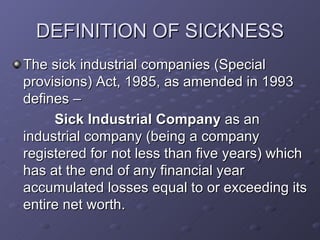

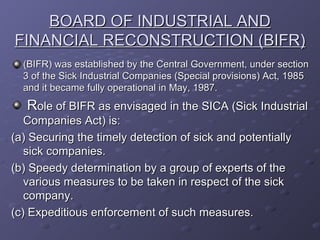

The document discusses corporate finance rehabilitation for sick industrial units. It defines a sick industrial company as one with accumulated losses exceeding its net worth for at least 5 years. The Board of Industrial and Financial Reconstruction (BIFR) was established to detect, determine measures for, and enforce the rehabilitation of sick companies. When a company is deemed sick, BIFR directs an operating agency to prepare a revival package that can include additional financing, loan repayment postponement, management changes, asset sales or leases to restore the company's health. Revival is needed to utilize existing assets and infrastructure and prevent impacts on dependent ancillary units, banks and financial institutions. Causes of sickness can be internal factors like poor project implementation or marketing,