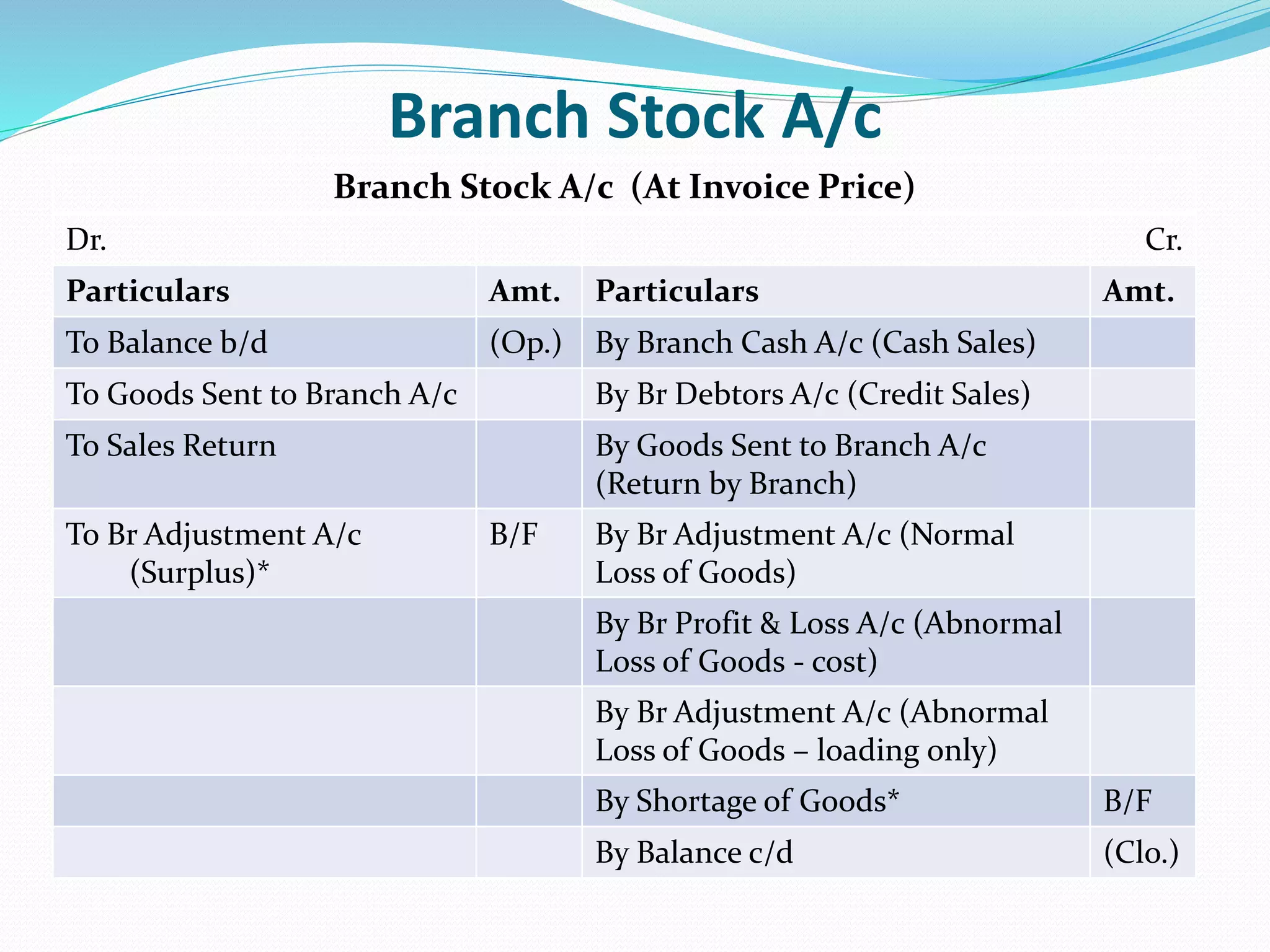

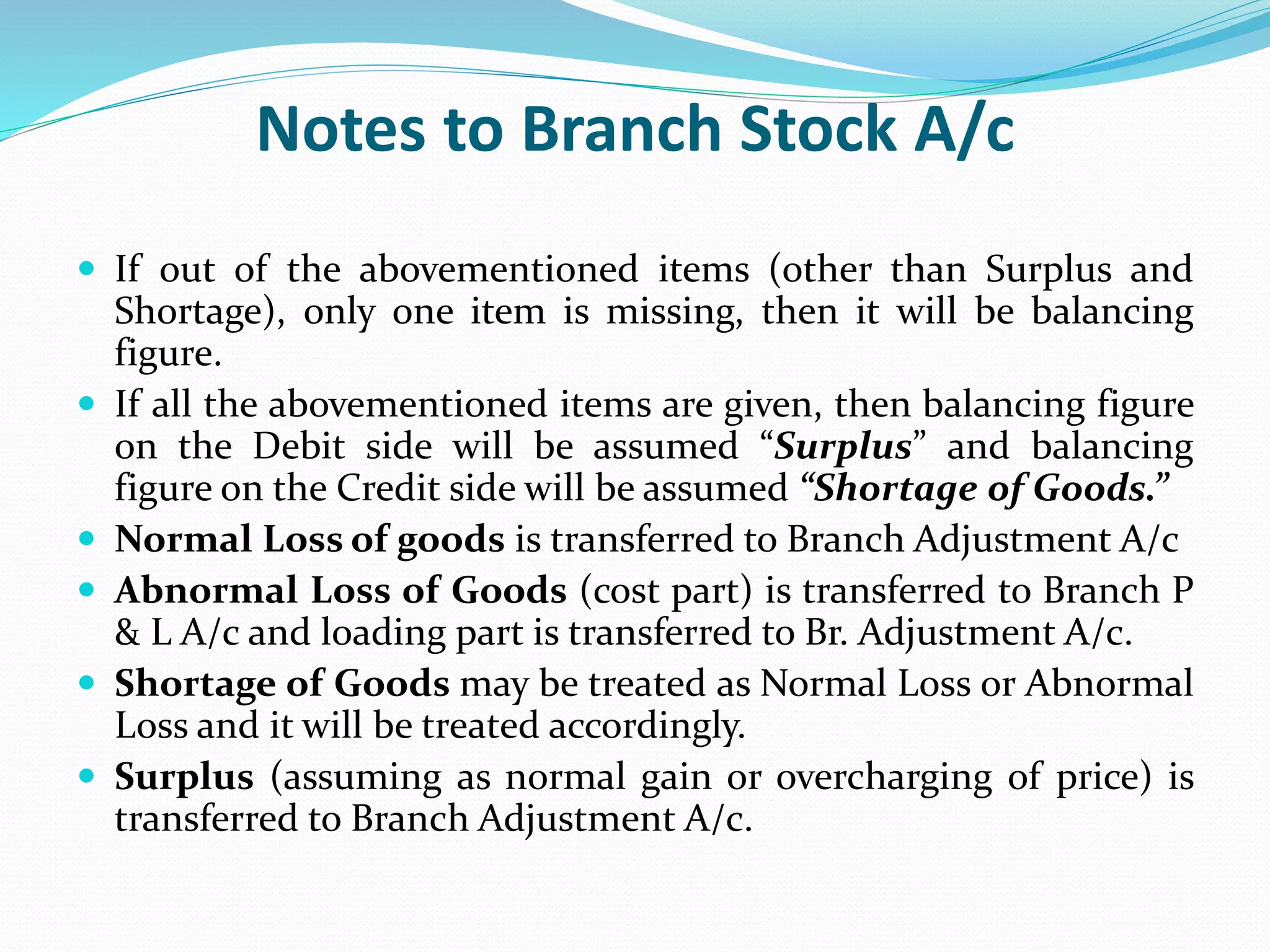

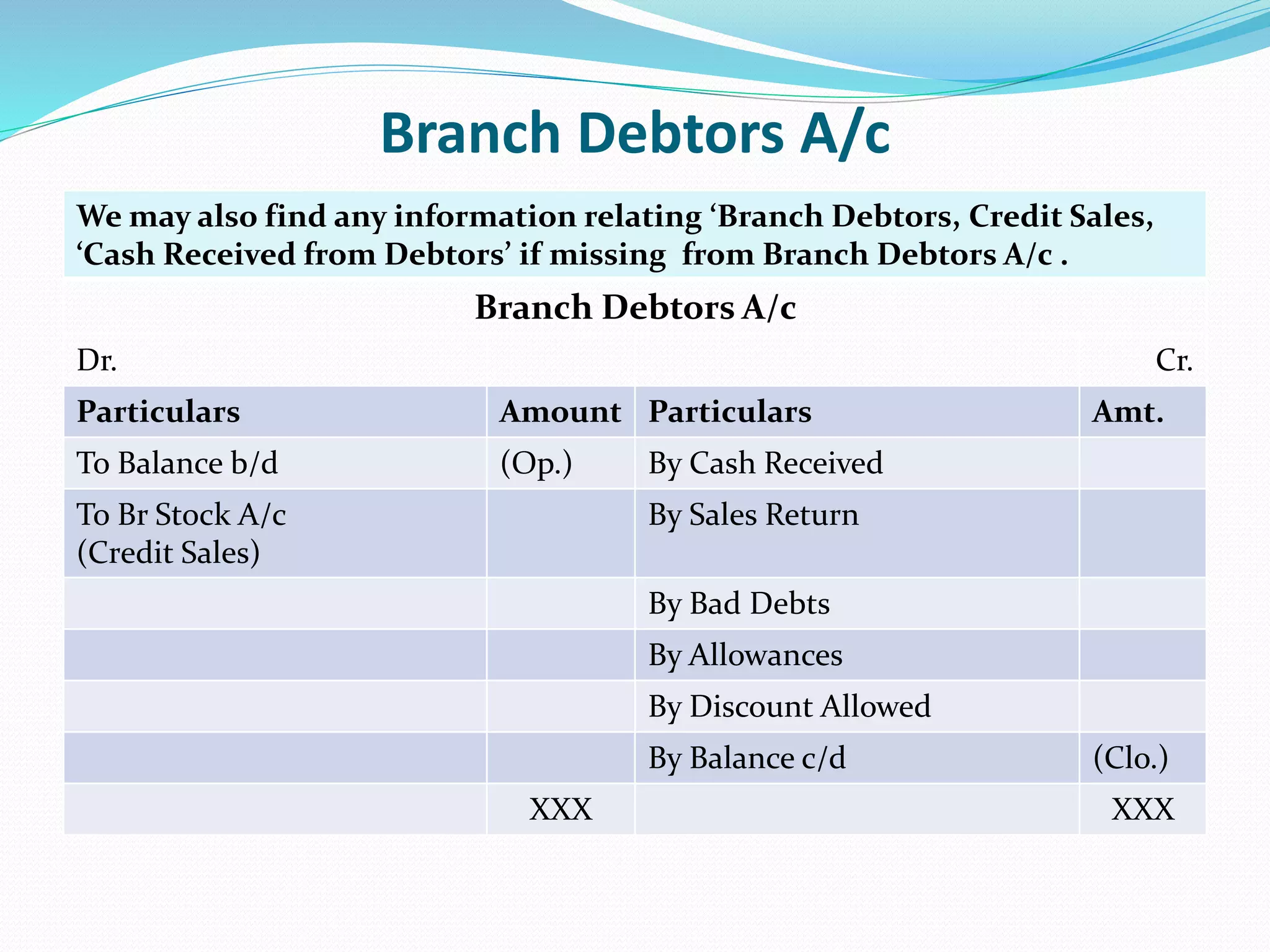

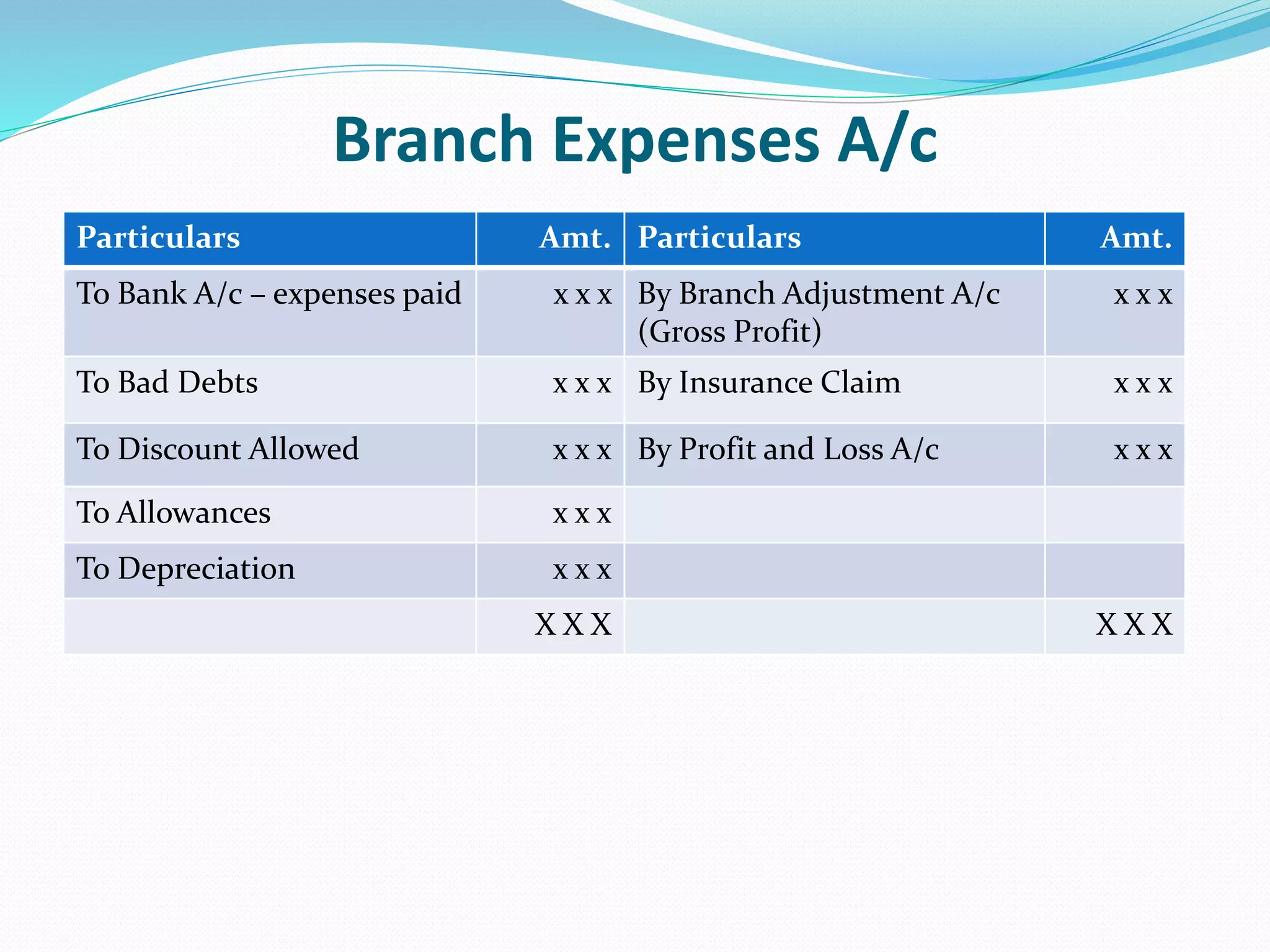

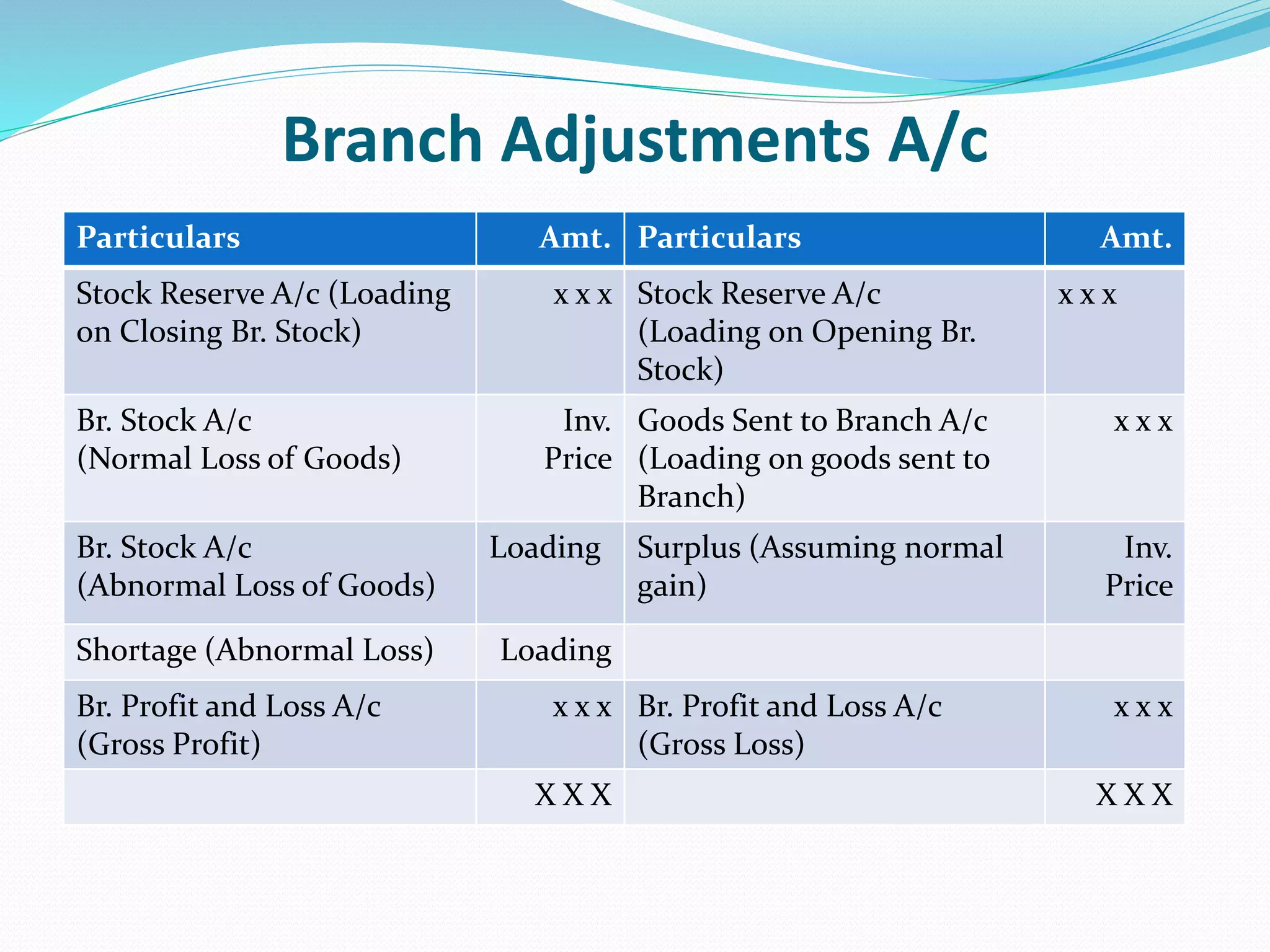

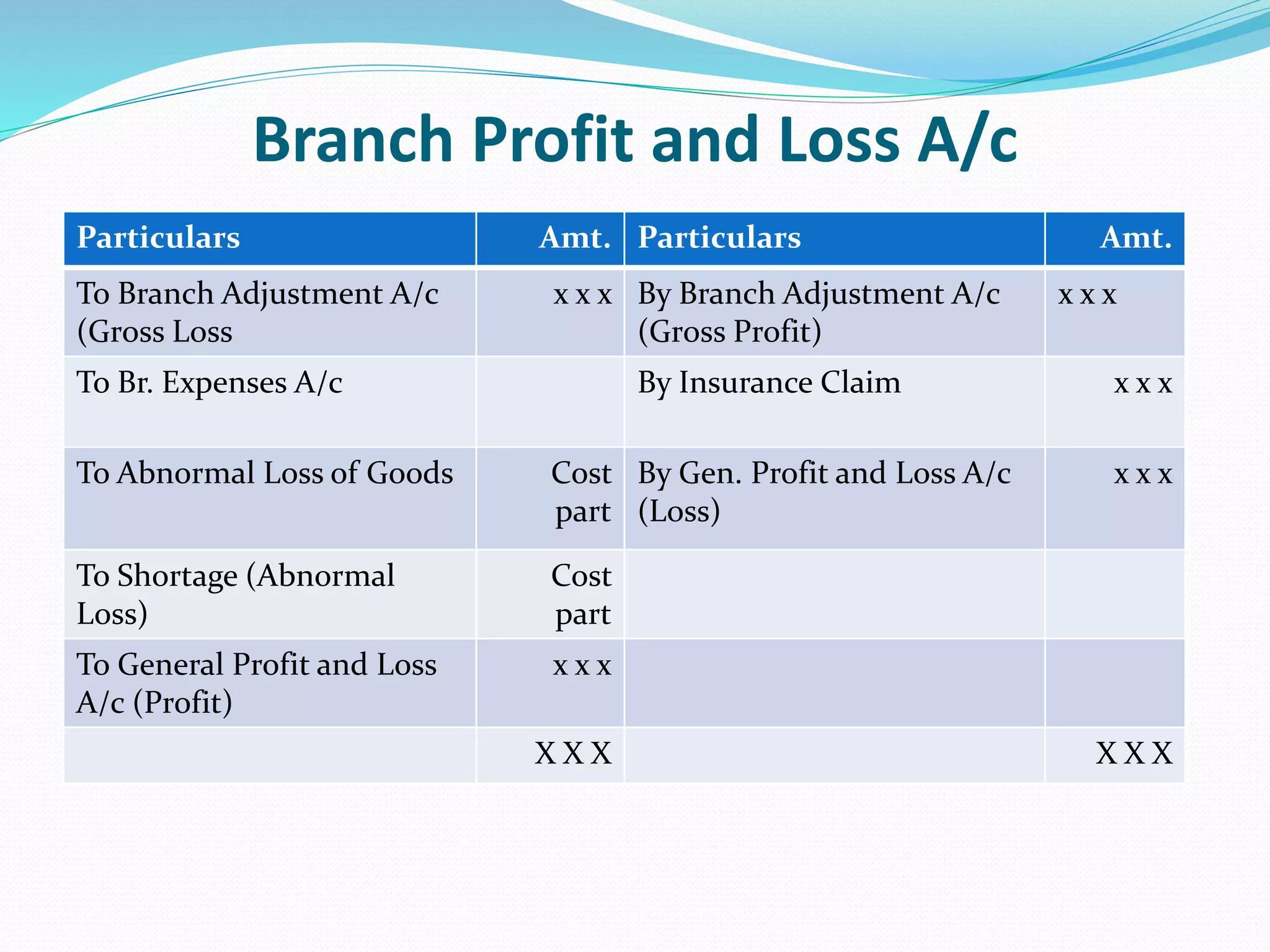

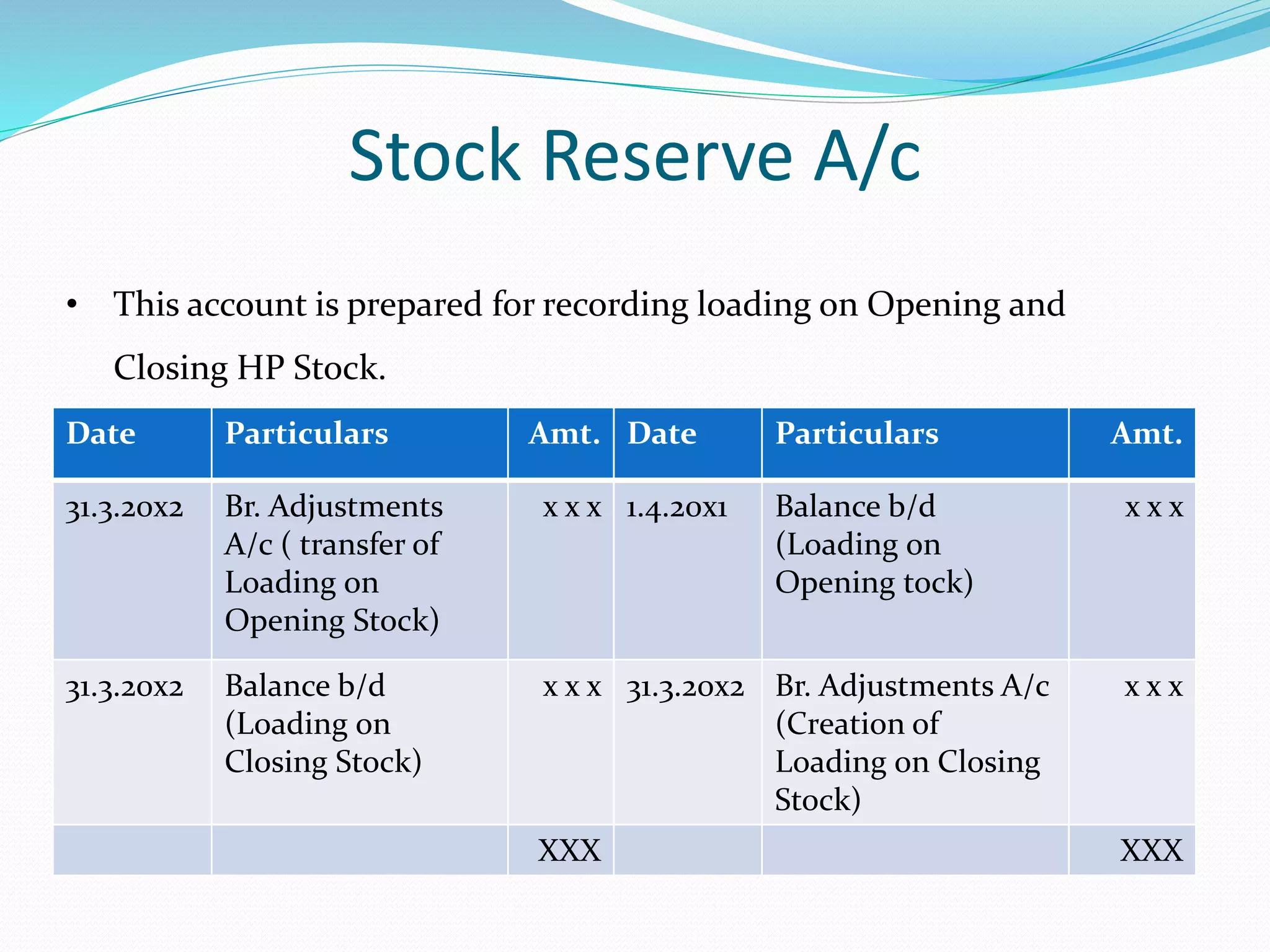

The document discusses key terms and ledger accounts related to branch accounting, including branch stock, branch debtors, and goods supplied by the head office to branches. It outlines how to prepare various accounts such as branch stock, debtors, expenses, and profit and loss, along with notes on handling surplus, shortfalls, and losses. Additionally, it includes details on adjustments for loading on stock and profit calculations in a branch set-up.