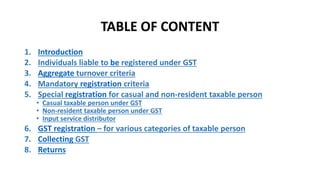

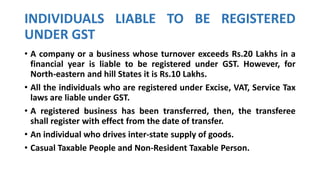

The document outlines the criteria and obligations for taxable persons liable for Goods and Services Tax (GST) registration in India, detailing categories such as casual and non-resident taxable persons. It specifies the turnover thresholds for registration, the requirements for different types of individuals and businesses, and explains the processes for collecting GST and filing returns. Additionally, it mentions exceptions and special provisions under the GST Act, including rules for individuals in various business scenarios.