The document discusses several aspects of the global economy including:

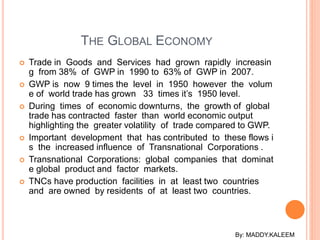

- Trade and foreign direct investment have grown rapidly in recent decades, increasing economic integration.

- Gross world product, the total output of all economies, has grown significantly but global trade has grown even faster.

- Economic growth moves in cycles internationally as economies influence each other through trade, investment, and financial flows. Downturns in one country can spread to others through these global connections.