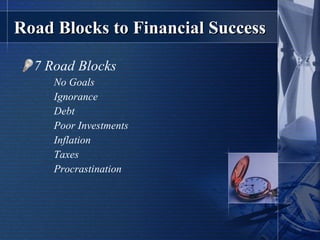

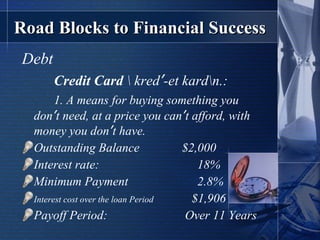

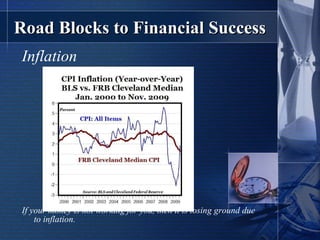

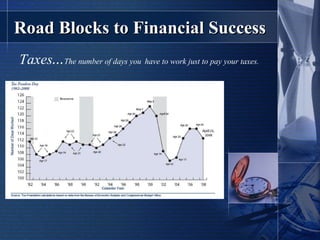

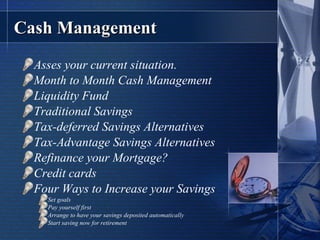

The document outlines the main roadblocks to financial success, including lack of goals, ignorance, debt, poor investments, inflation, taxes, and procrastination. It also presents six keys to financial mastery: risk management, cash management, investment planning, tax planning, retirement planning, and estate planning. Each key emphasizes the importance of strategic planning and informed decision-making to achieve long-term financial security.