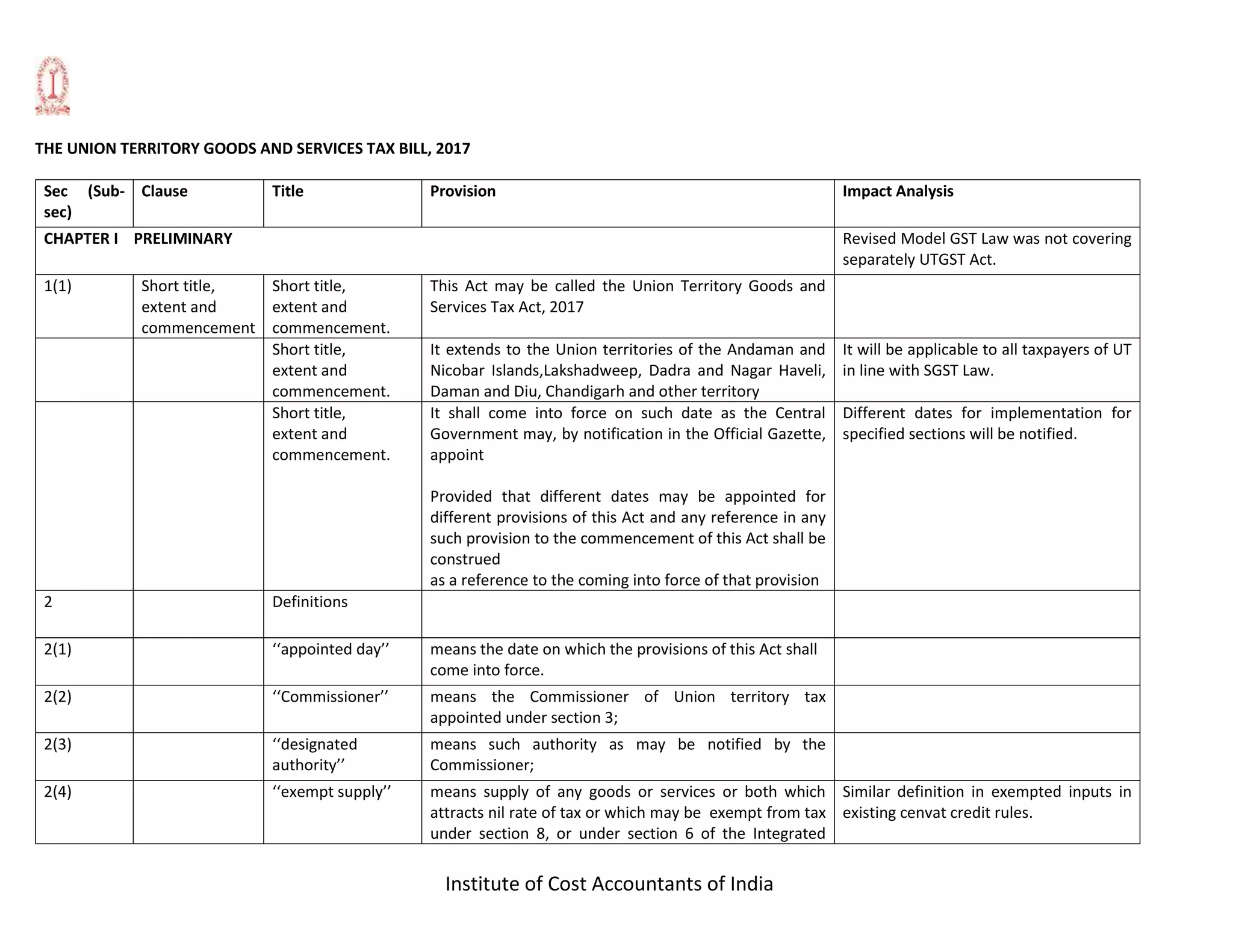

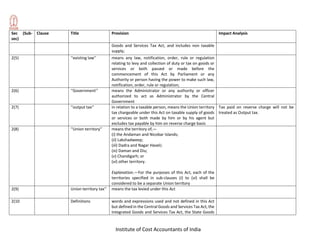

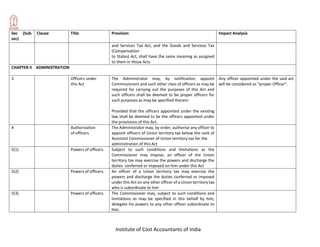

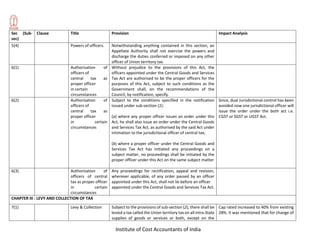

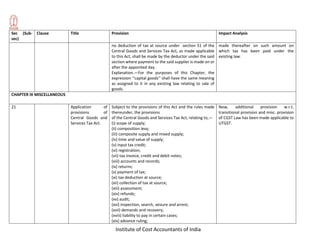

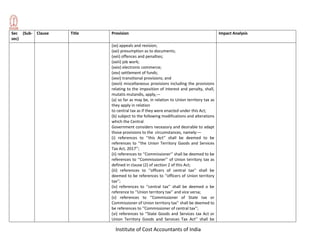

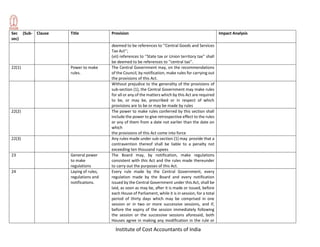

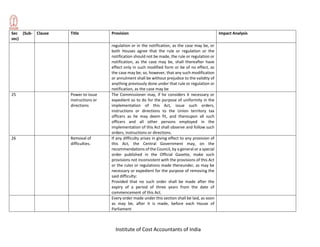

The document discusses key provisions of the Union Territory Goods and Services Tax Bill, 2017. Some key points:

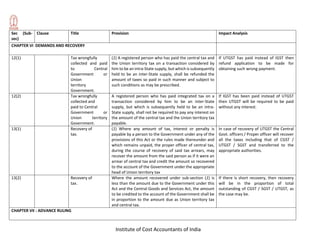

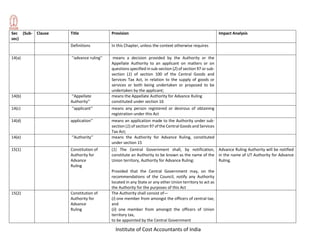

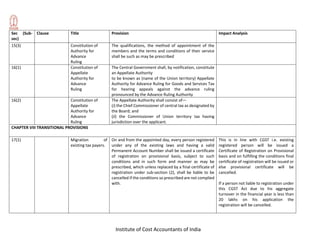

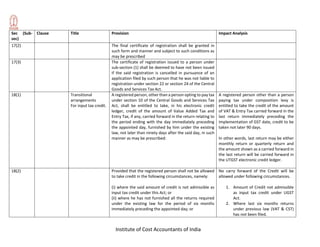

1) The bill establishes a goods and services tax for Union Territories in India to be called the Union Territory GST (UTGST). It will apply uniformly to all Union Territories and come into force on dates notified by the central government.

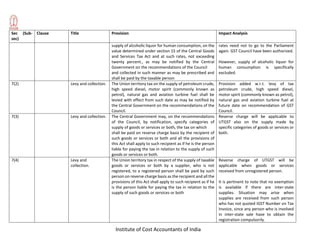

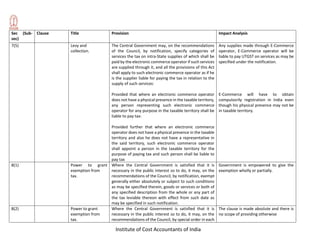

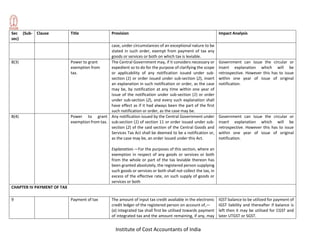

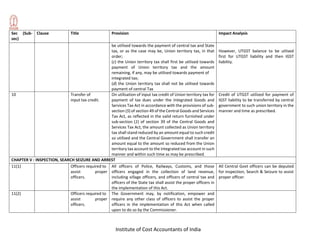

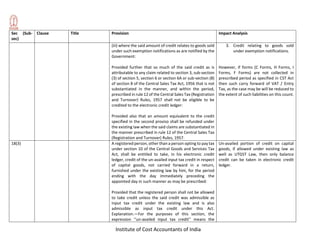

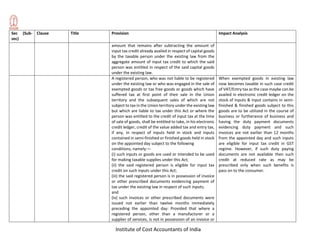

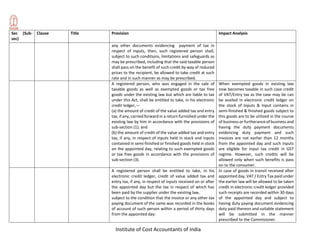

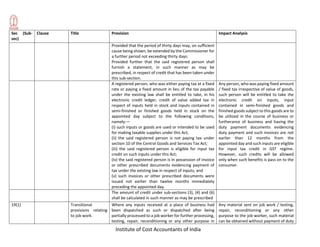

2) The UTGST will be levied on all intra-state supplies of goods and services in Union Territories at rates up to 20%, excluding alcohol. The tax will apply to e-commerce operators and in some cases reverse charge will apply.

3) Administration and enforcement will be carried out by Commissioners and other officers. Officers from the