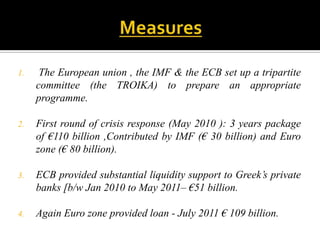

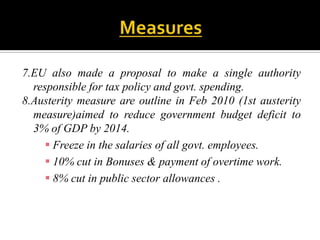

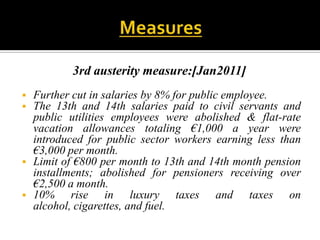

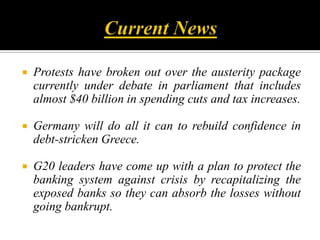

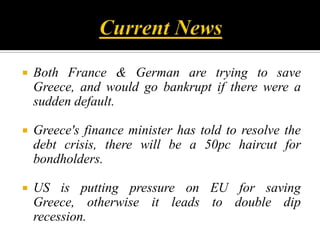

Greece accumulated high levels of debt in the decade before the financial crisis when markets were liquid. This led to a sovereign debt crisis as the financial crisis deepened and liquidity dried up, making borrowing more difficult and expensive. The crisis impacted Greece through lower incomes, savings, capital flows and sector output like tourism and shipping that contribute significantly to GDP. The European Union, IMF and ECB implemented measures like bailout loans and austerity programs to reduce Greece's deficit while the ECB also engaged in bond purchases to increase confidence. Protests have occurred against austerity cuts while leaders debate solutions to the dilemma of whether to continue supporting Greece or risk default.