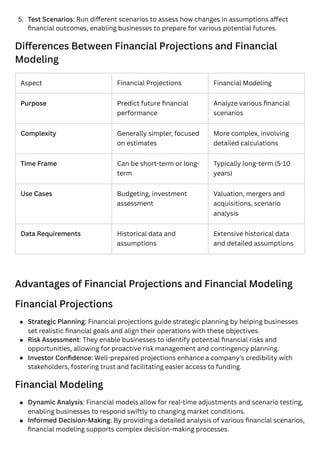

Financial projections and modeling are crucial for strategic business planning, helping organizations forecast future financial performance and make informed decisions regarding investments and operations. Projections estimate revenues, expenses, and cash flows, while modeling creates detailed representations for scenario analysis and valuation. Together, they enhance decision-making, risk management, and investor confidence, providing a roadmap for navigating complex economic environments.