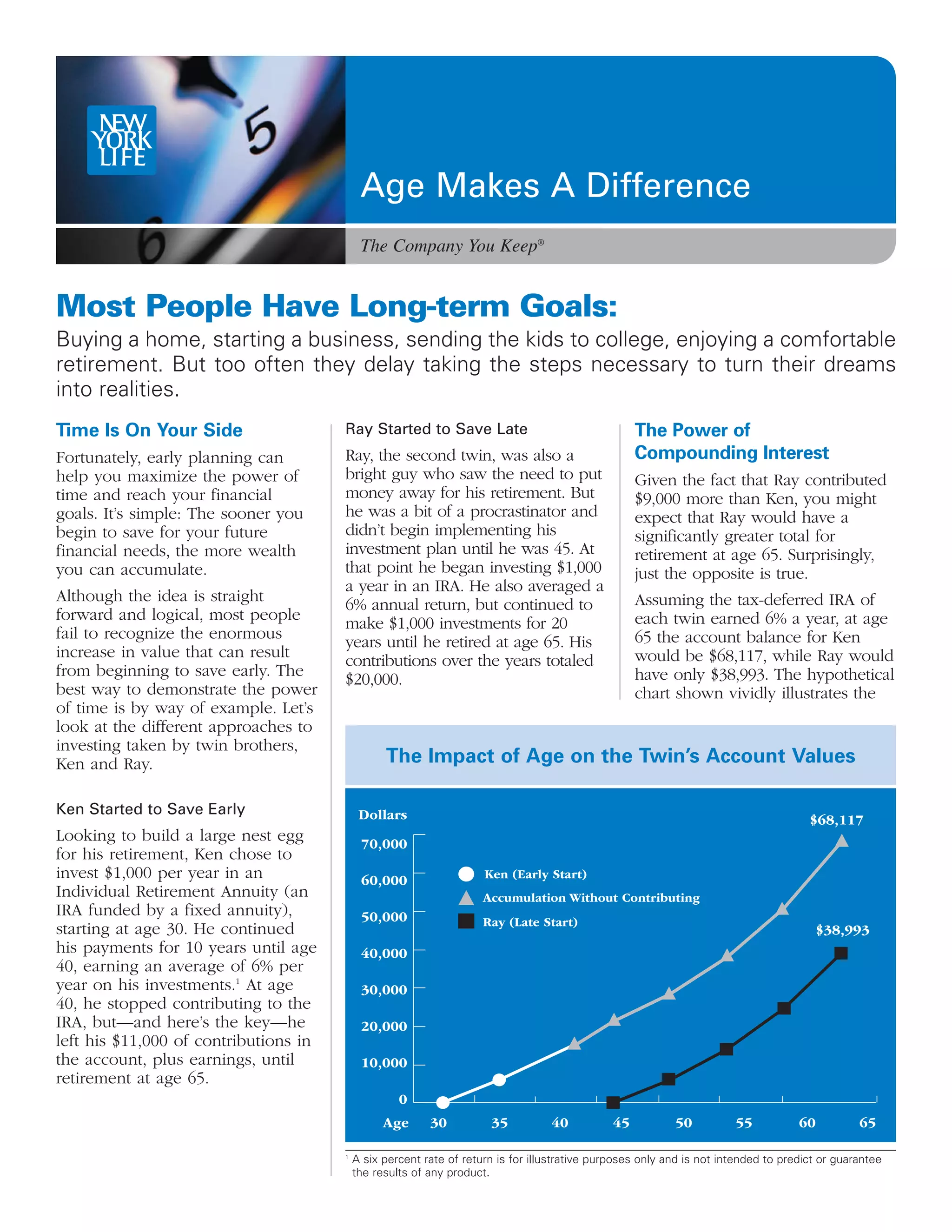

The document highlights the importance of early savings and investment planning for achieving long-term financial goals, illustrated through the comparison of twin brothers Ken and Ray. Ken, who started saving at age 30, accumulated significantly more wealth by age 65 compared to Ray, who began investing later. It emphasizes that delaying financial decisions, like purchasing life insurance, can lead to missed opportunities and financial risks.