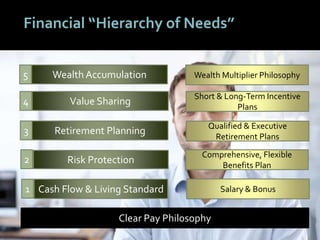

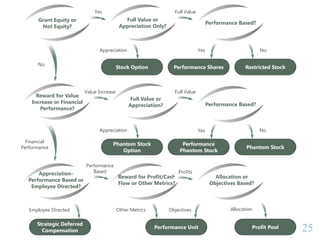

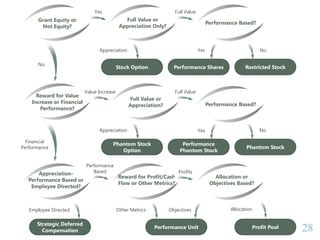

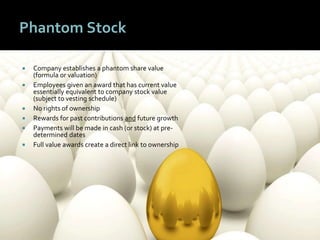

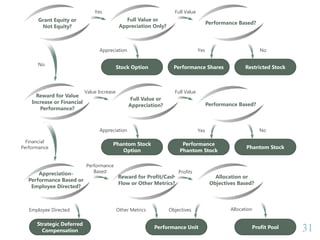

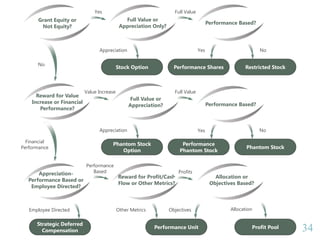

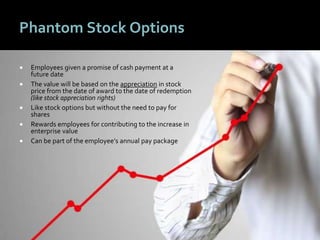

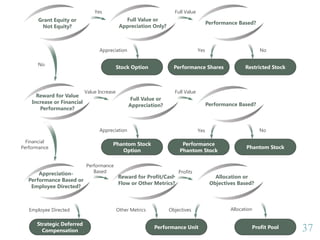

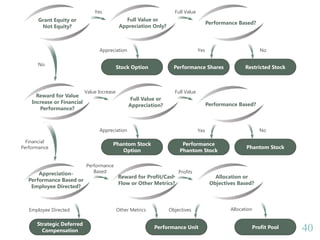

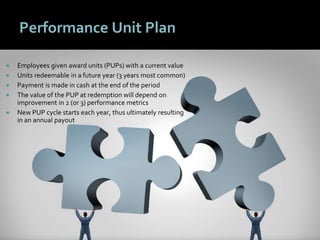

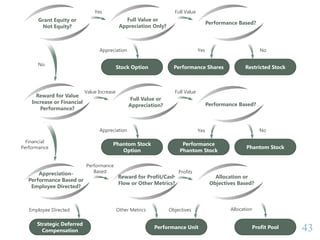

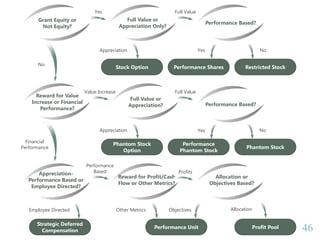

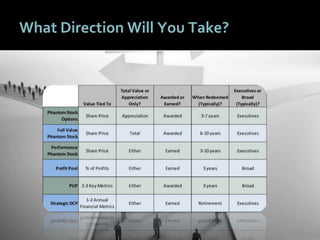

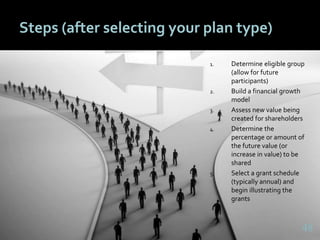

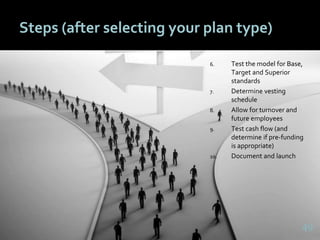

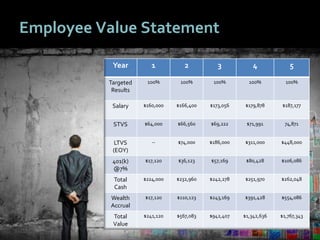

The document discusses various long-term incentive plan (LTIP) options for companies to use to attract, retain, and motivate top talent. It presents 9 alternatives for long-term value sharing plans, including stock options, restricted stock, phantom stock, and profit pools. For each option, it outlines whether the plan provides equity or not, is based on appreciation or full value, and whether it rewards value increases or financial performance. The document advocates that long-term value sharing is important to attract the best talent, reinforce a company's business model, and build an ownership mindset among employees. It provides steps for selecting and implementing an LTIP to share in a company's future value creation.