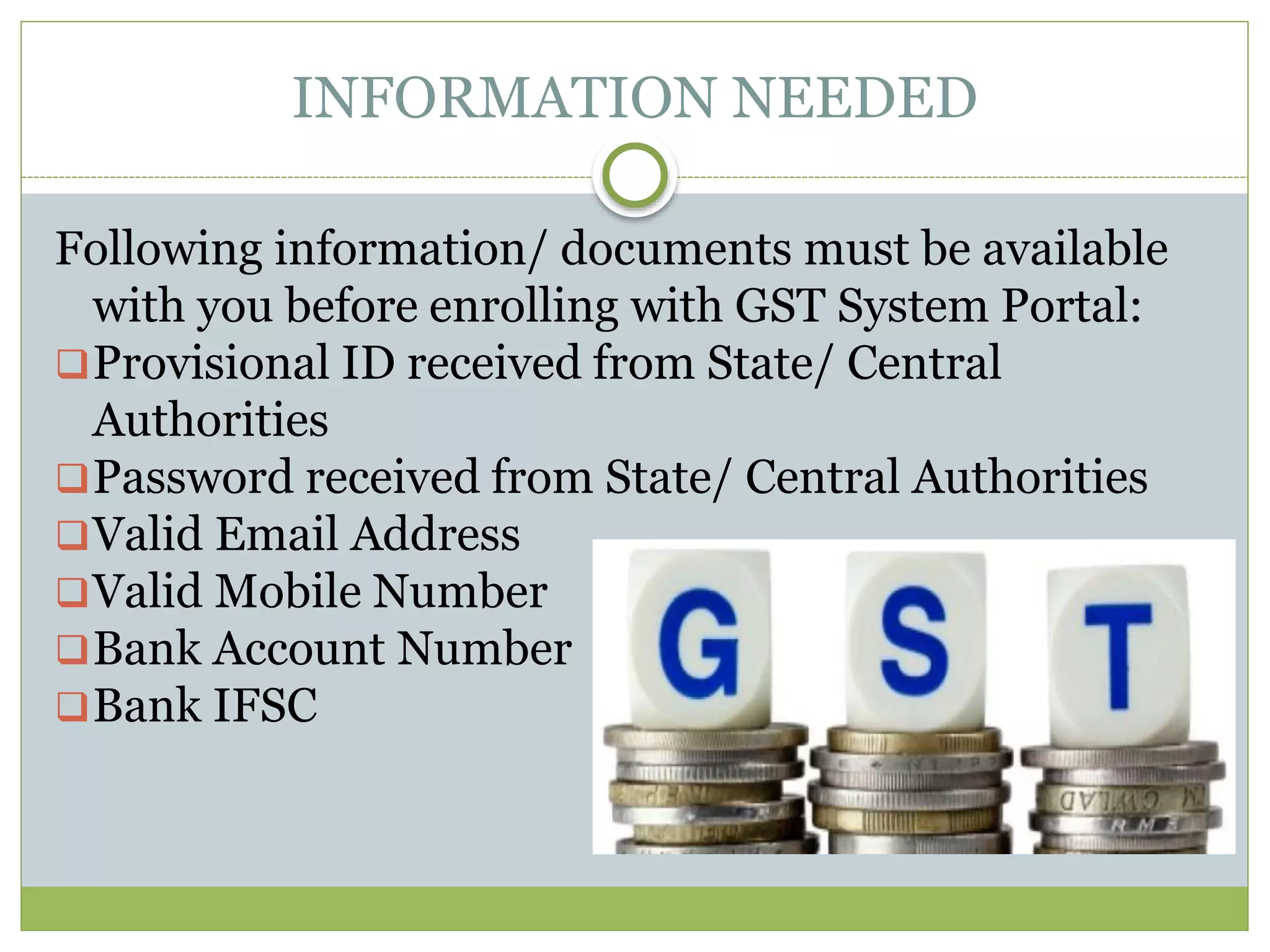

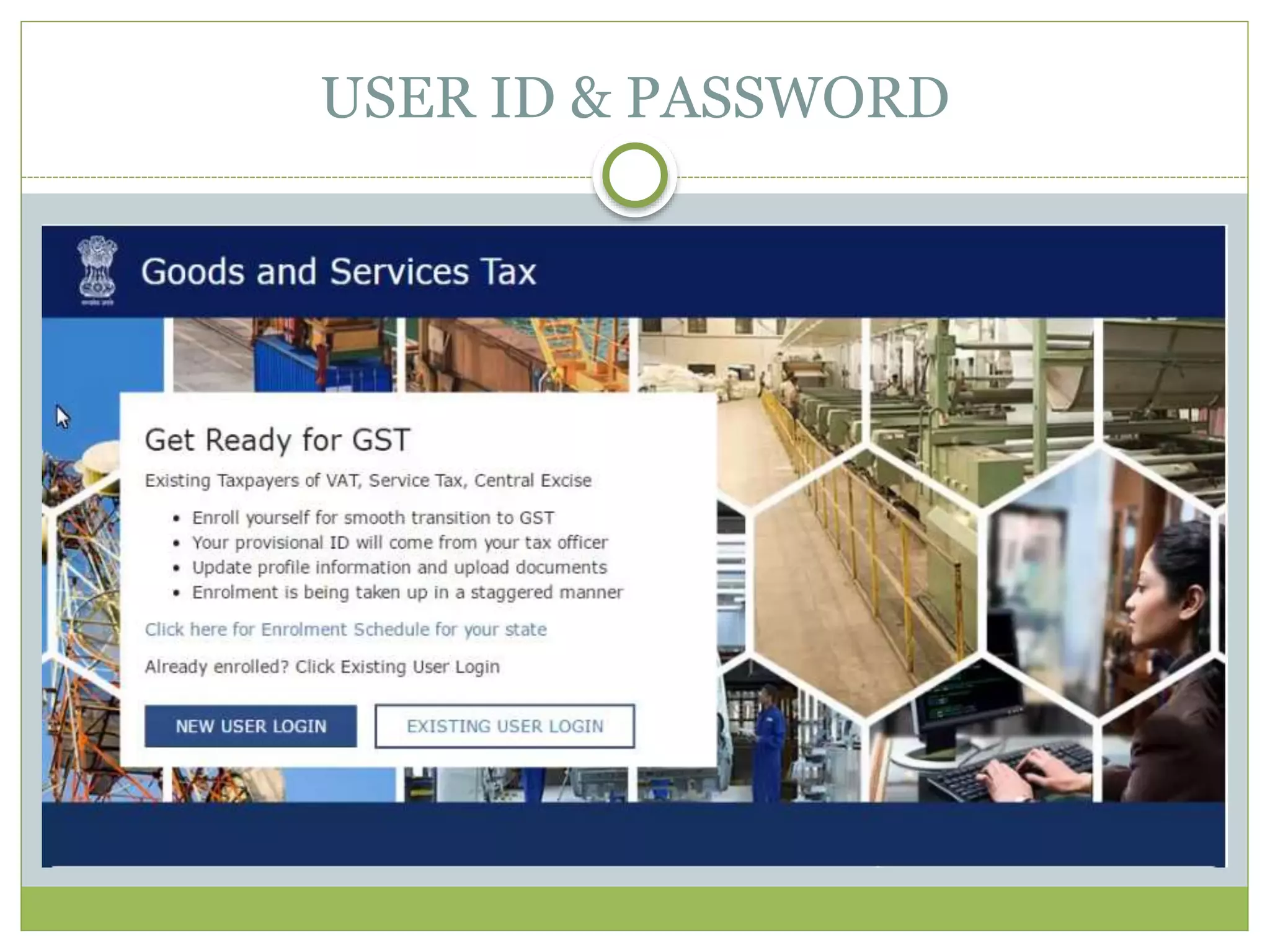

The document provides information about the process for existing taxpayers to enroll on the GST system portal and for new applicants to apply for GST registration. It states that existing taxpayers currently registered under other acts will need to validate their data and fill remaining fields on the GST portal. New applicants will need to submit application forms along with documents like PAN, business details, and bank account information. The document outlines the required formats and timelines for both enrollment and new registration.