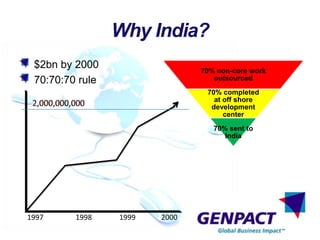

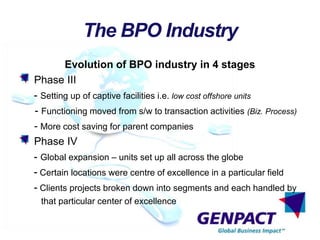

This document provides an overview of Genpact and the business process outsourcing (BPO) industry in India. It discusses why India is an attractive location for BPO, highlighting factors like labor costs and skilled workforce. It outlines Genpact's history, starting as a subsidiary of GE and growing to be a large global BPO firm. The document also examines considerations for client firms in outsourcing, the vendor-client relationship, potential risks, and issues Genpact faced becoming independent from GE.