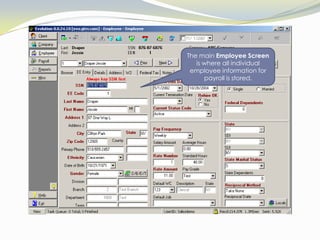

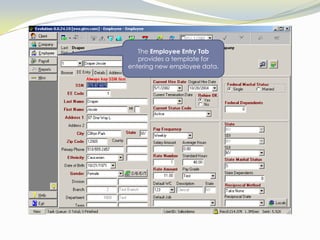

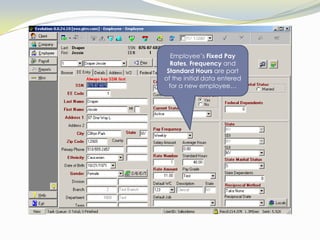

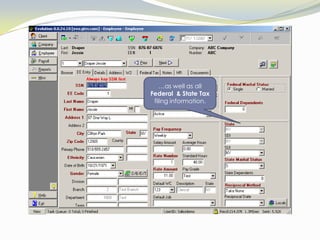

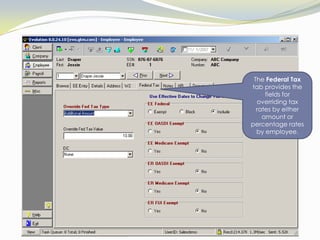

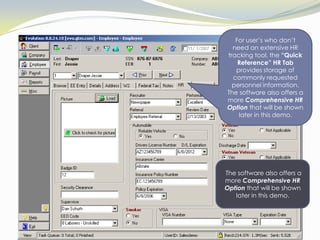

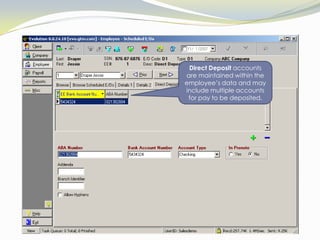

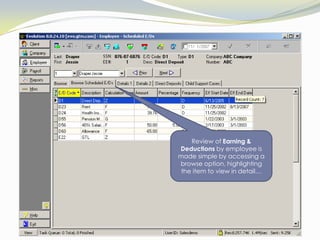

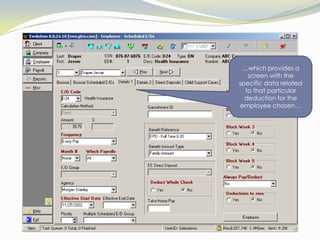

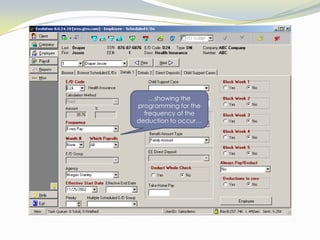

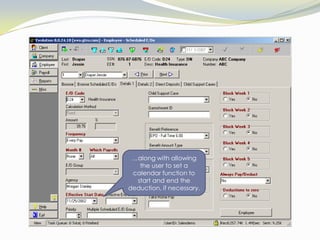

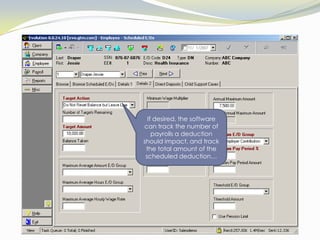

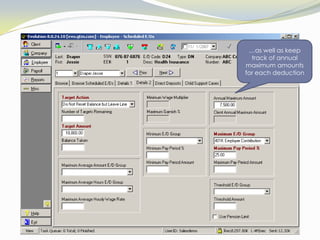

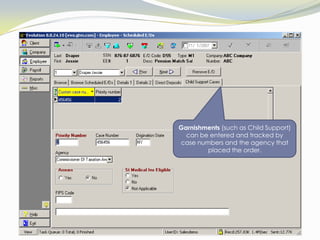

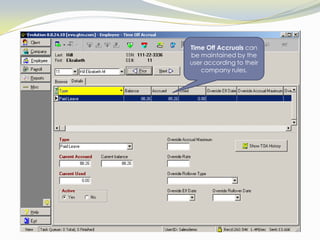

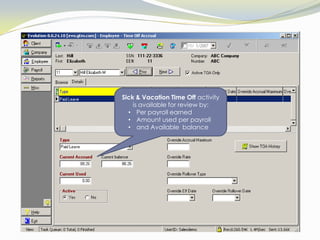

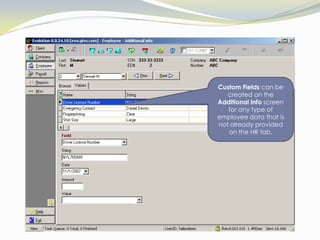

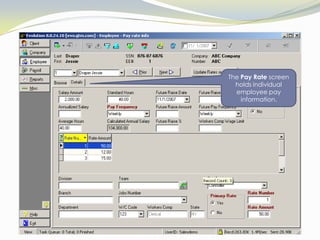

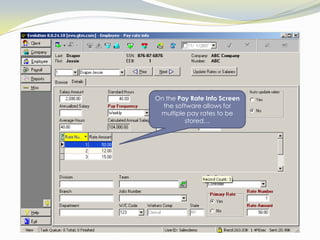

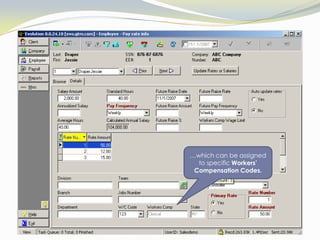

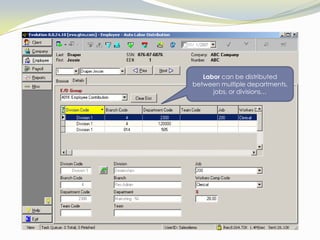

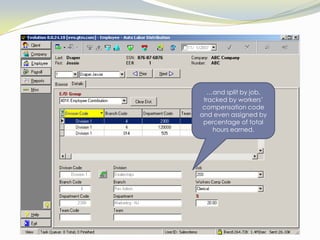

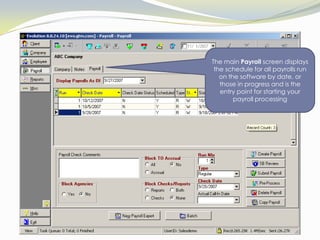

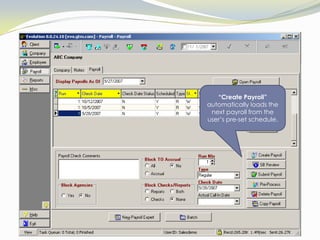

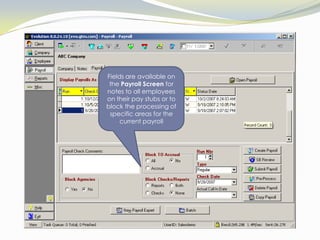

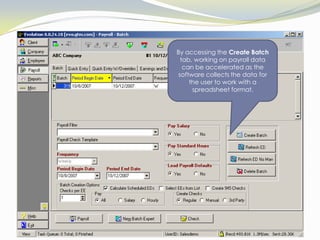

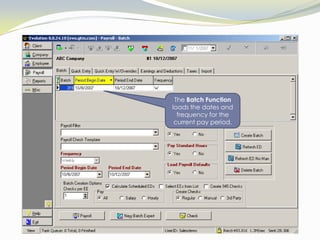

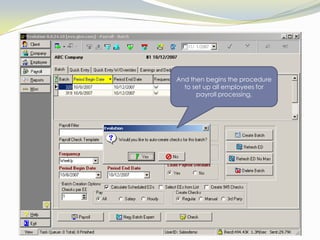

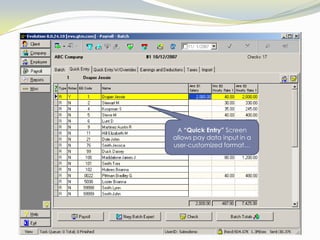

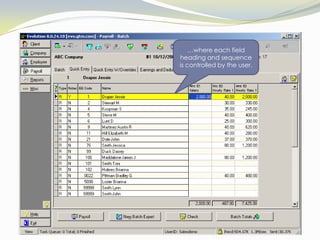

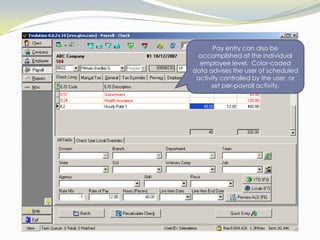

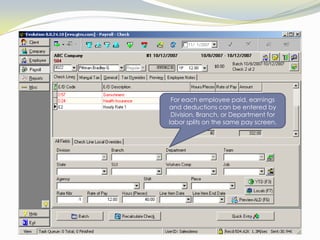

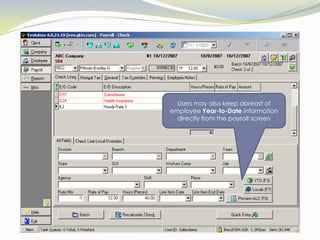

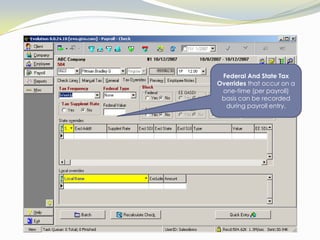

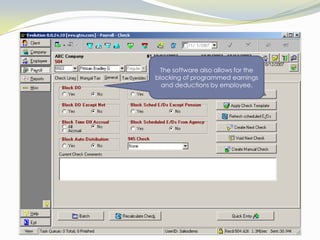

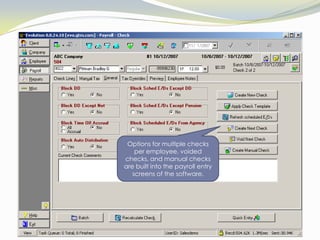

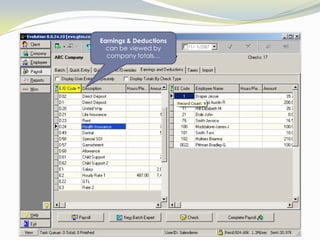

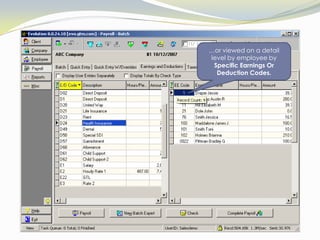

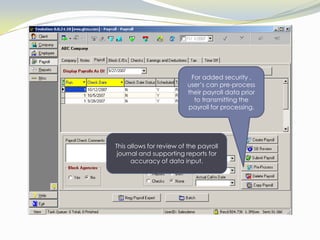

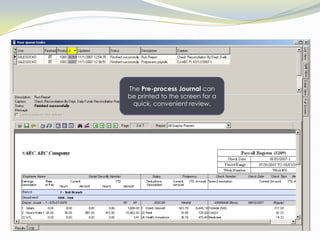

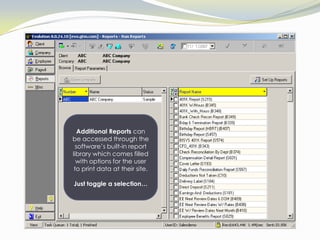

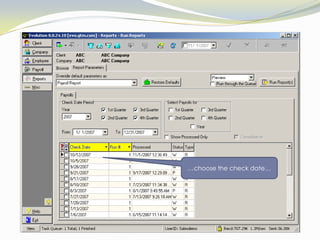

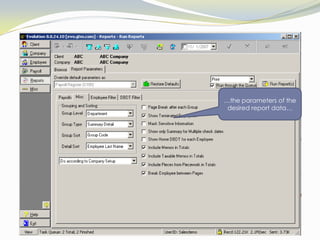

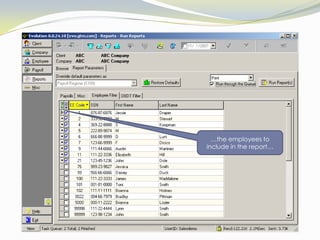

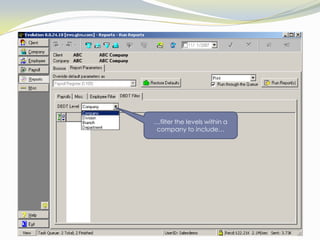

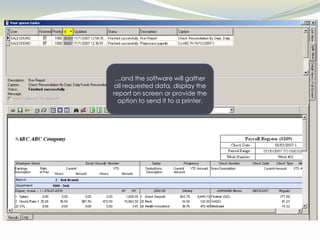

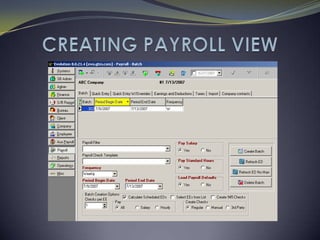

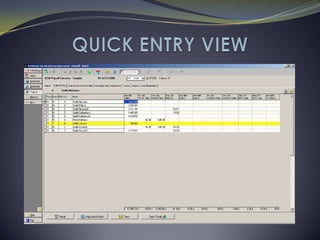

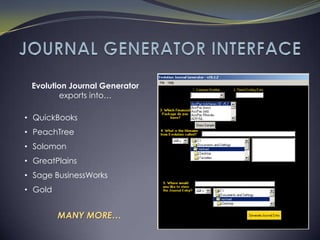

GTM Payroll Services offers a comprehensive online payroll and HR management software that facilitates employee data management, payroll processing, and reporting. The software includes features such as tax filing, direct deposit setup, time off accrual management, and custom reporting capabilities. Users can streamline payroll processing, manage employee information efficiently, and access a variety of pre-built reports for better decision-making.