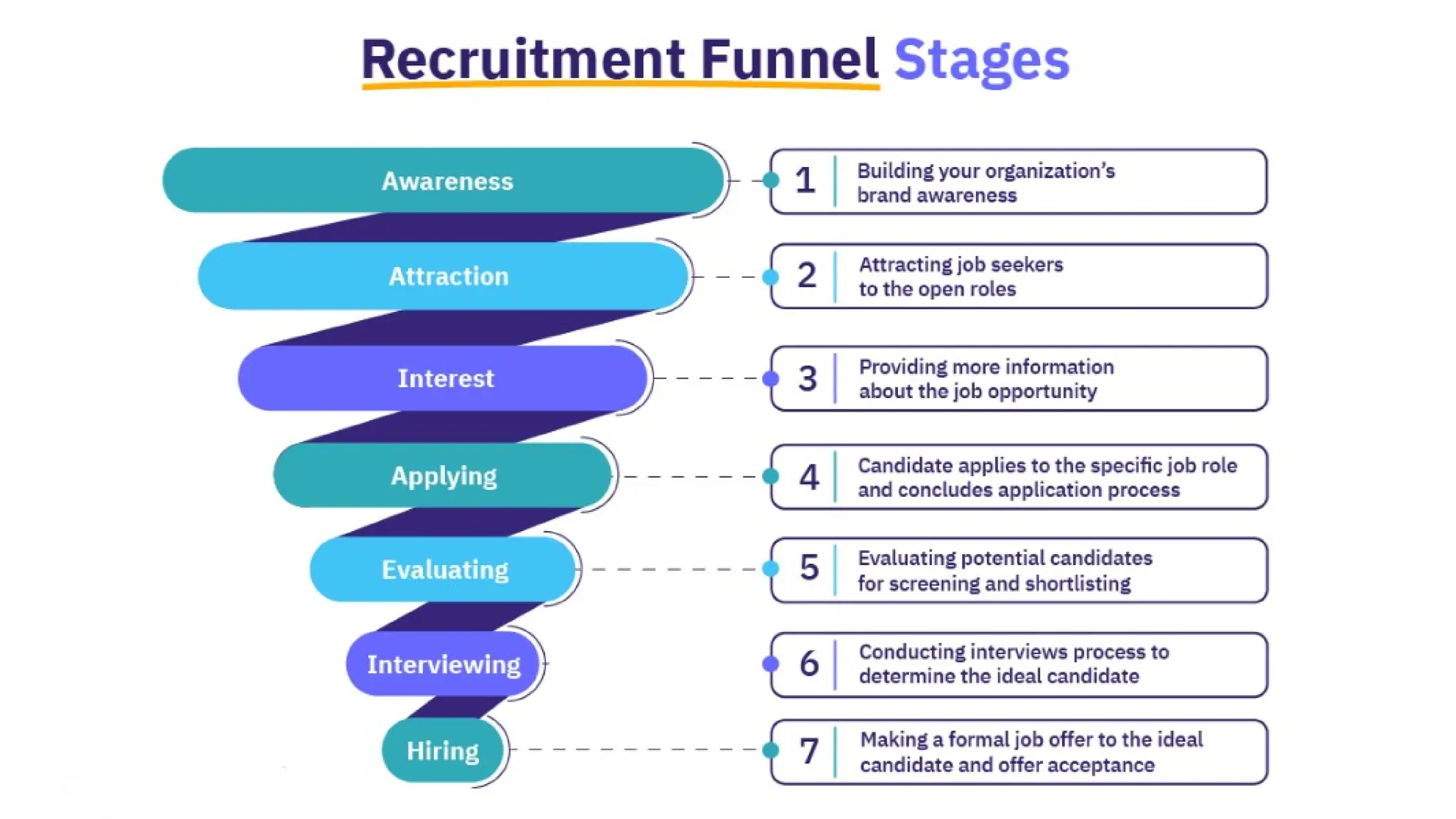

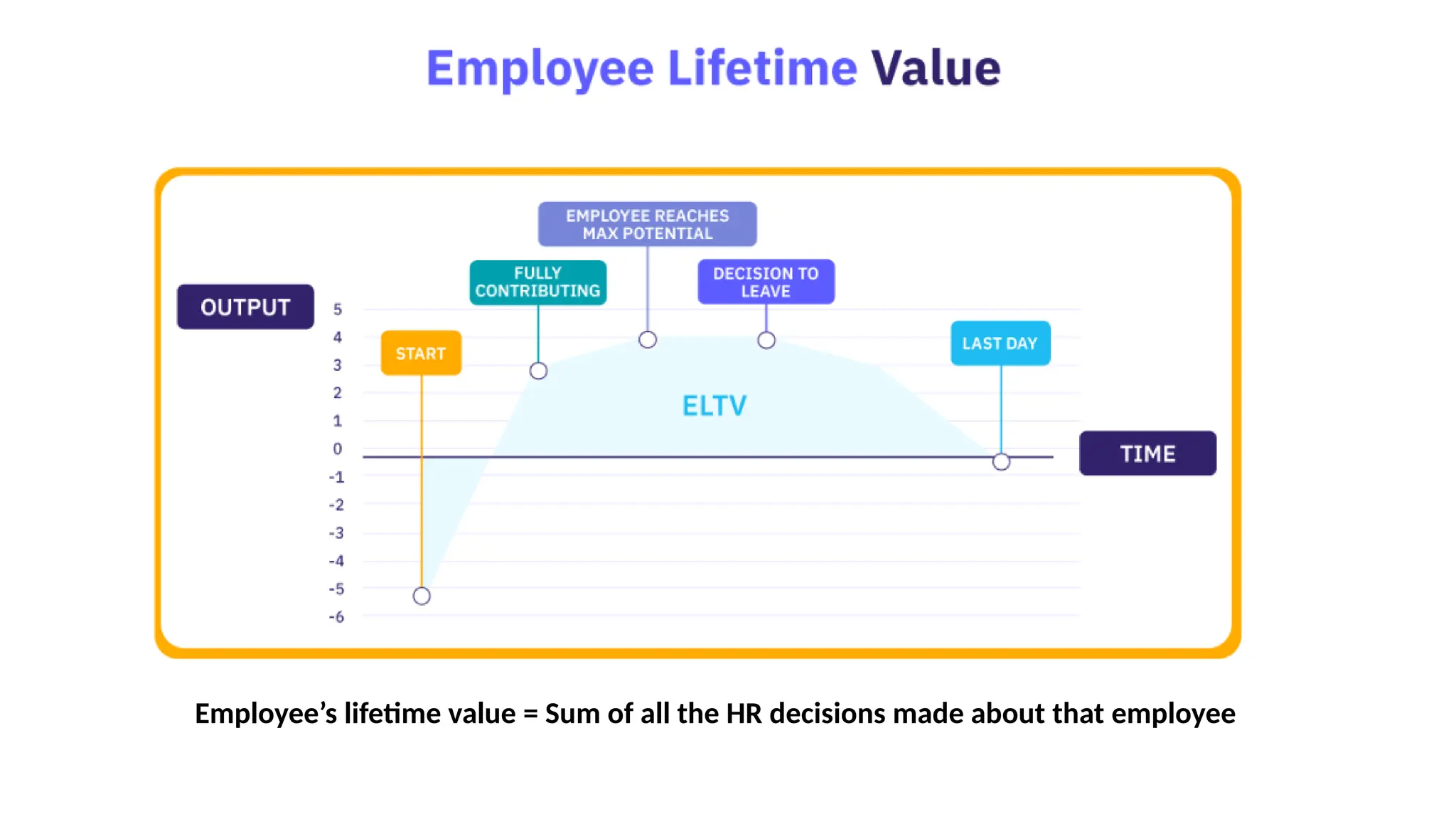

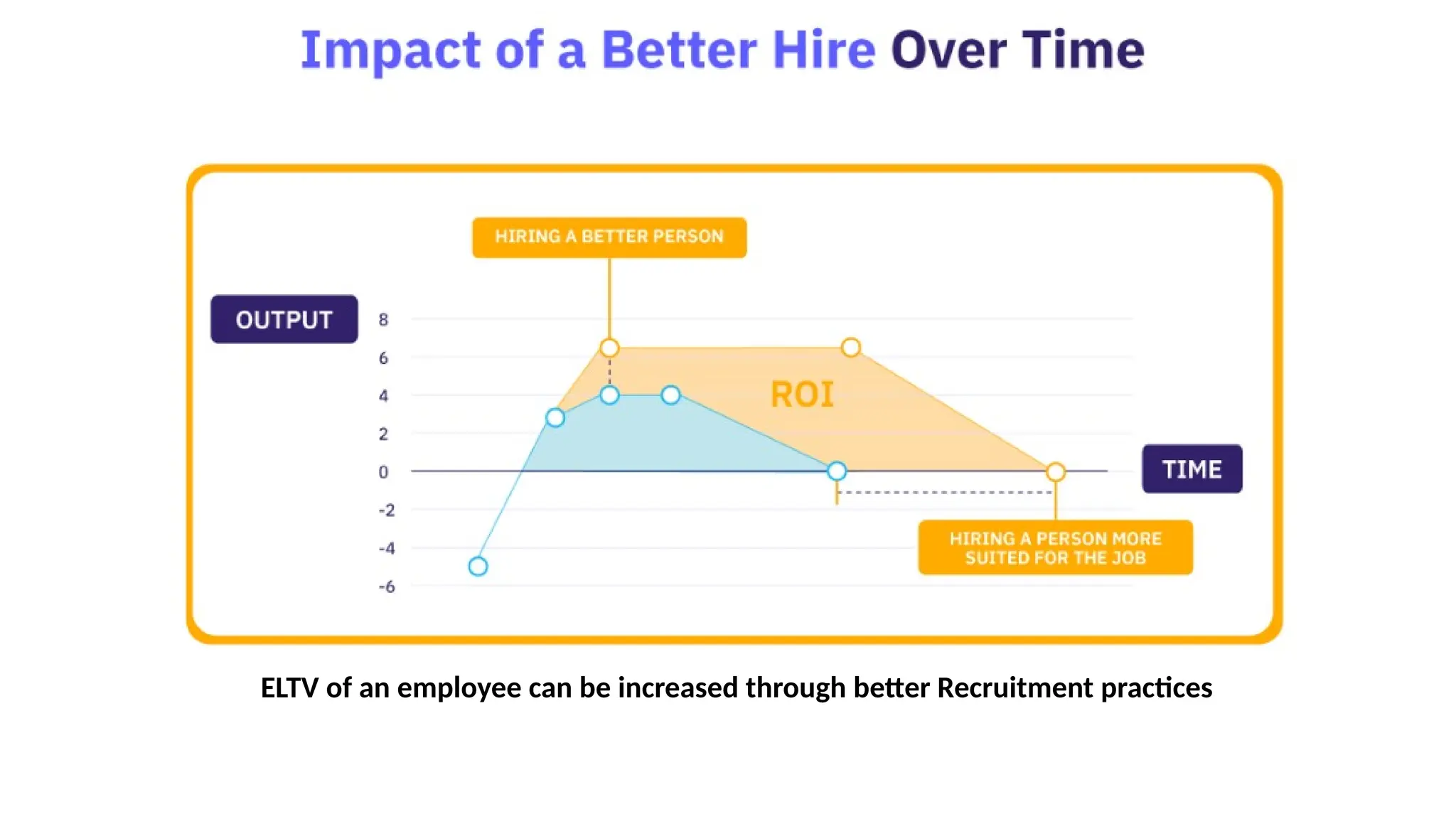

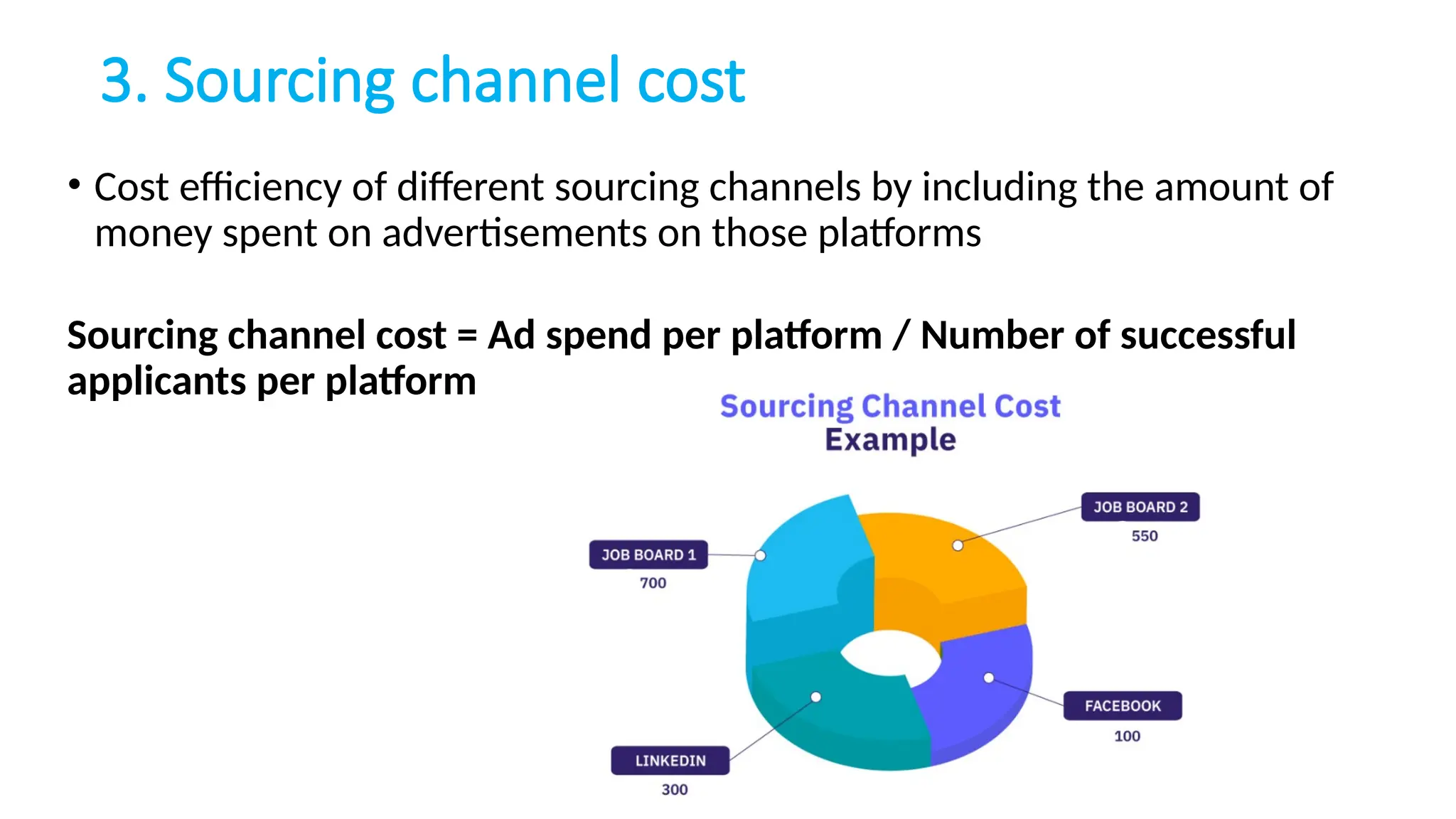

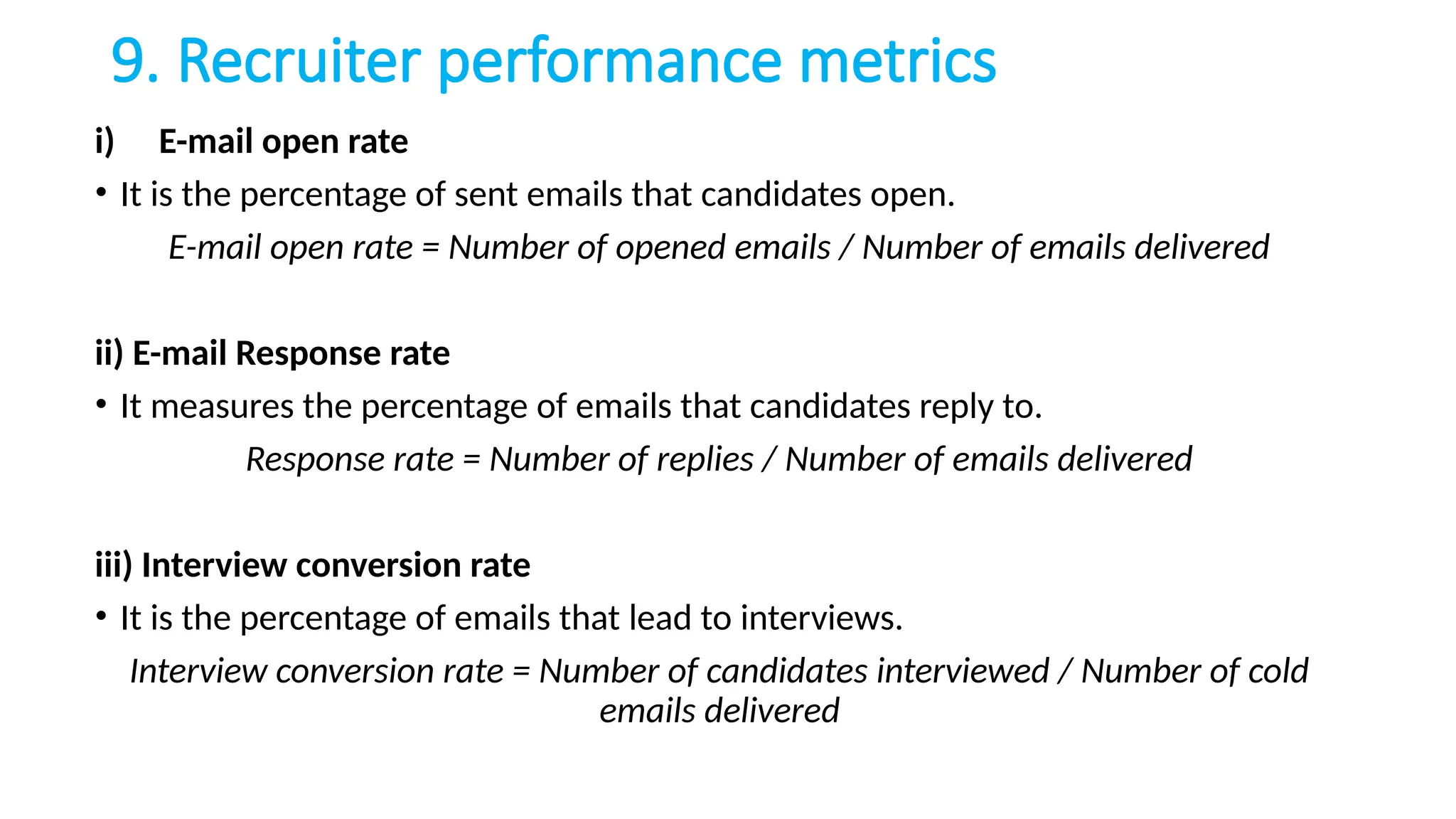

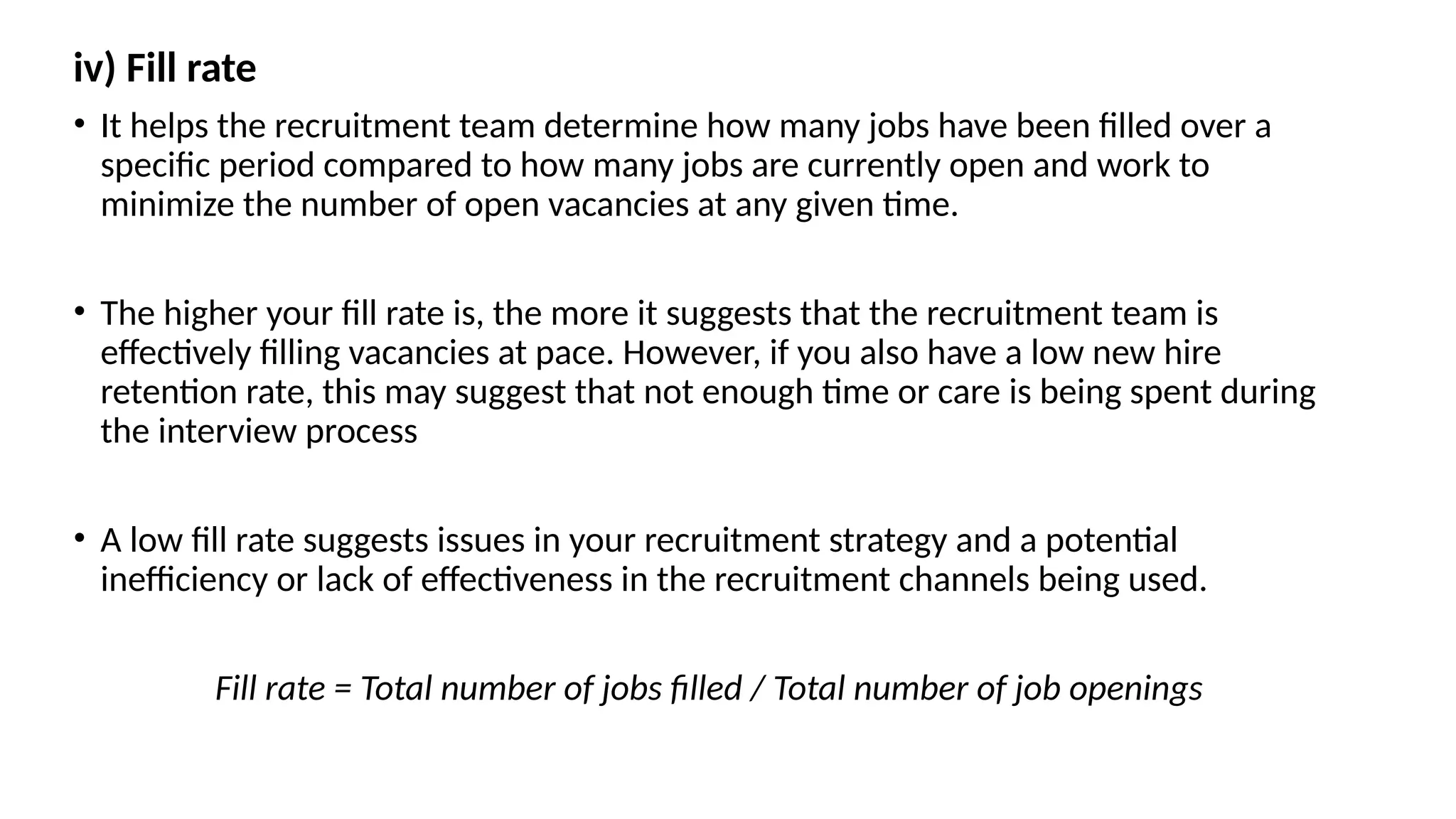

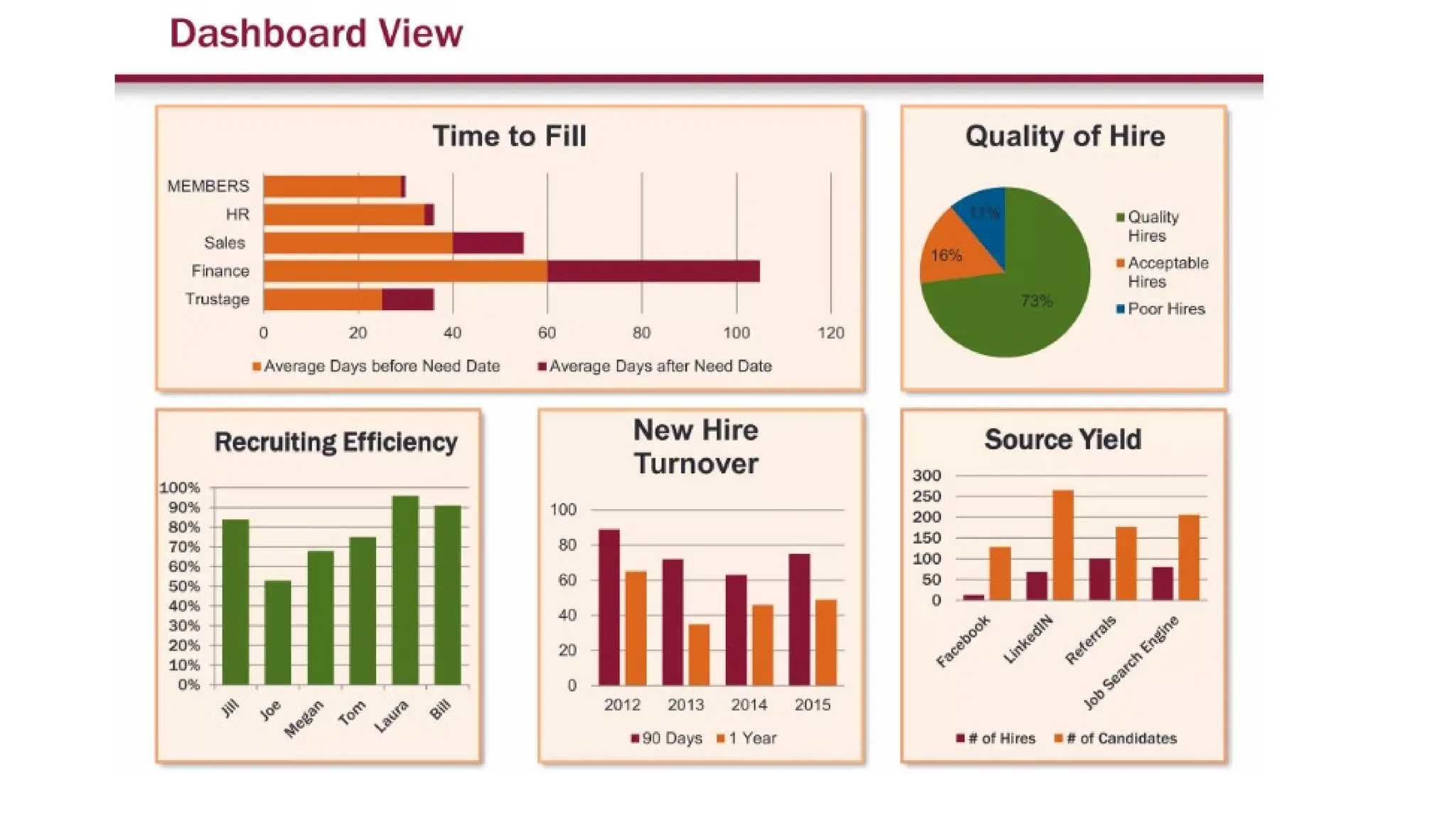

The document outlines various HR metrics and analytics for recruitment and training, emphasizing the importance of tracking performance indicators such as employee lifetime value, sourcing channel effectiveness, and quality of hire. It details several metrics to evaluate recruitment success, including time to fill, candidate assessment scores, and first-year attrition rates. Additionally, it provides insights on measuring training effectiveness through metrics related to financial performance, learner engagement, course completion rates, and operational efficiency.