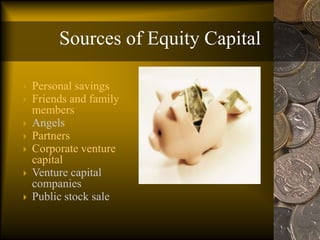

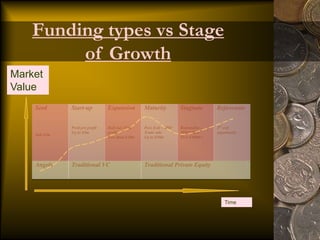

Equity financing involves raising money for a company by selling shares of ownership or stock. It allows the company to access capital without taking on debt. There are various sources of equity financing such as personal savings, friends and family, angel investors, venture capital firms, and public stock sales. Equity financing provides ownership stakes to investors and freedom from debt repayments, but it also means sharing control of the company and profits with shareholders. The process of obtaining equity financing can be demanding and time-consuming as well.