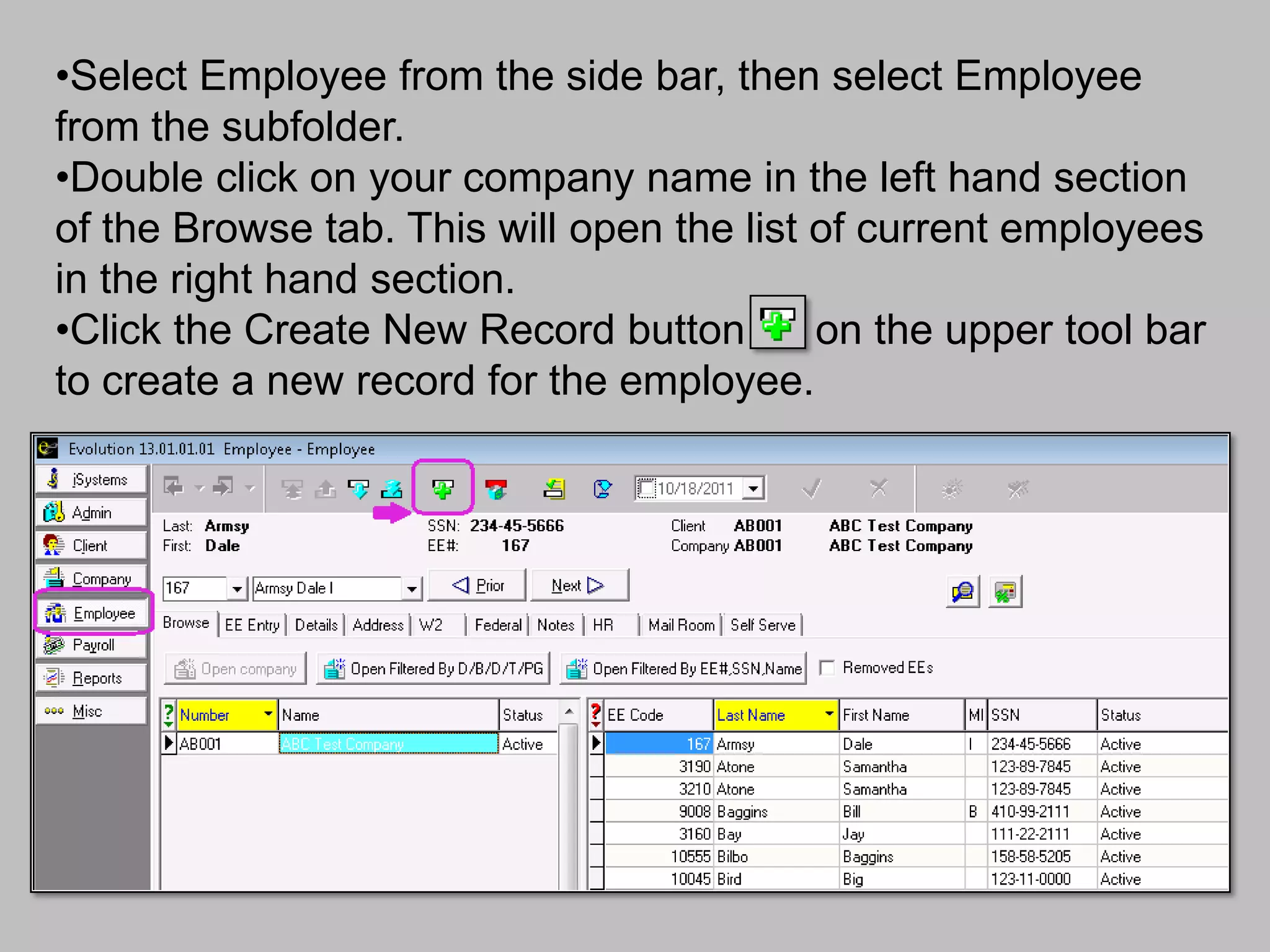

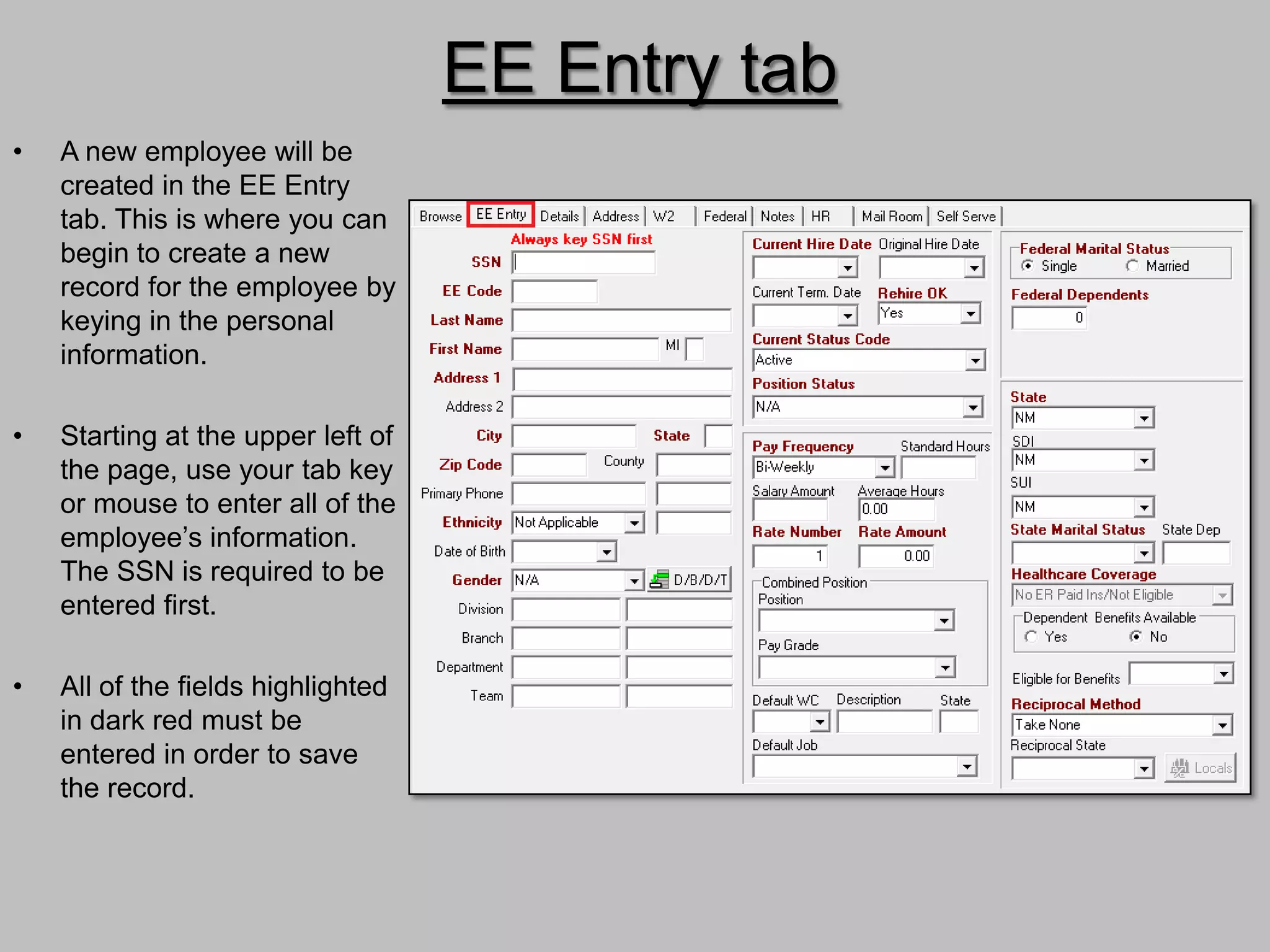

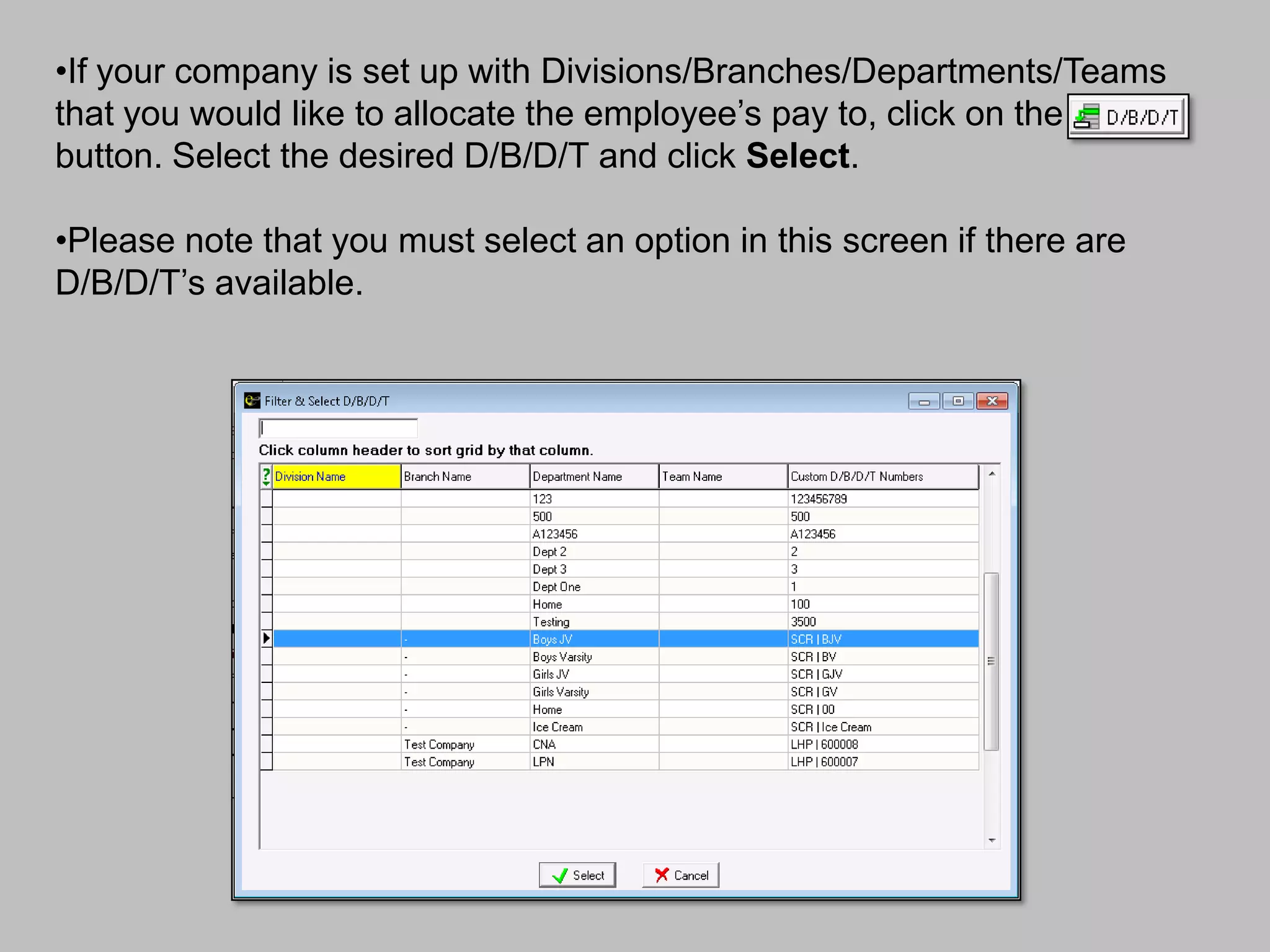

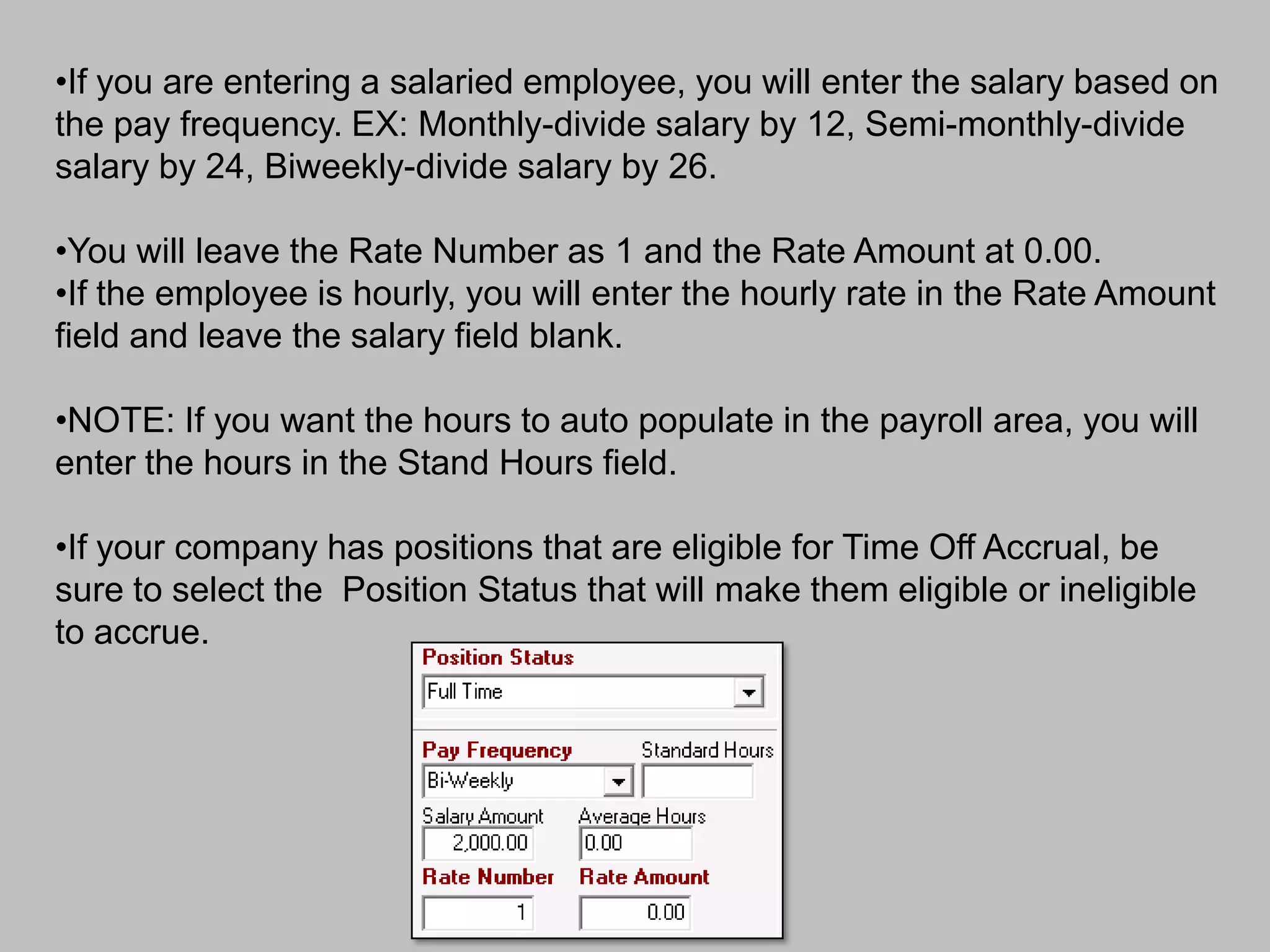

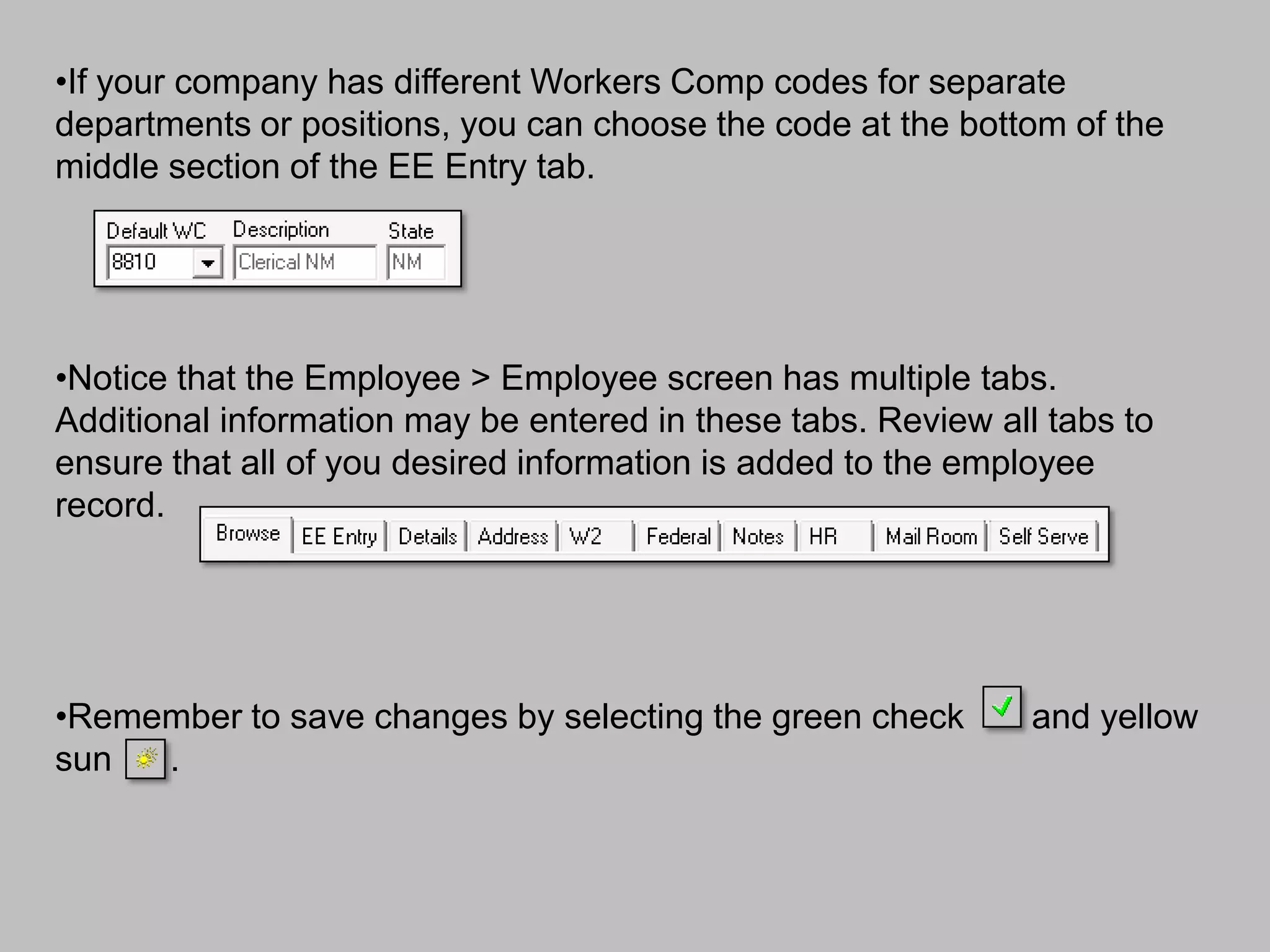

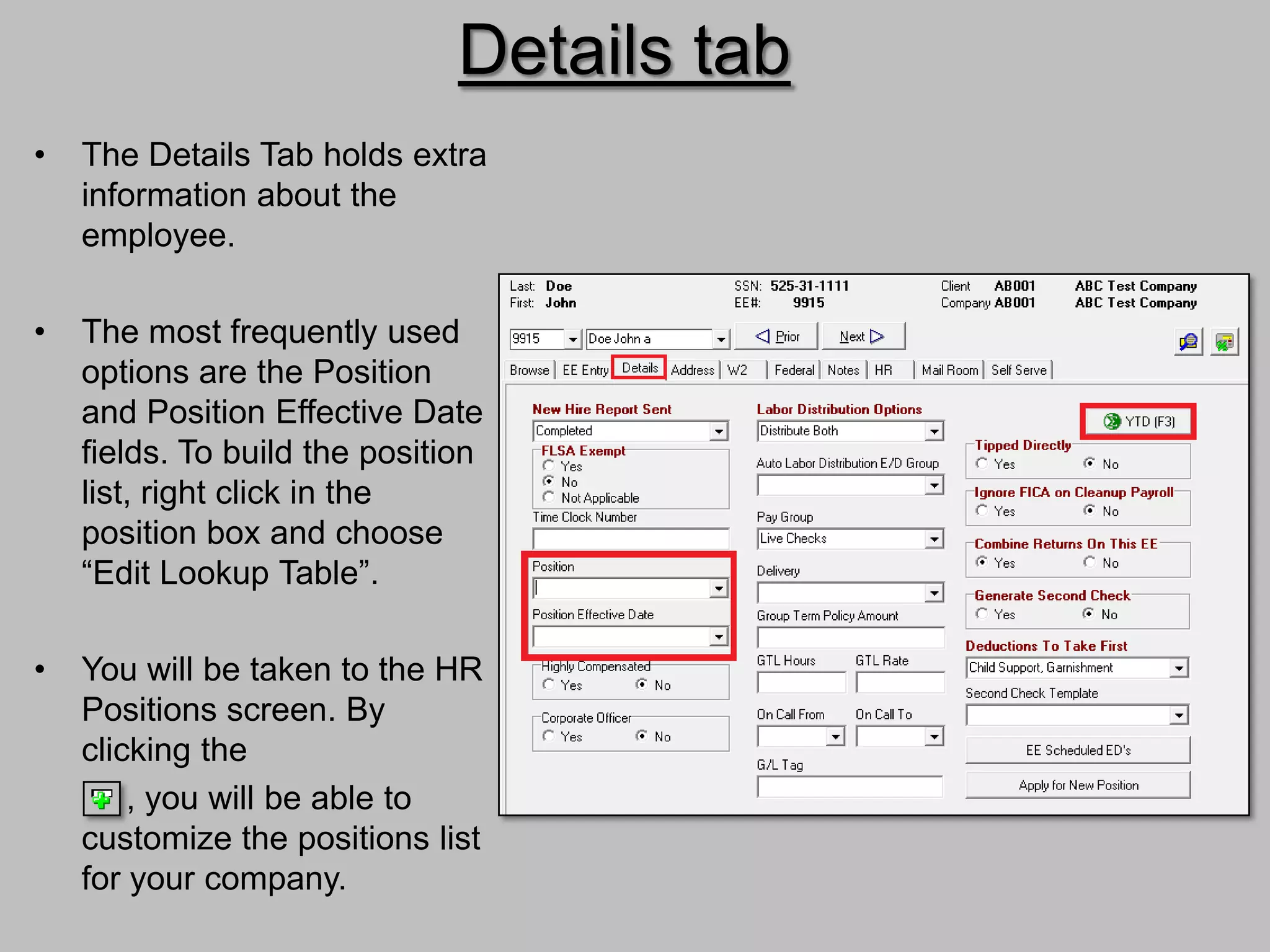

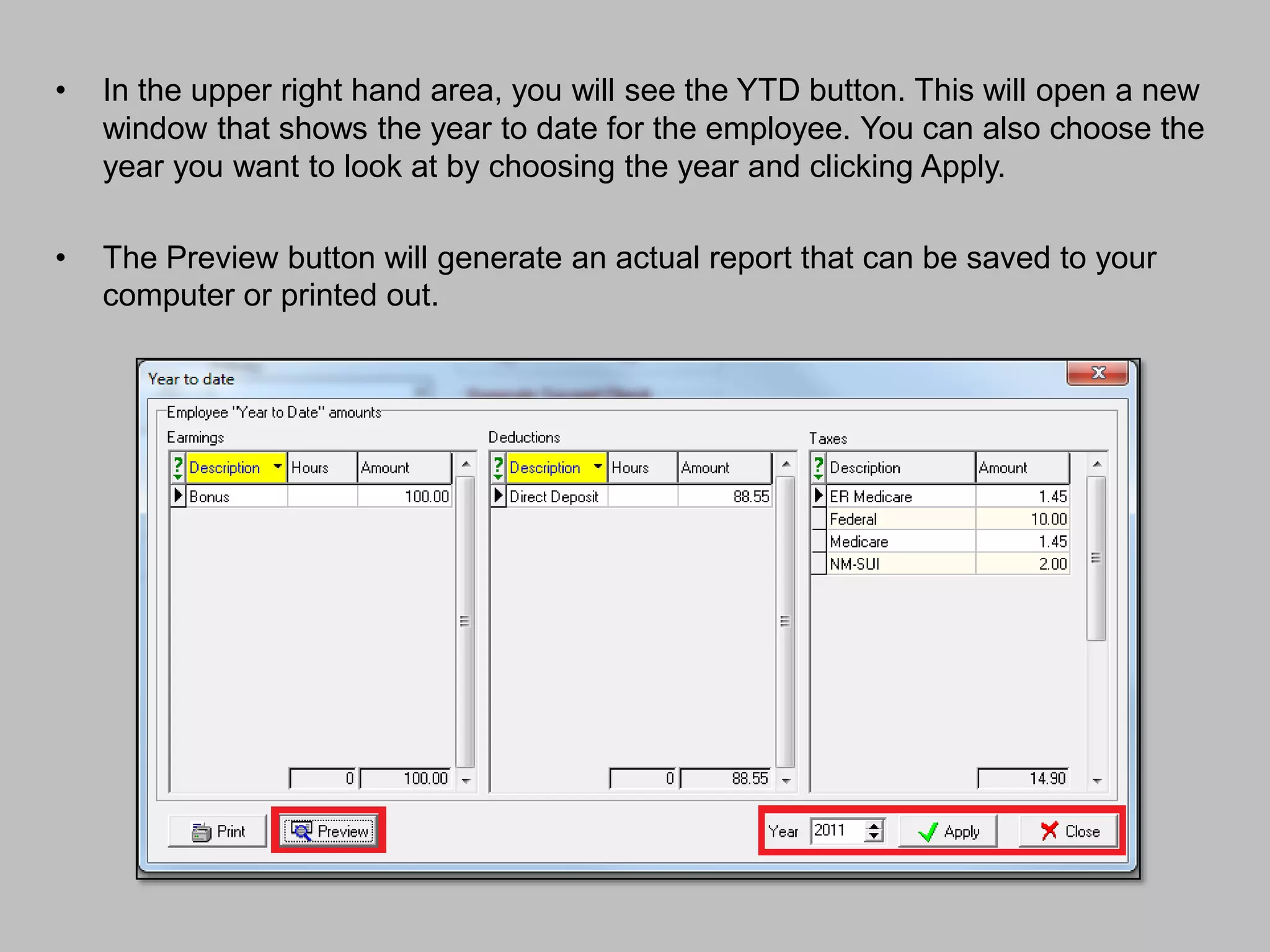

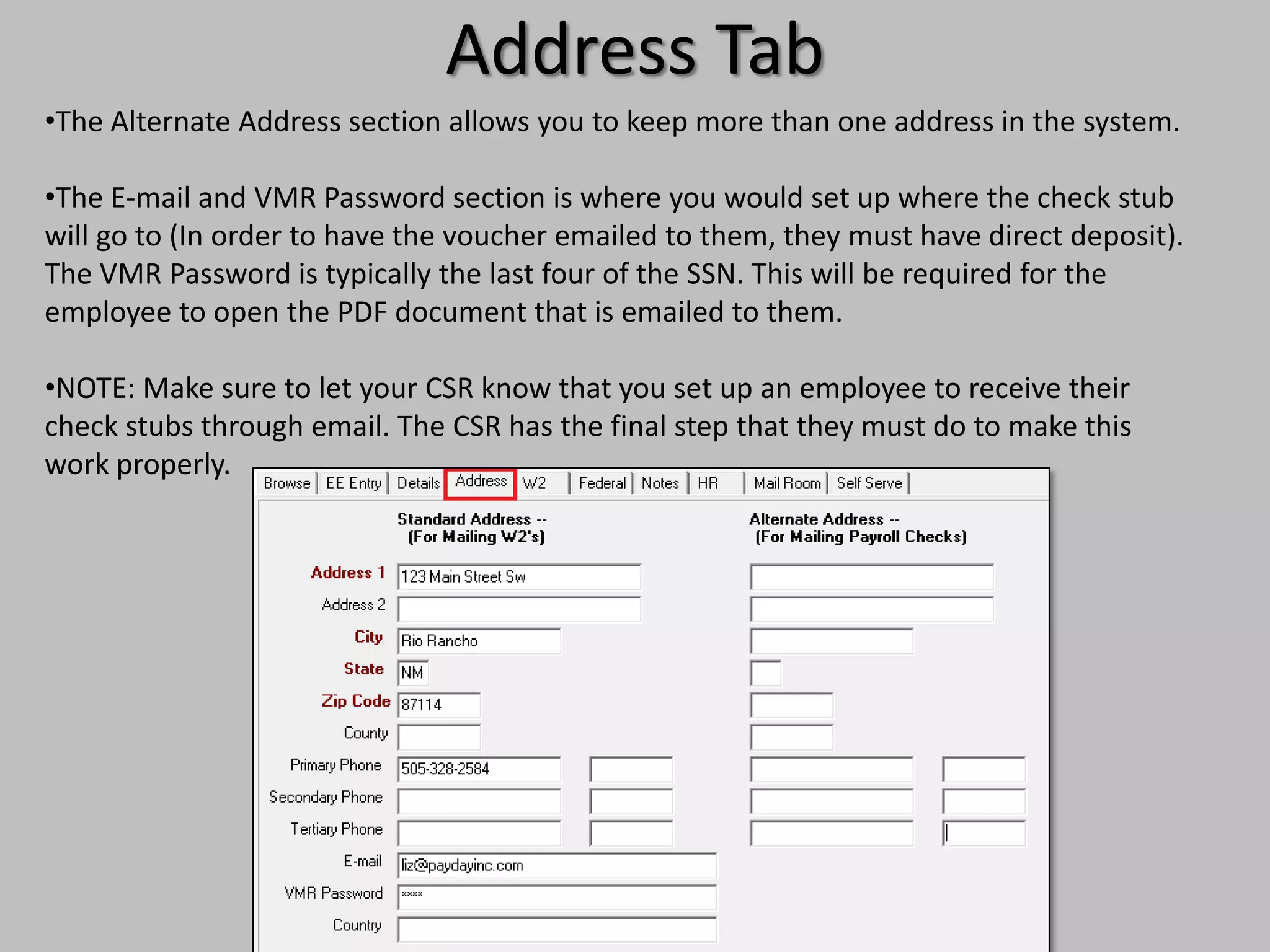

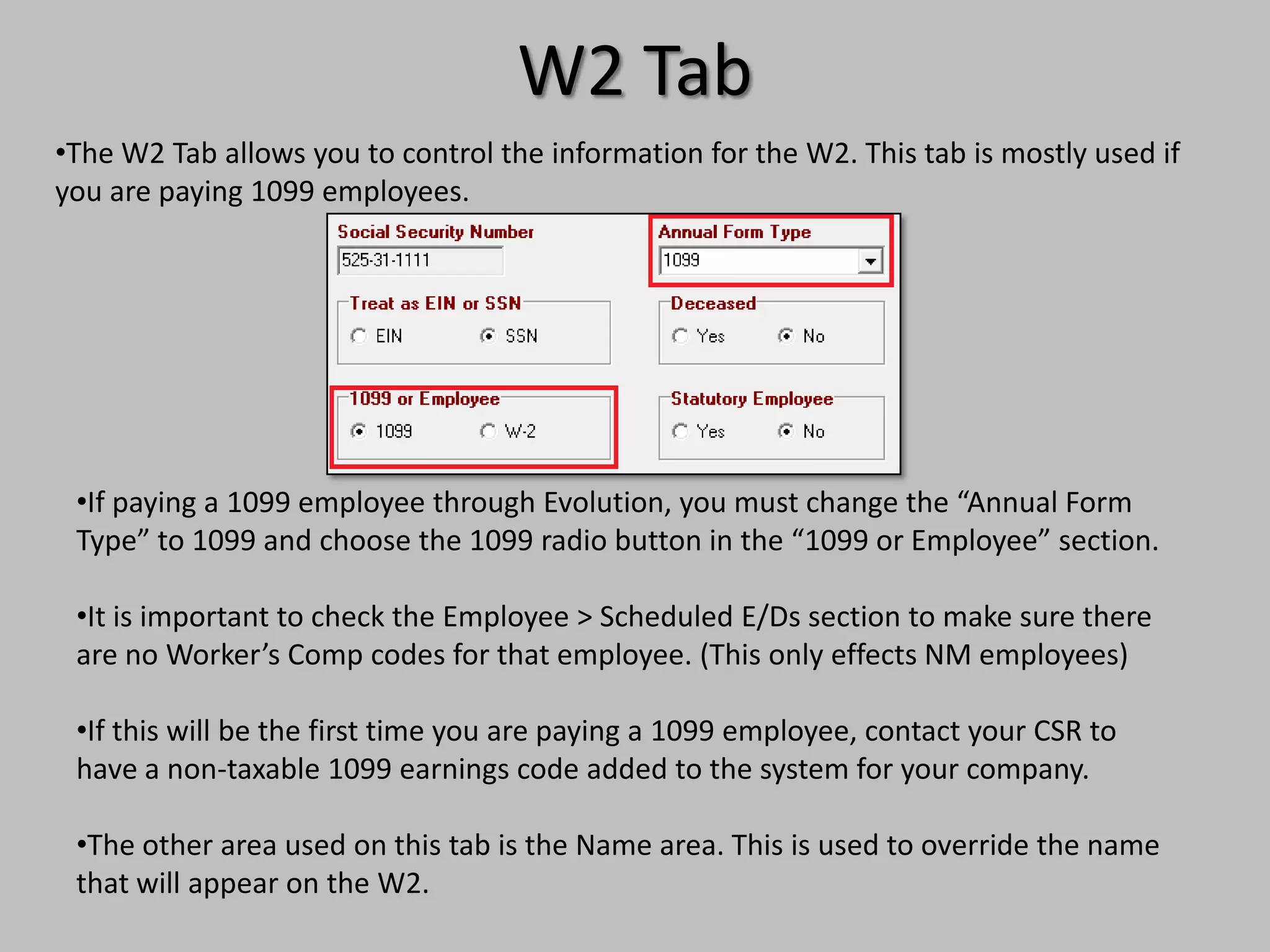

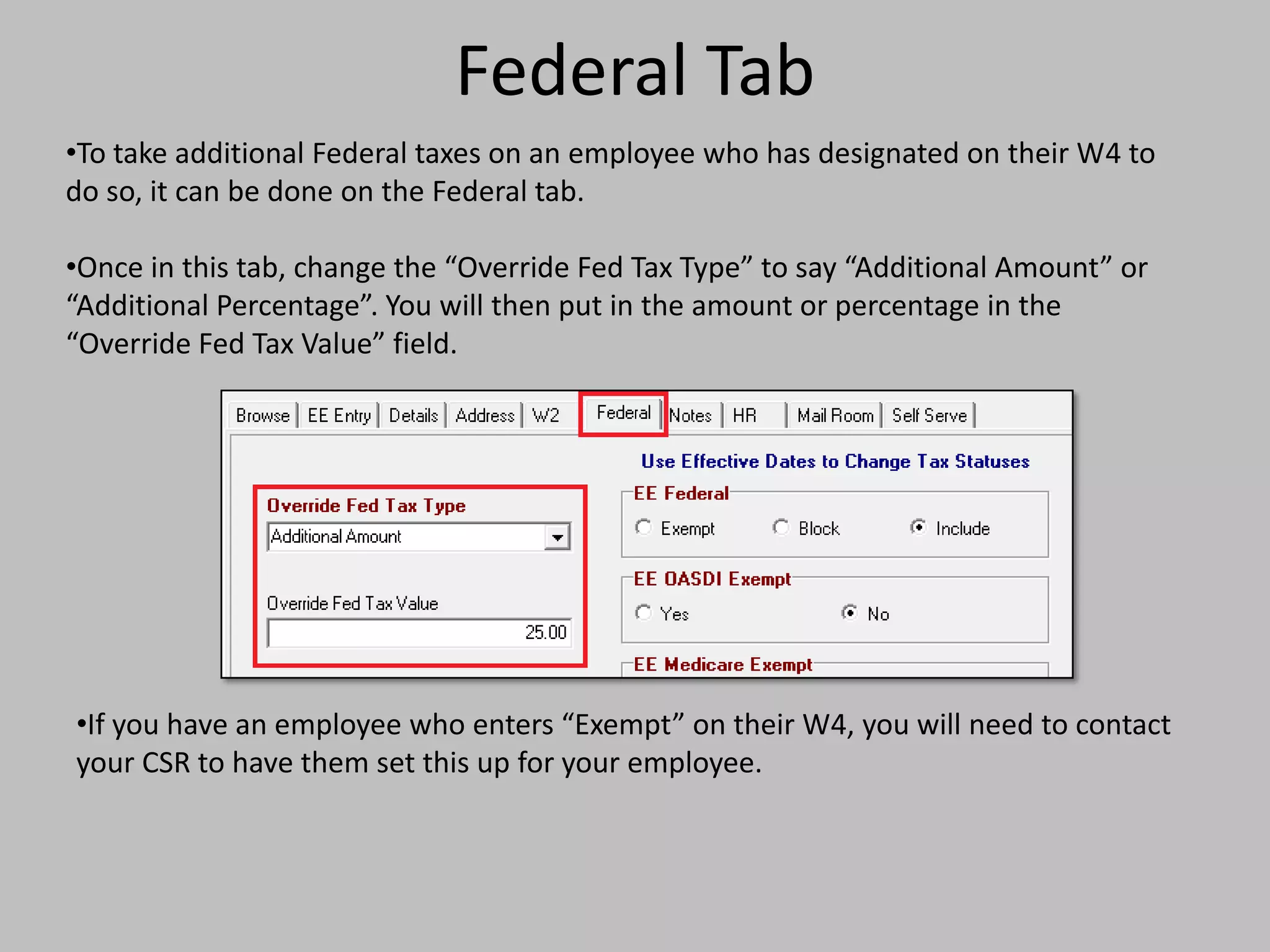

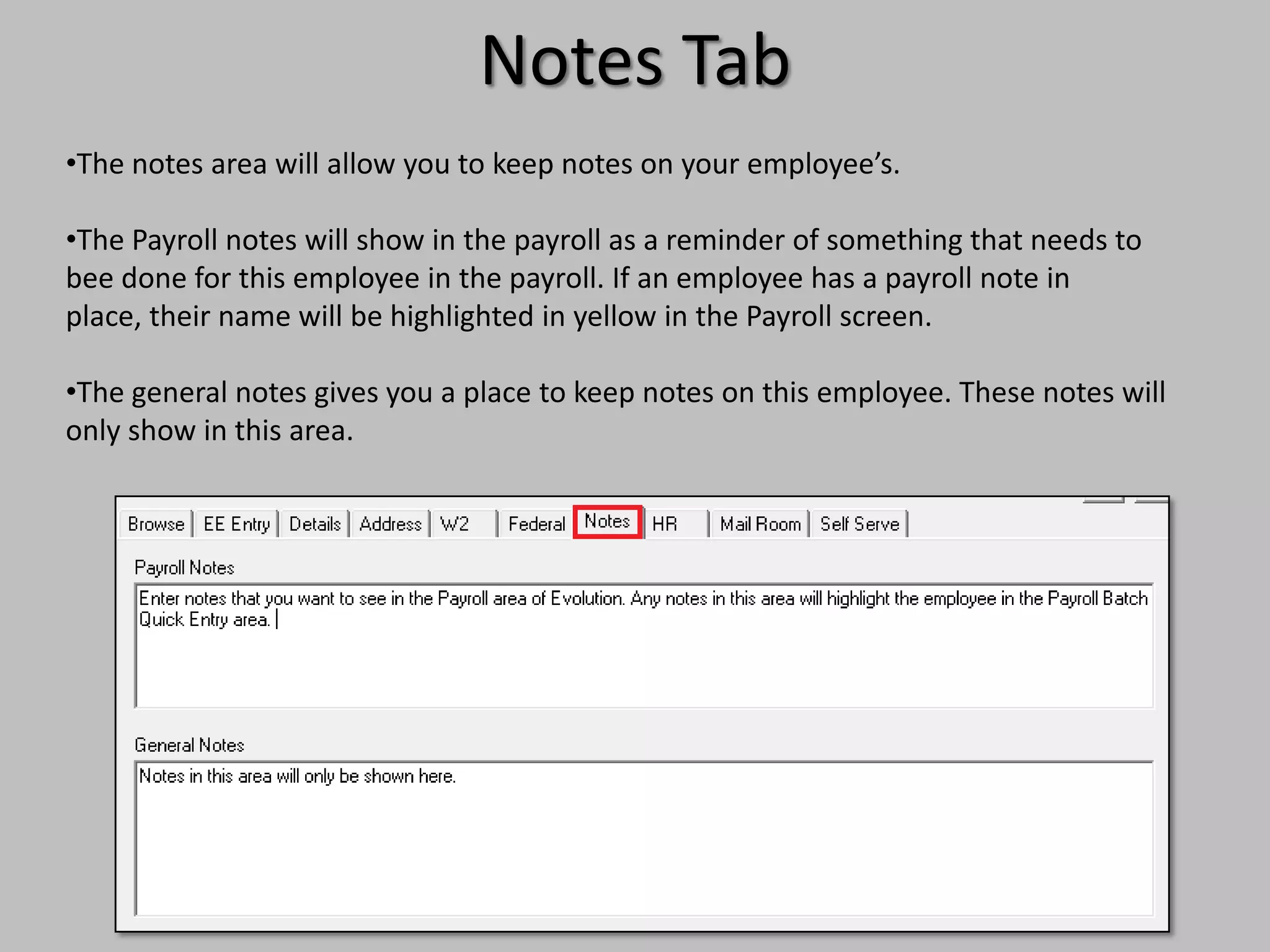

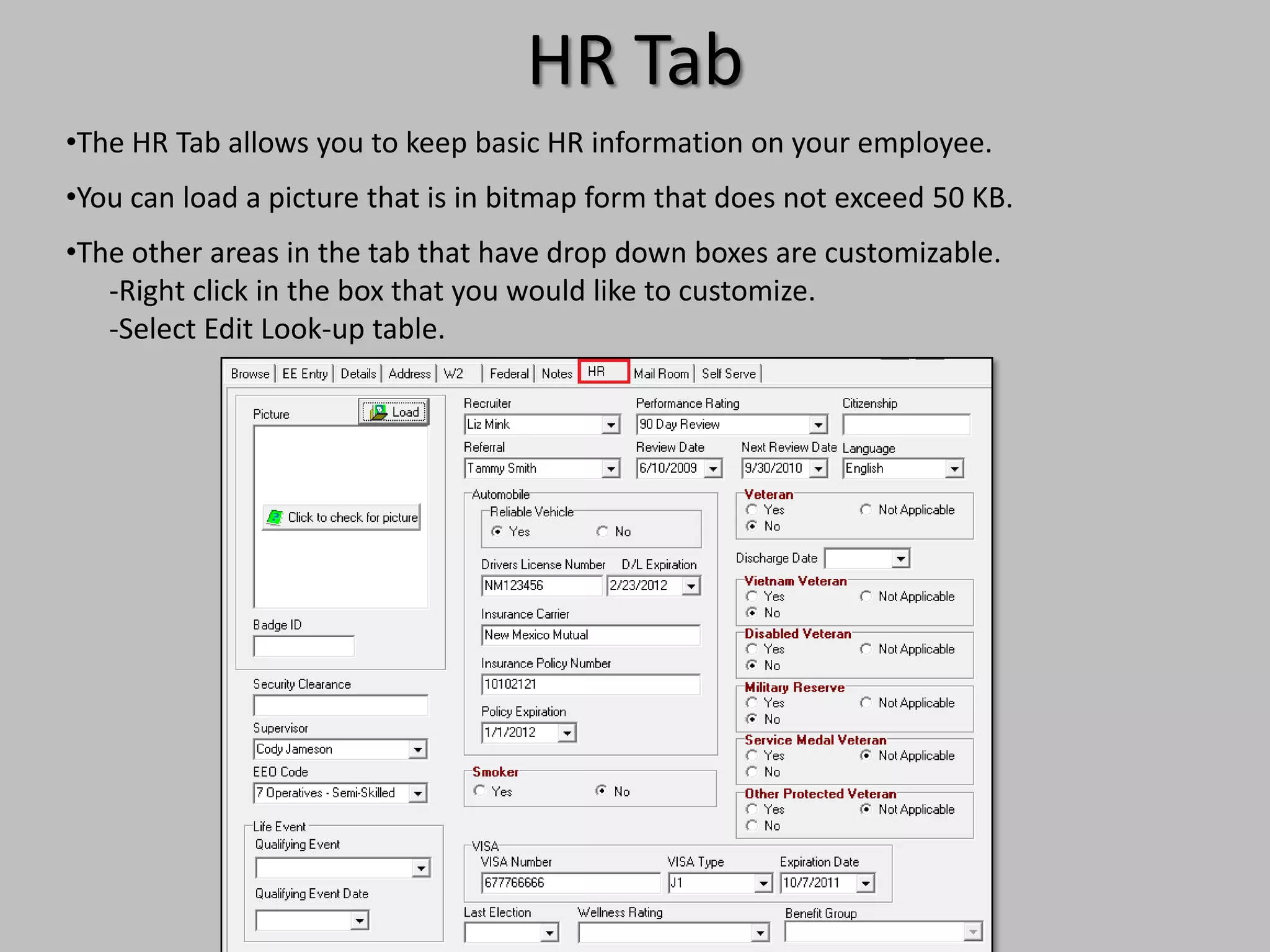

This document provides instructions for creating a new employee record in the Evolution system. It outlines the steps to enter the employee's personal information on the EE Entry tab, including required fields. It describes adding additional details like position, address, federal and state tax withholding preferences. The document stresses saving the record and notifies the reader there may be additional configuration needed depending on the employee's specific pay setup.