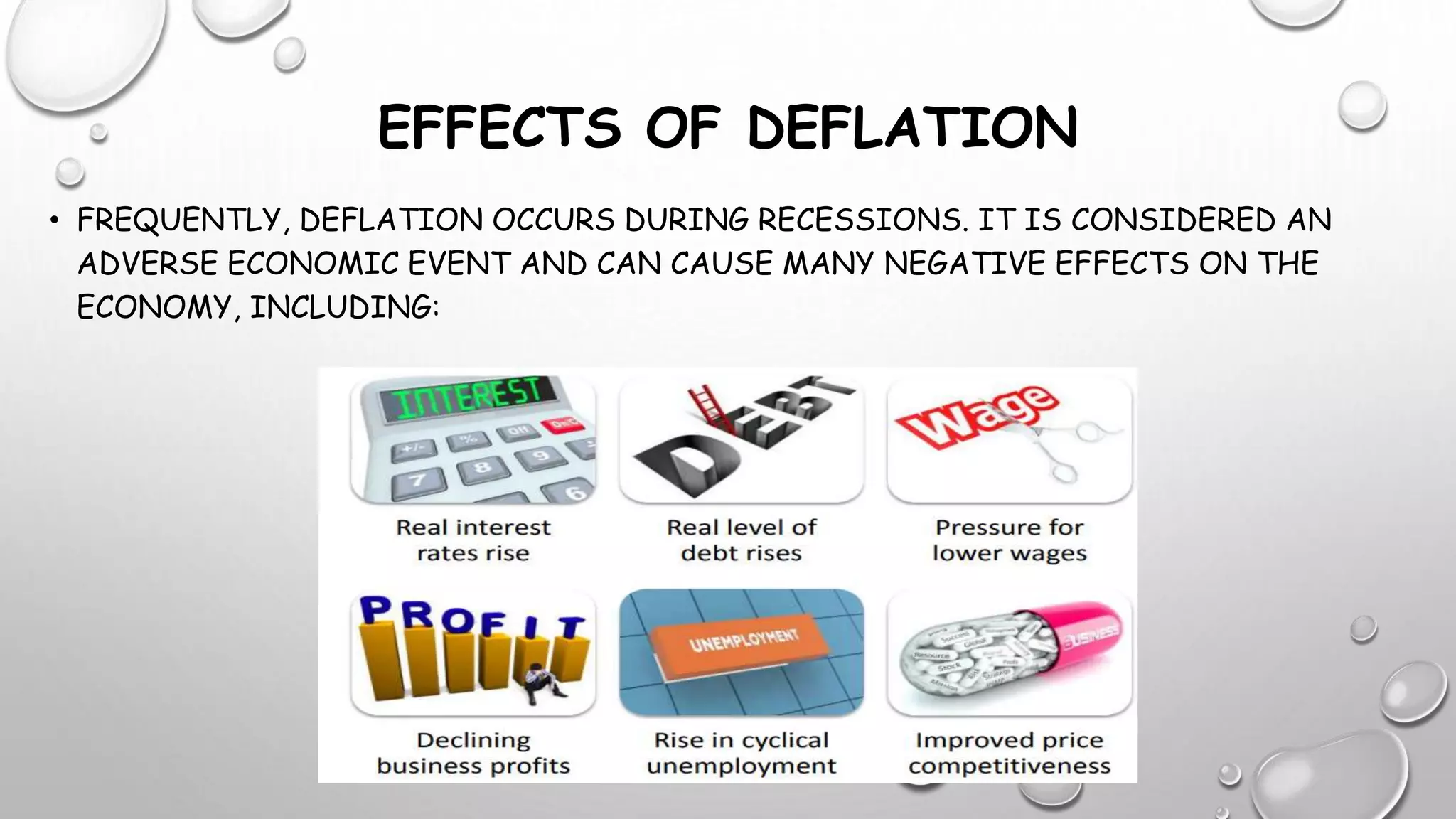

Deflation is a decline in the general price level of goods and services, often seen as an economic problem that can worsen recessions. It typically arises from a fall in aggregate demand or an increase in aggregate supply, leading to increased unemployment and a rise in the real value of debt. Counteracting deflation involves using macro-stimulus policies such as monetary easing and fiscal measures to boost demand.