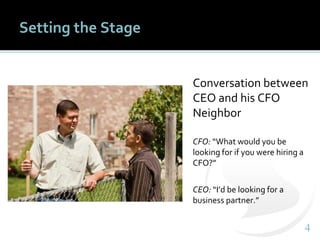

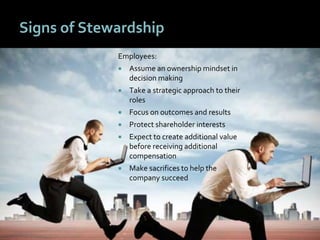

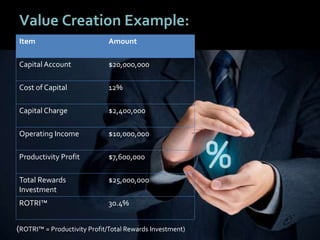

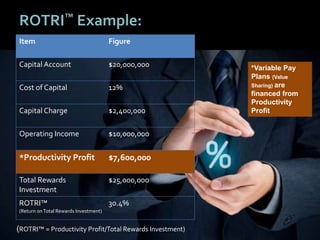

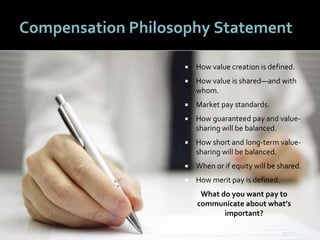

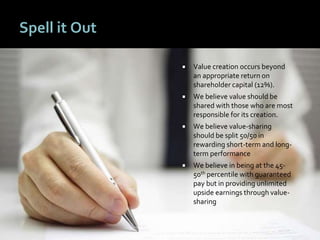

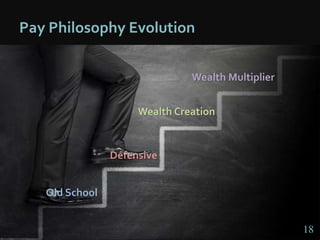

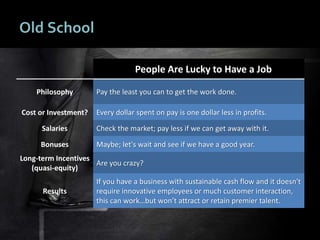

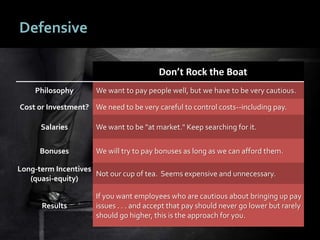

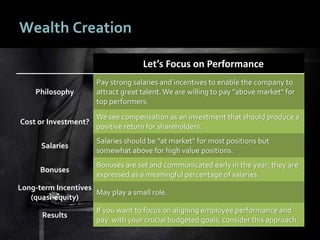

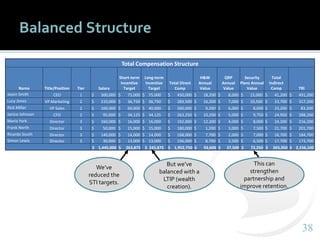

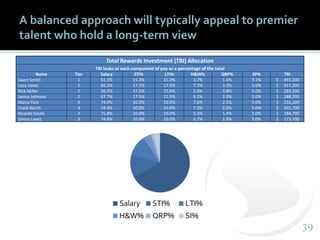

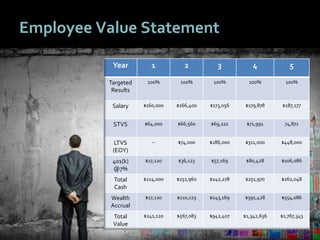

The document outlines strategies for transforming an entitlement mindset among employees into a stewardship approach to enhance business performance. It emphasizes the importance of defining value creation, developing a clear pay philosophy, and establishing a balanced pay strategy to foster employee engagement and alignment with business goals. Key recommendations include articulating compensation based on productivity and responsibility, incentivizing top performers, and structuring compensation as an investment in talent and shareholder value.