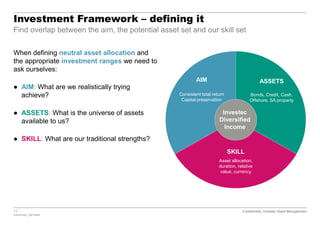

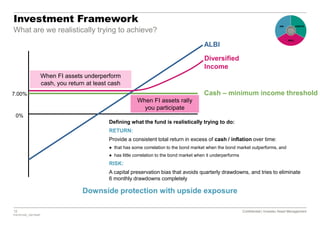

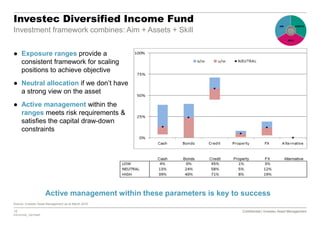

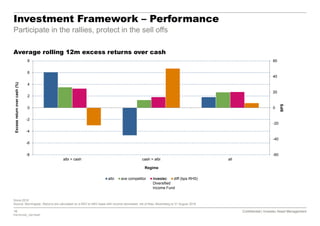

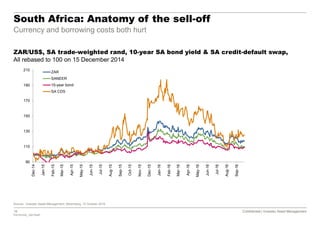

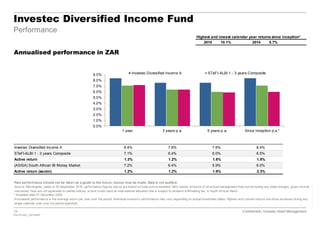

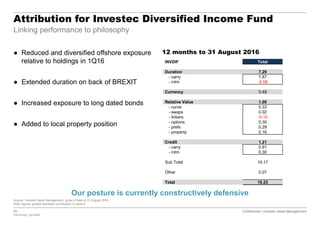

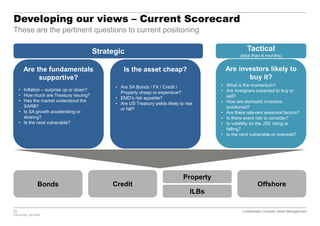

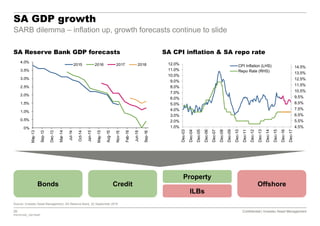

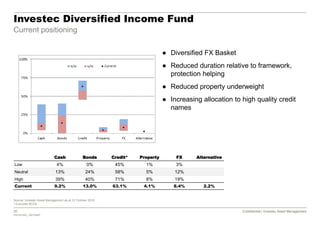

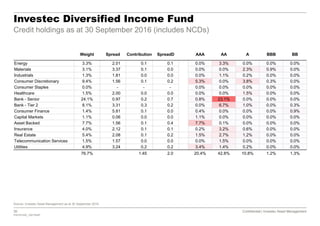

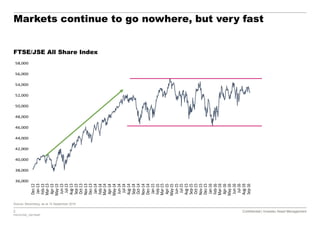

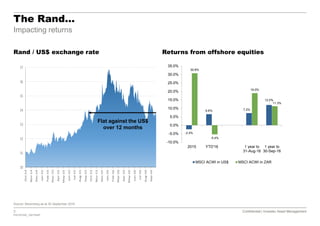

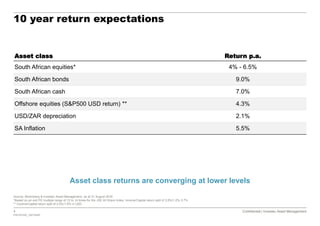

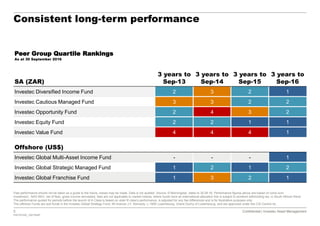

This document discusses opportunities in fixed income investing in a high risk, low return environment. It provides an overview of recent market performance, including declines in global equity markets and weakness in the South African rand. The document then outlines the investment framework and objectives of the Investec Diversified Income Fund, which aims to generate consistent income while preserving capital. Specific strategies discussed include diversifying across asset classes, regions, and securities to reduce risk. Performance and attribution for the fund are presented, showing it has achieved its goals. The document concludes with the managers' views on current investment opportunities and risks.

![6 Confidential | Investec Asset Management

P20161020_7921554P

Confidential | Investec Asset Management

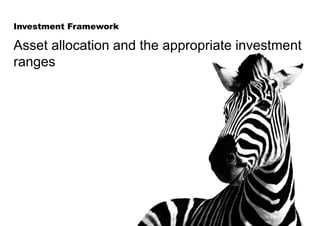

ExpectedReturnInvestec core fund solutions

Note: [ ] indicates maximum in equities. Offshore funds available as feeder funds

Global Strategic Managed

(USD / GBP / ZAR)

[75%]

Global Franchise

(USD / GBP / ZAR)

[100%]

Global Multi-Asset Income

(USD / ZAR)

[40%]

LocalInternational

Diversified

Income

Opportunity

[75%]

Cautious

Managed

[40%]

Value

[100%]Equity

[100%]

Expected Risk (Volatility)

GrowthIncome

ExpectedReturn

Worldwide

Flexible

[100%]](https://image.slidesharecdn.com/investec-10november2016-161115063836/85/Investec-Senate-Group-Presentation-6-320.jpg)