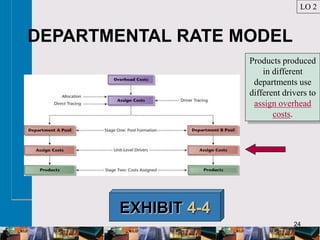

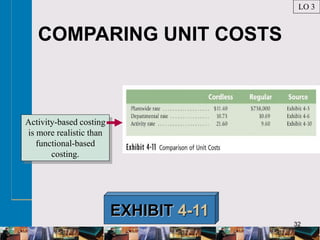

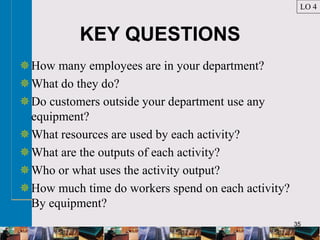

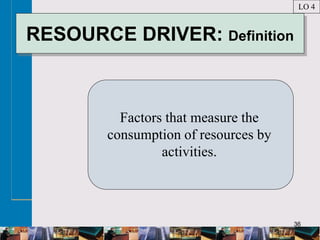

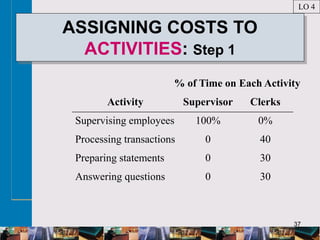

1. An activity-based costing system assigns overhead costs to products based on their consumption of activities, rather than traditional volume-based drivers. This provides more accurate product costs than functional-based costing.

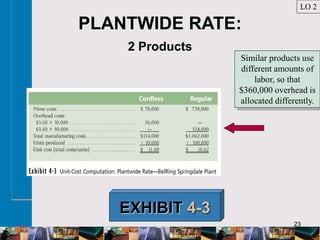

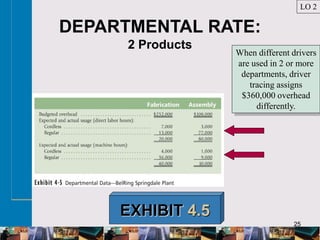

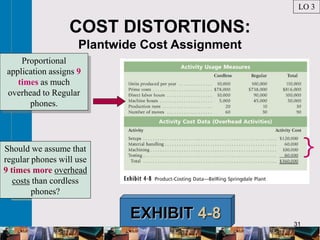

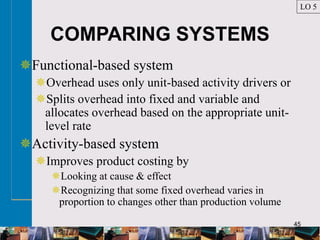

2. Functional-based costing may distort product costs when overhead is assigned using only unit-level drivers, as it does not account for how products consume non-unit level activities differently. Activity-based costing identifies these activities and assigns costs to products based on their activity usage.

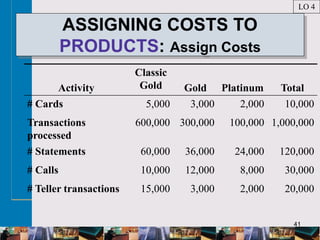

3. To reduce the complexity of an activity-based costing system, companies can use consumption ratios or approximate the system to reduce the number of activity rates needed while still providing more accurate product costs than a traditional functional