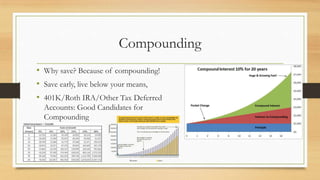

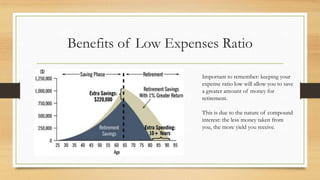

The document provides an overview of financial independence, highlighting its benefits such as employment freedom, reduced stress, and the ability to pursue retirement on one's terms. It discusses two primary methods for achieving financial independence: asset accumulation and expense reduction, along with the importance of understanding active versus passive income. Additionally, it emphasizes the significance of low expense ratios for maximizing savings through the power of compounding.