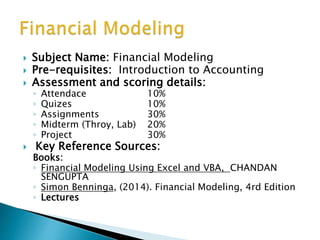

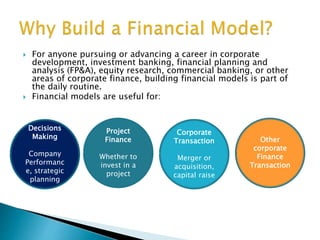

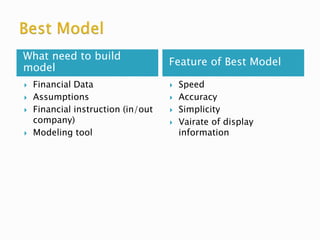

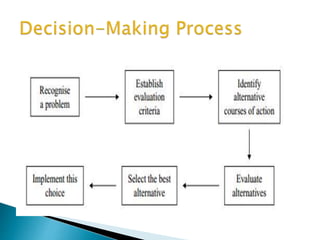

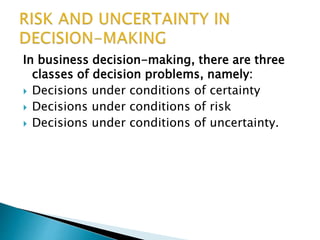

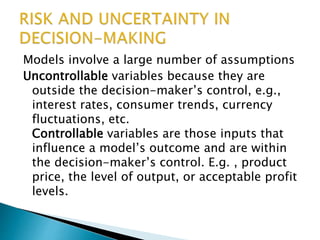

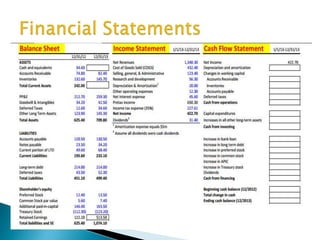

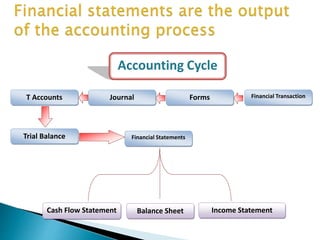

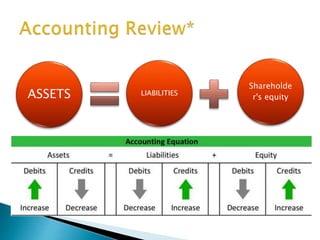

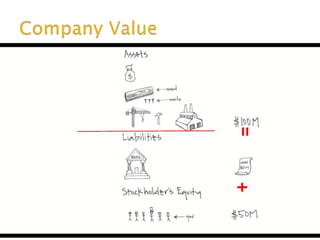

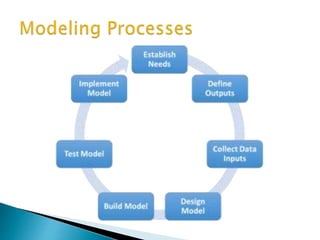

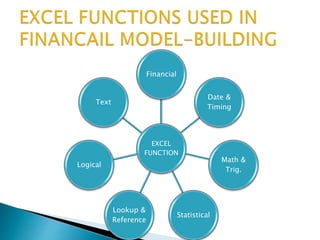

The document outlines a course on financial modeling, detailing its prerequisites, assessment criteria, and key reference sources. Financial modeling, essential for careers in finance, involves analyzing historical data to value companies/projects and aids in decision-making under different conditions of certainty, risk, and uncertainty. It emphasizes the importance of spreadsheets, particularly Excel, for building models and highlights the necessity of understanding both theory and practical functions for effective financial analysis.