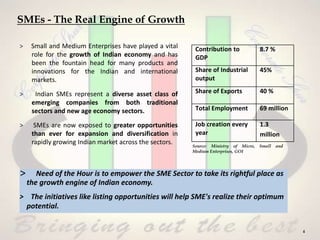

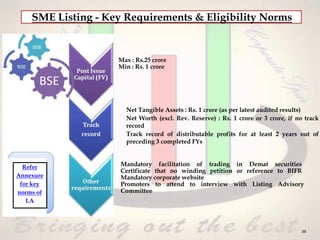

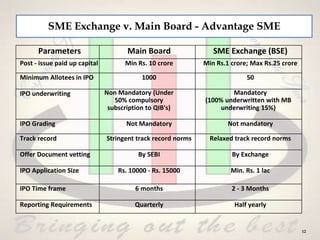

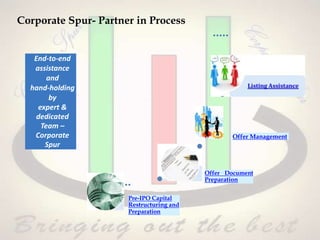

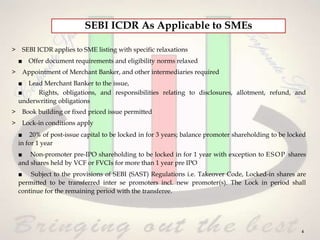

The document discusses investment opportunities in Indian small and medium enterprises (SMEs). It notes that SMEs play a vital role in India's economic growth and job creation. Listing on SME stock exchanges can help companies access capital, increase visibility, and attract new investors. The requirements for SME listings are more relaxed than the main board, with lower capitalization thresholds and reporting obligations. Listing provides benefits like financing options, tax incentives, and improving corporate governance.