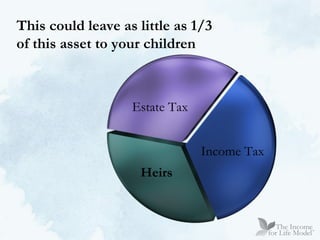

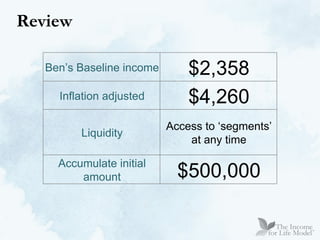

The document discusses five key challenges to retirement security: longevity, low interest rates, inflation, sub-par investing results, and taxes. It notes that longevity has increased life expectancy dramatically, interest rates are at low levels, inflation continues to rise, many investors achieve returns below market indexes, and taxes on retirement funds can leave little for heirs. The document advocates developing a written retirement plan to address these issues and securing a personalized financial analysis.