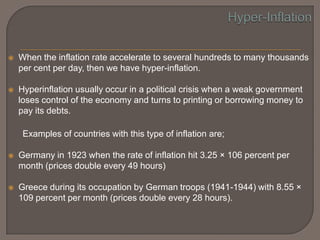

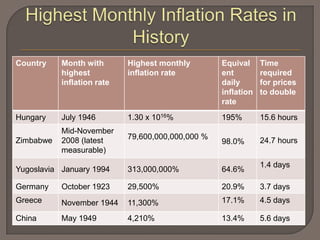

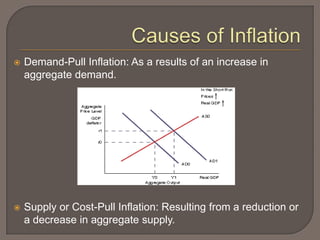

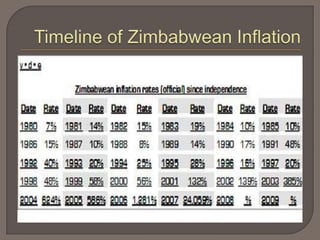

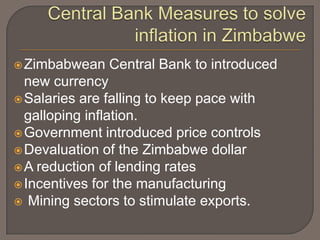

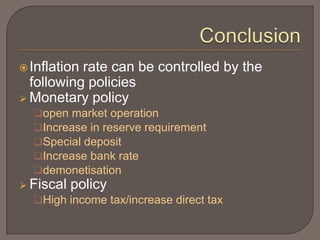

This document discusses inflation and deflation. It defines both concepts and provides types of inflation like hyperinflation. Causes of inflation and deflation are outlined. Examples of countries experiencing high inflation rates like Zimbabwe and historical hyperinflation events in Germany and Greece are examined. The costs of inflation are reviewed. Current inflation expectations and deflation challenges in Europe, Japan, and Finland are summarized. Policy options to address inflation are proposed.