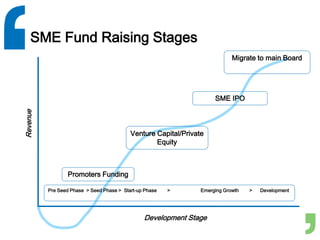

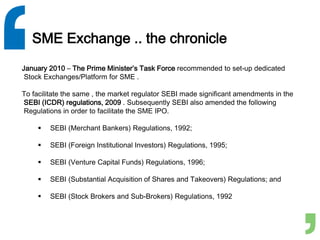

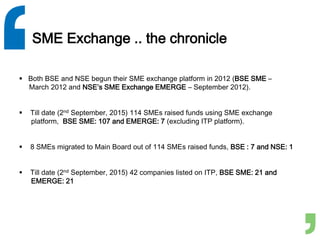

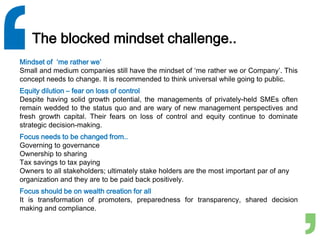

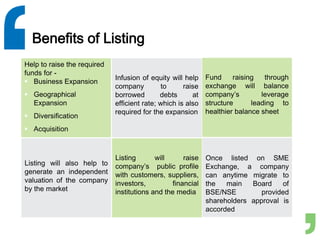

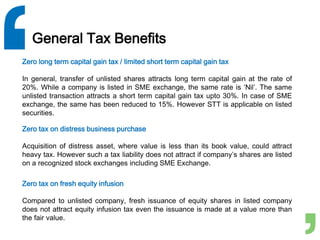

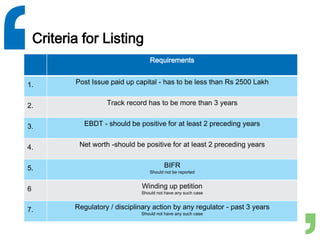

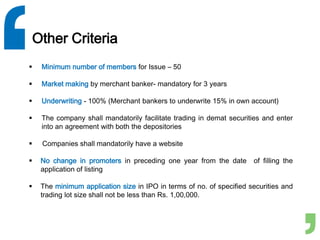

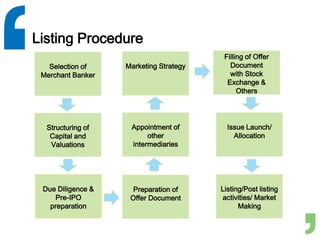

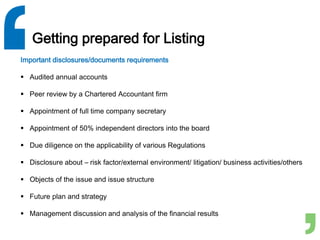

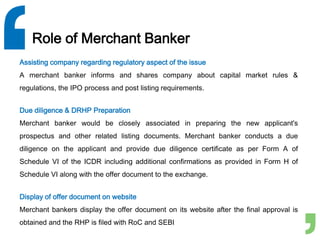

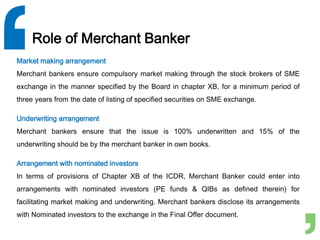

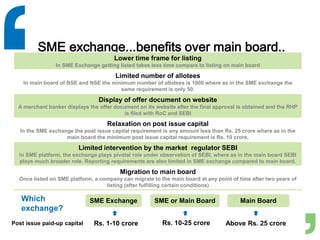

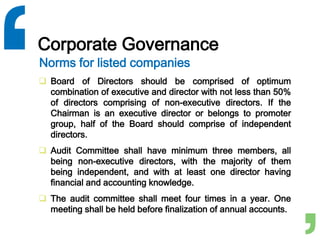

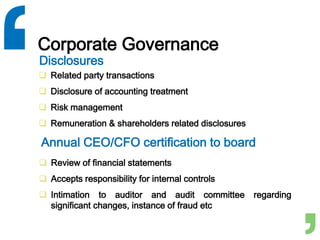

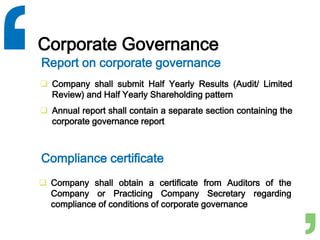

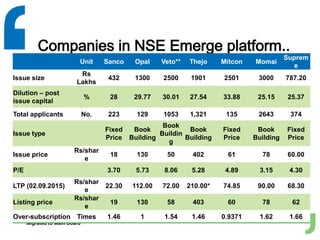

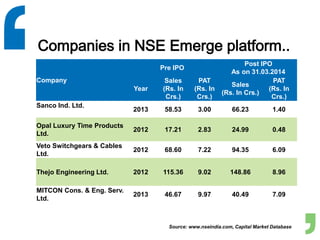

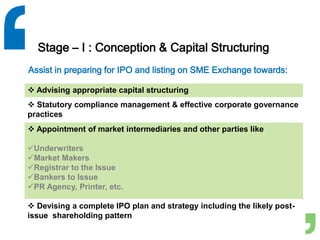

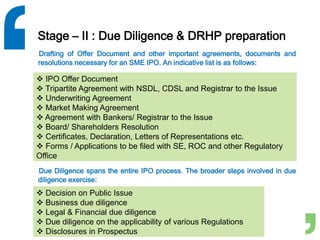

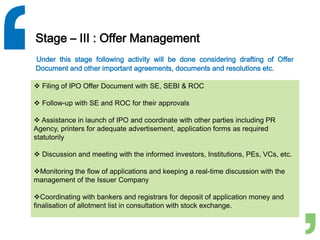

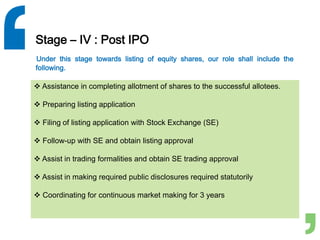

This document discusses the process of fundraising through an SME exchange platform. It begins with an overview of the stages of SME fundraising and the chronicle of SME exchanges in India. It then discusses some of the key challenges SMEs face in listing, the benefits of listing, eligibility criteria, and the roles of merchant bankers. It provides details on the listing procedure and getting prepared for listing. It also compares SME exchanges to the main board and discusses important post-listing considerations like corporate governance. Finally, it outlines the typical stages involved in an SME IPO process.