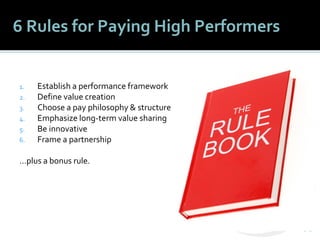

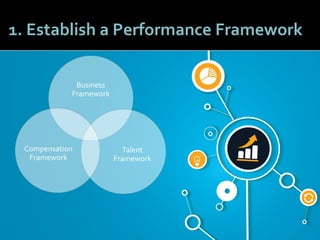

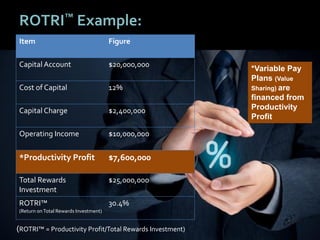

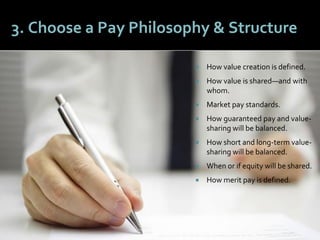

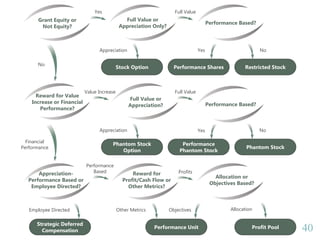

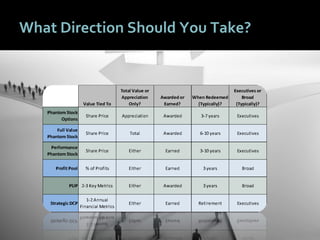

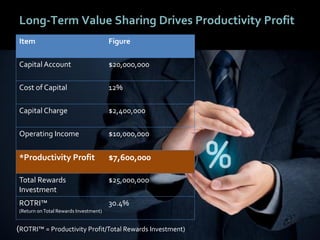

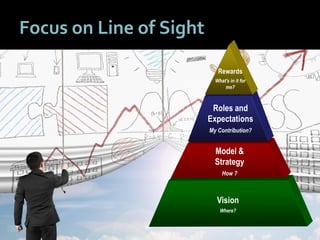

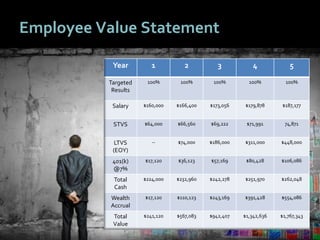

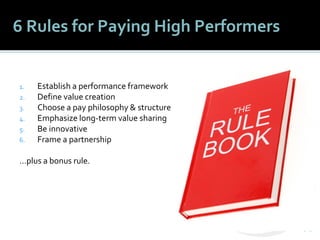

The document discusses strategies for compensating high performers to foster a culture of performance and business growth. It outlines six rules for effective pay strategies focusing on establishing performance frameworks, defining value creation, and promoting long-term value sharing. Additionally, it emphasizes the importance of innovative approaches and partnership-building between employees and leadership to attract and retain top talent in a competitive market.