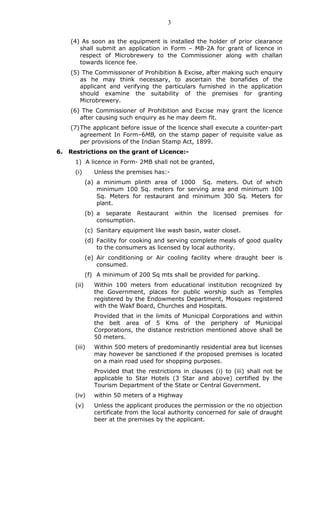

The Telangana Microbrewery Rules 2015 outline the licensure and operational requirements for microbreweries in Telangana, including definitions, application procedures, eligibility criteria, and compliance standards. These rules stipulate conditions for establishing microbreweries, including the necessary physical infrastructure, fees, and restrictions on proximity to sensitive locations. The document also details the responsibilities of the licensing authority and sets penalties for non-compliance.