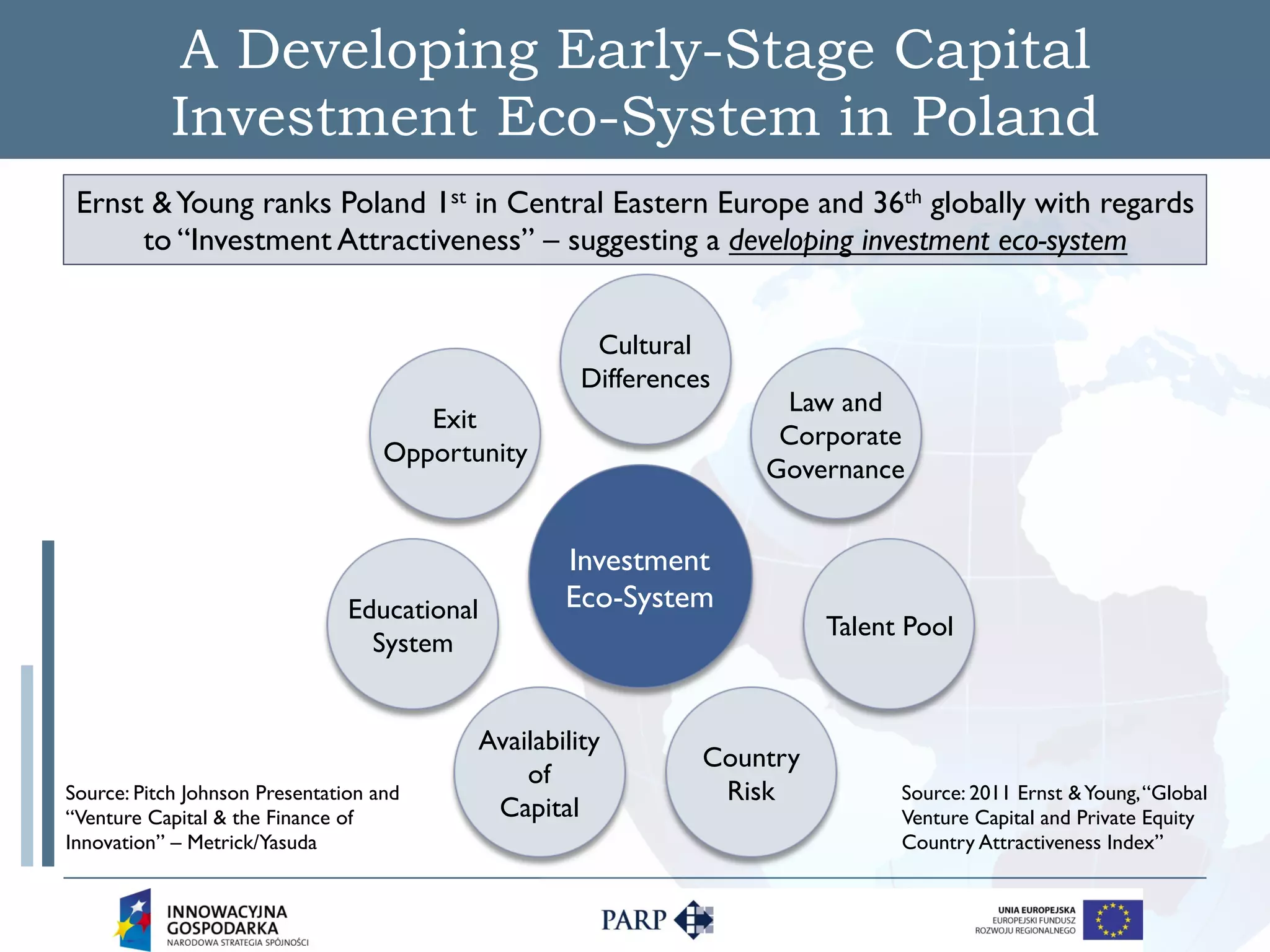

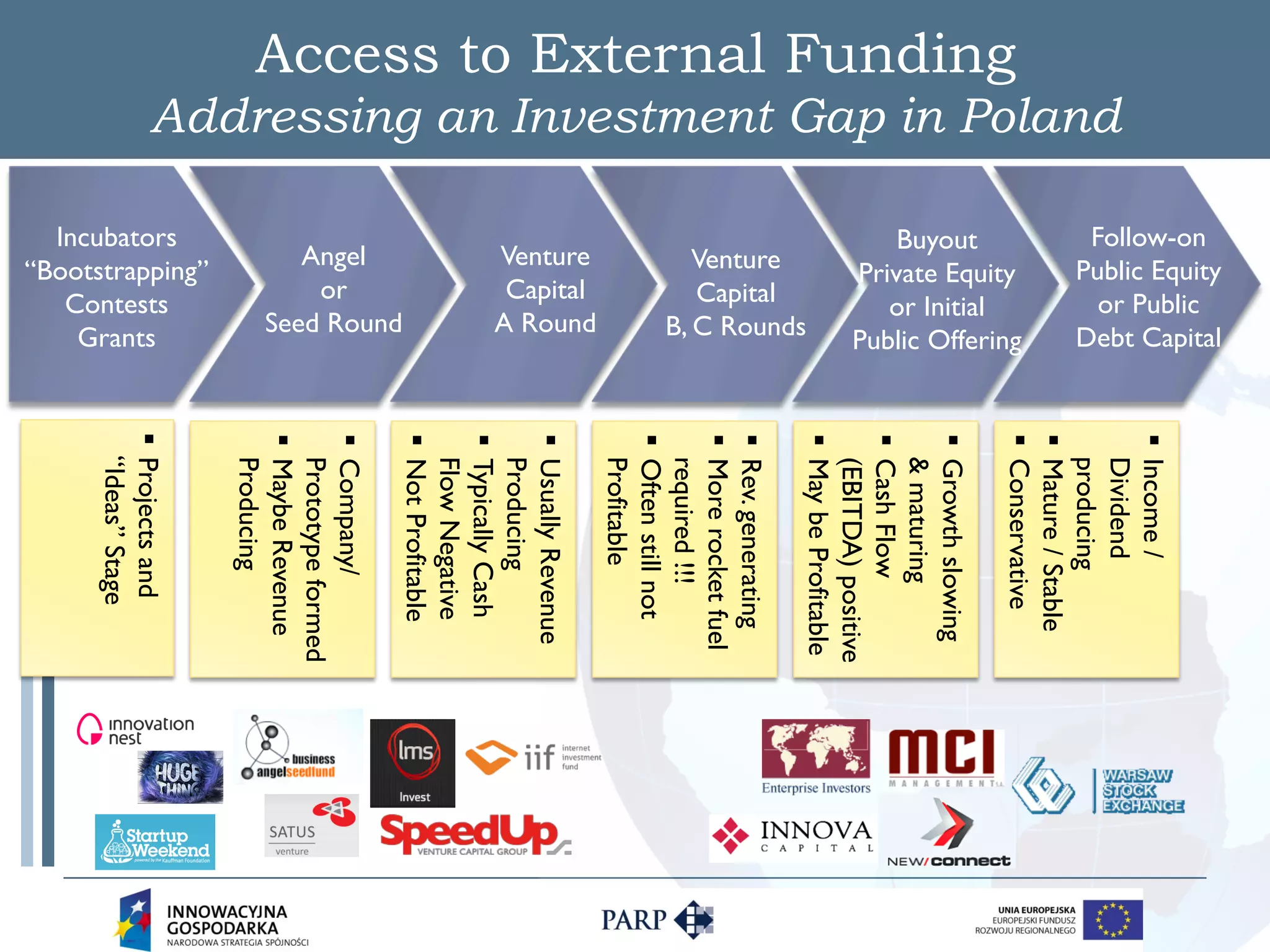

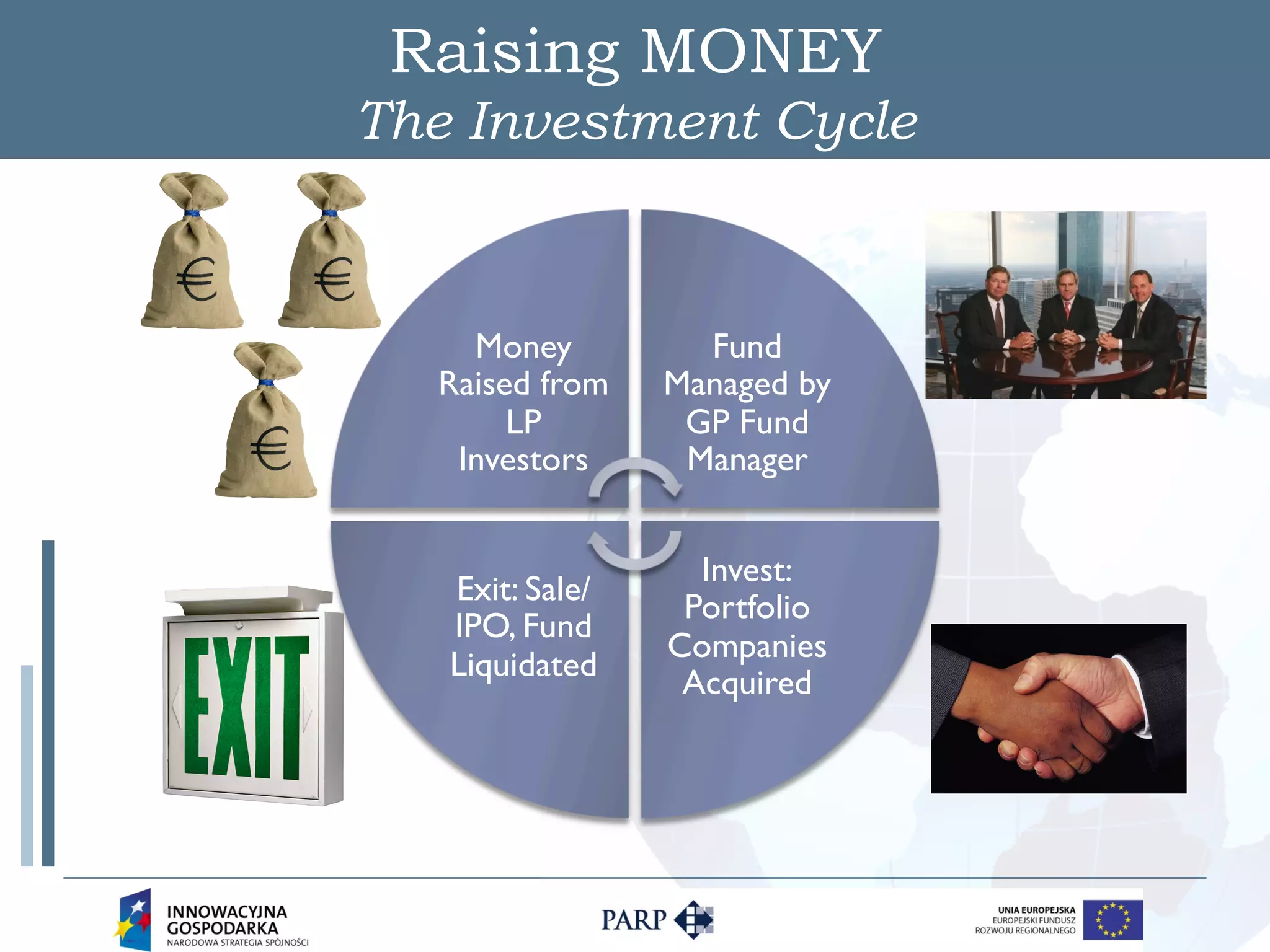

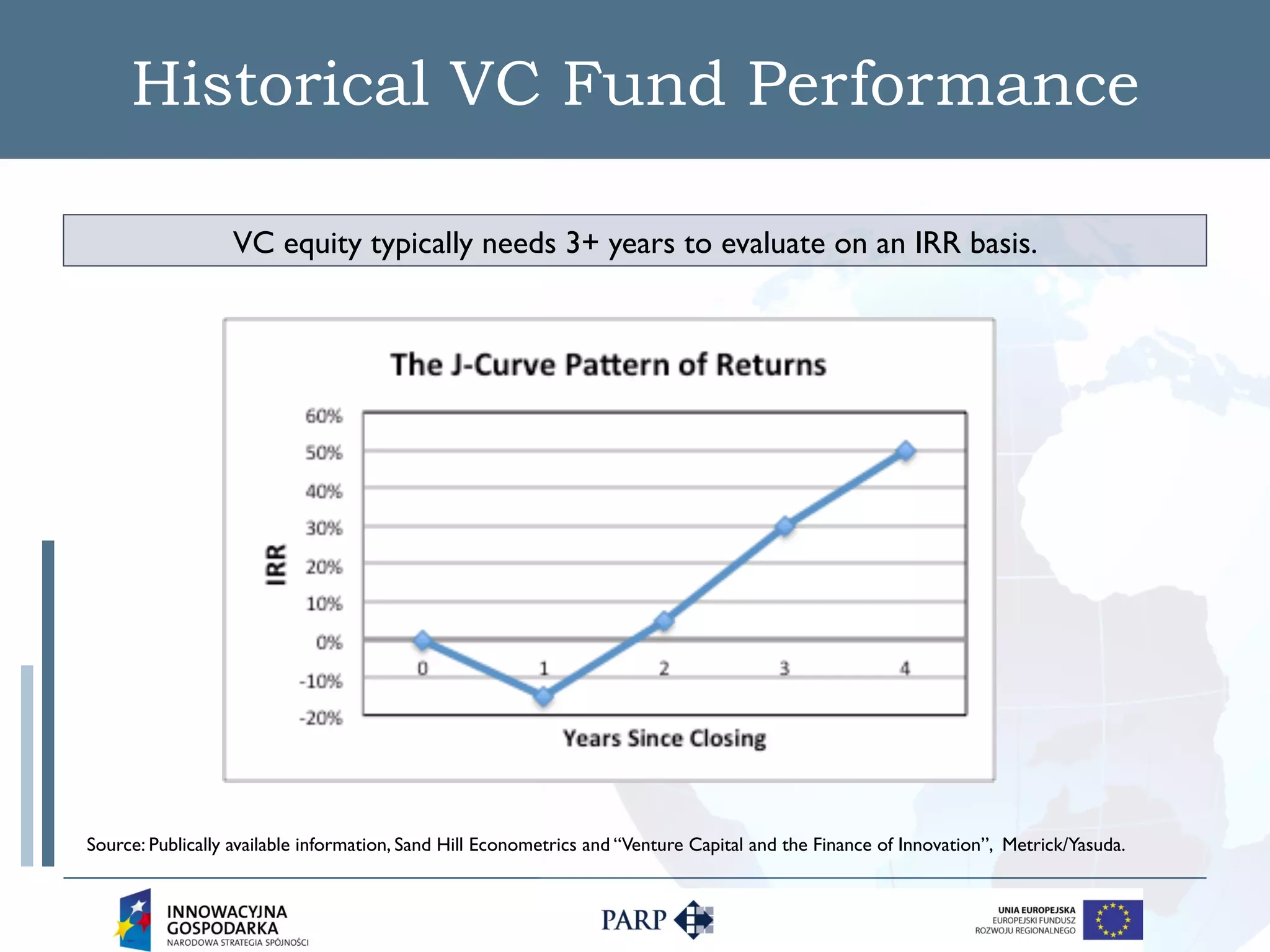

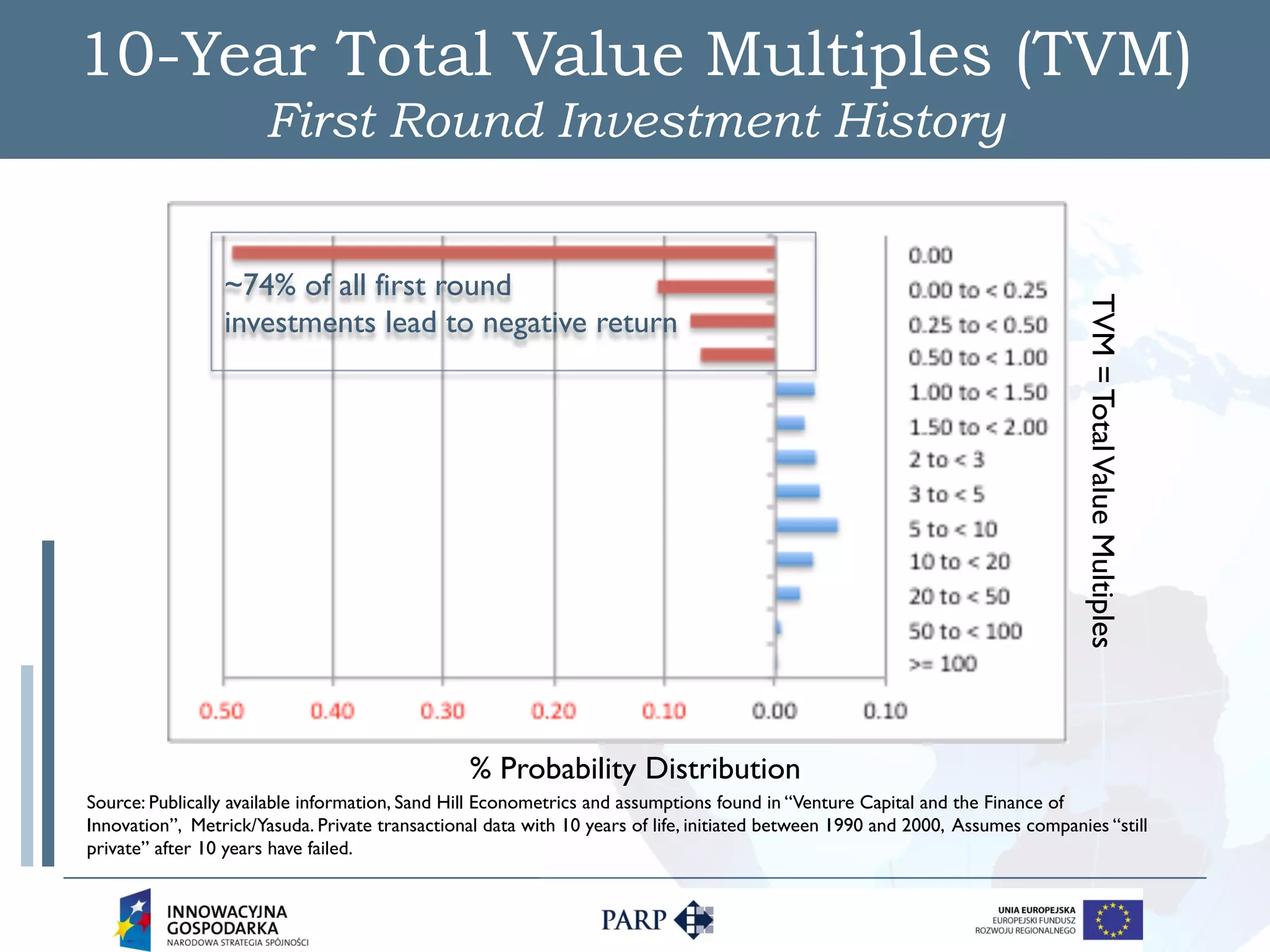

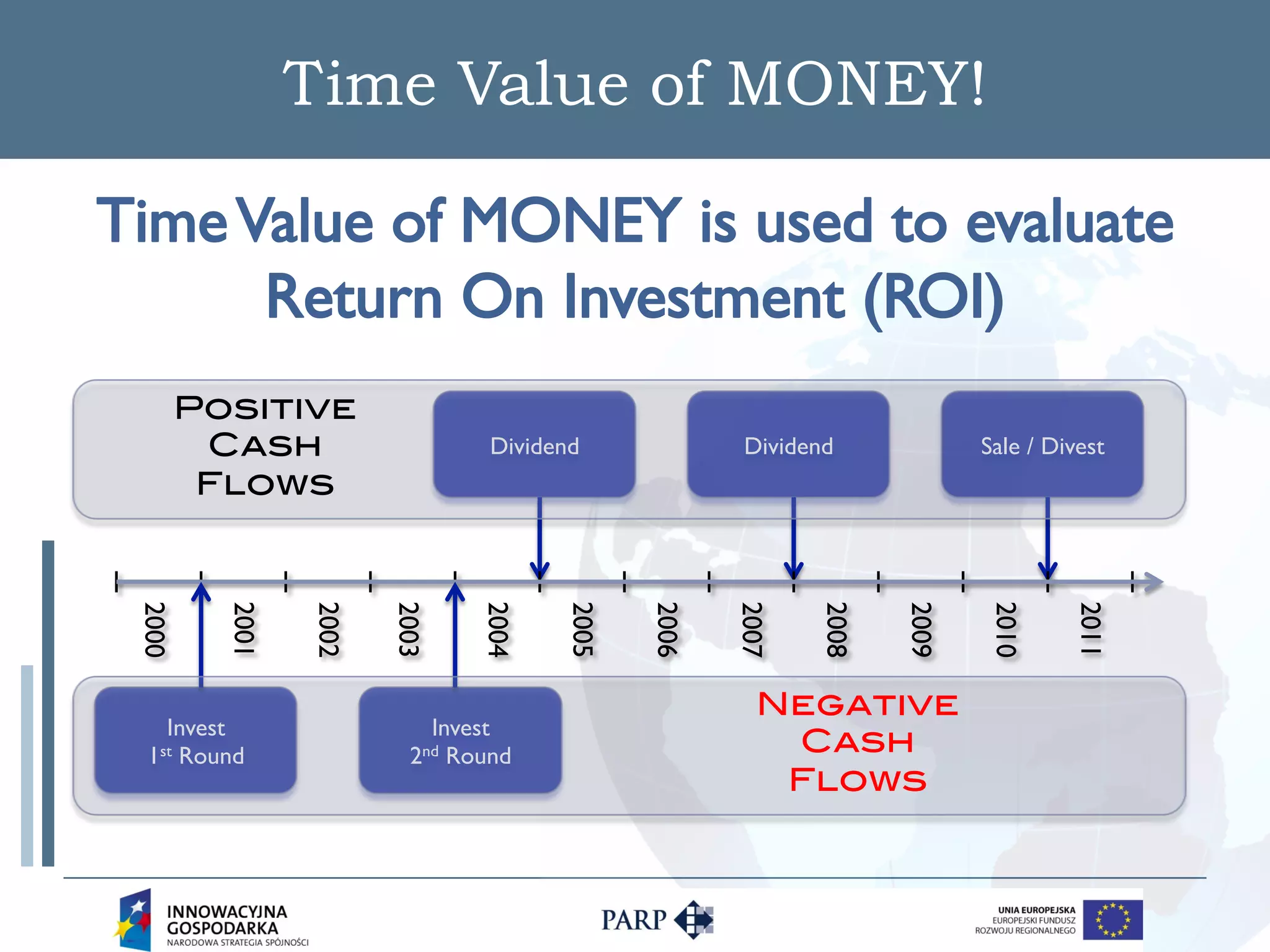

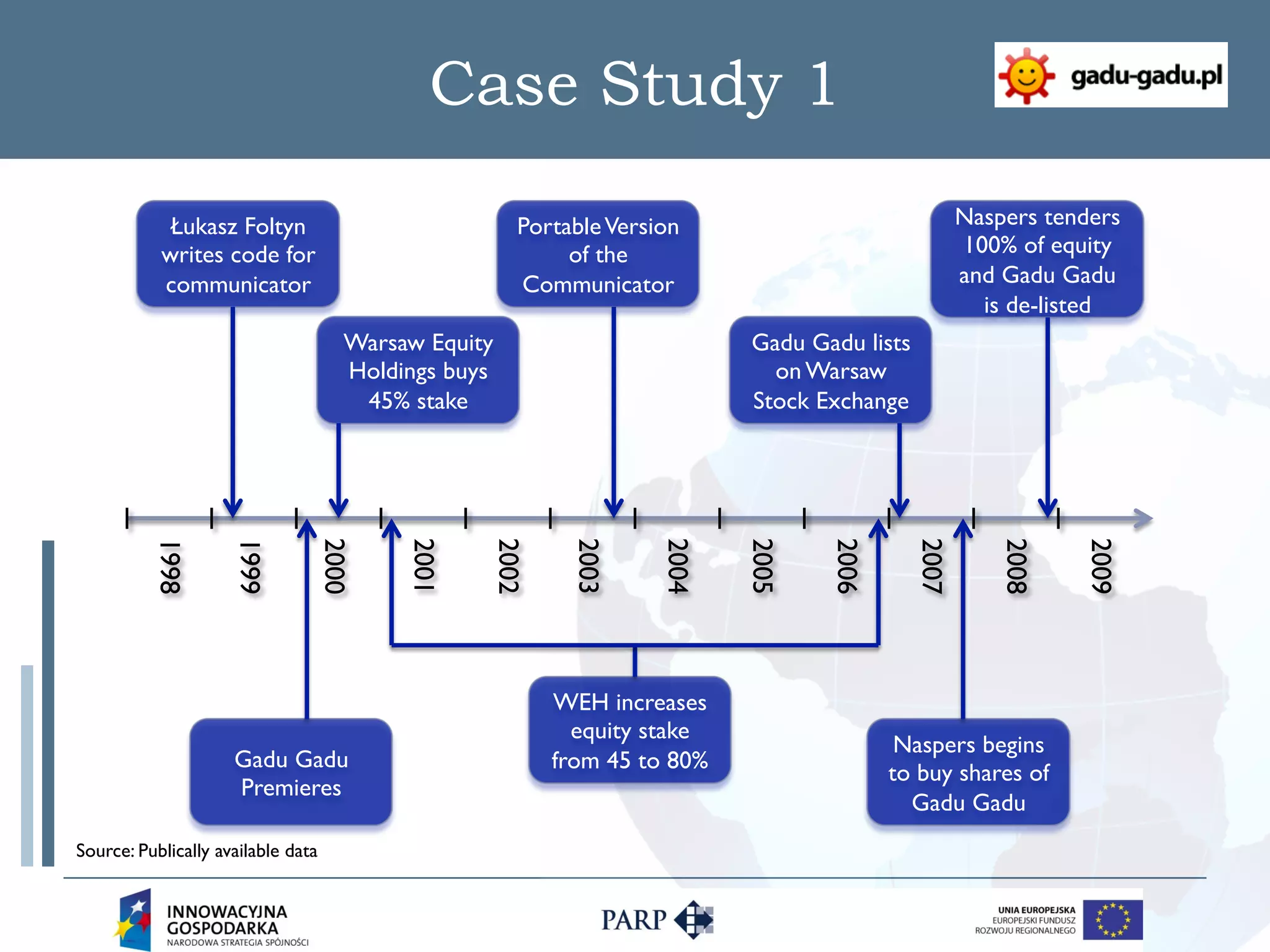

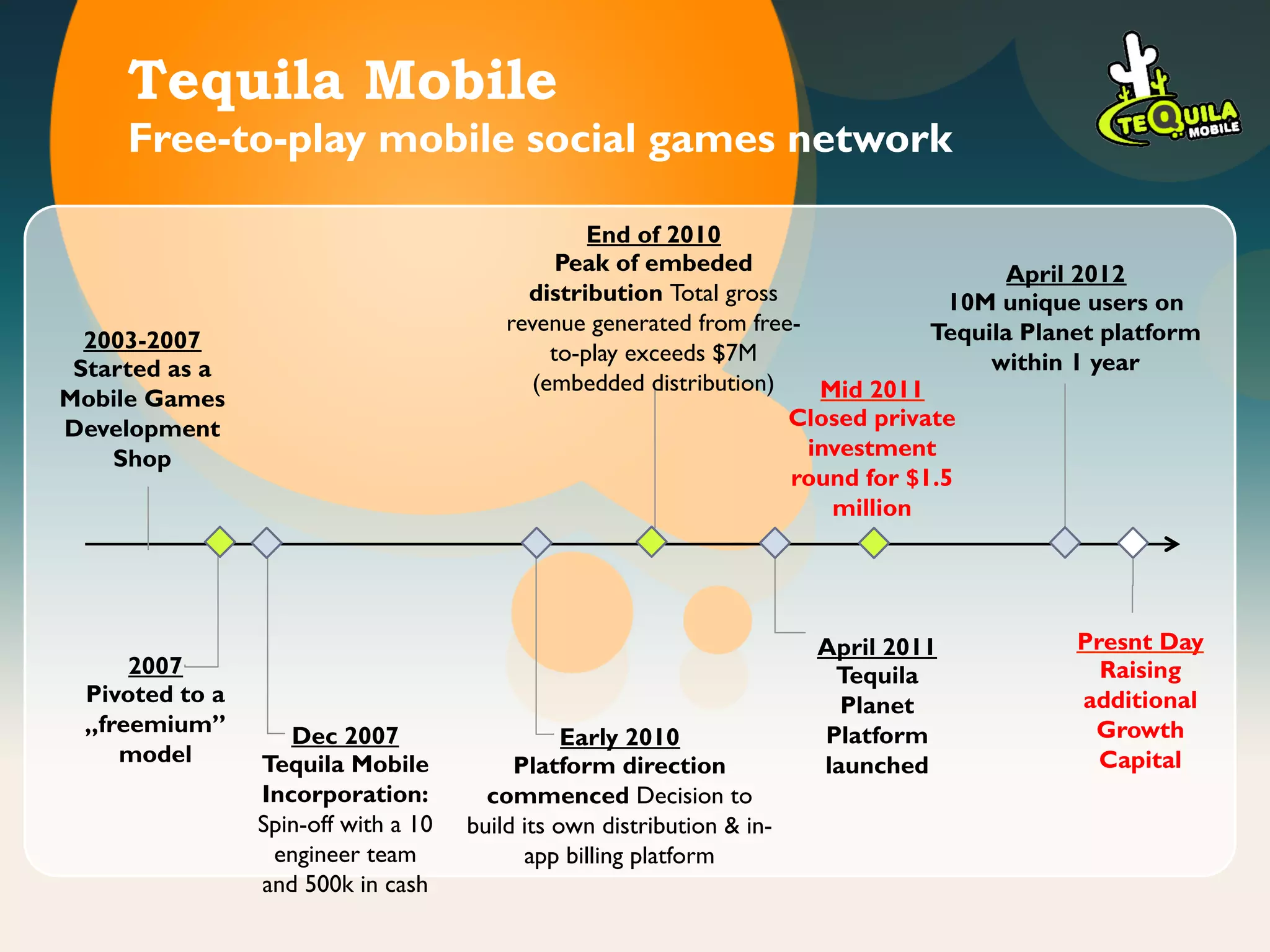

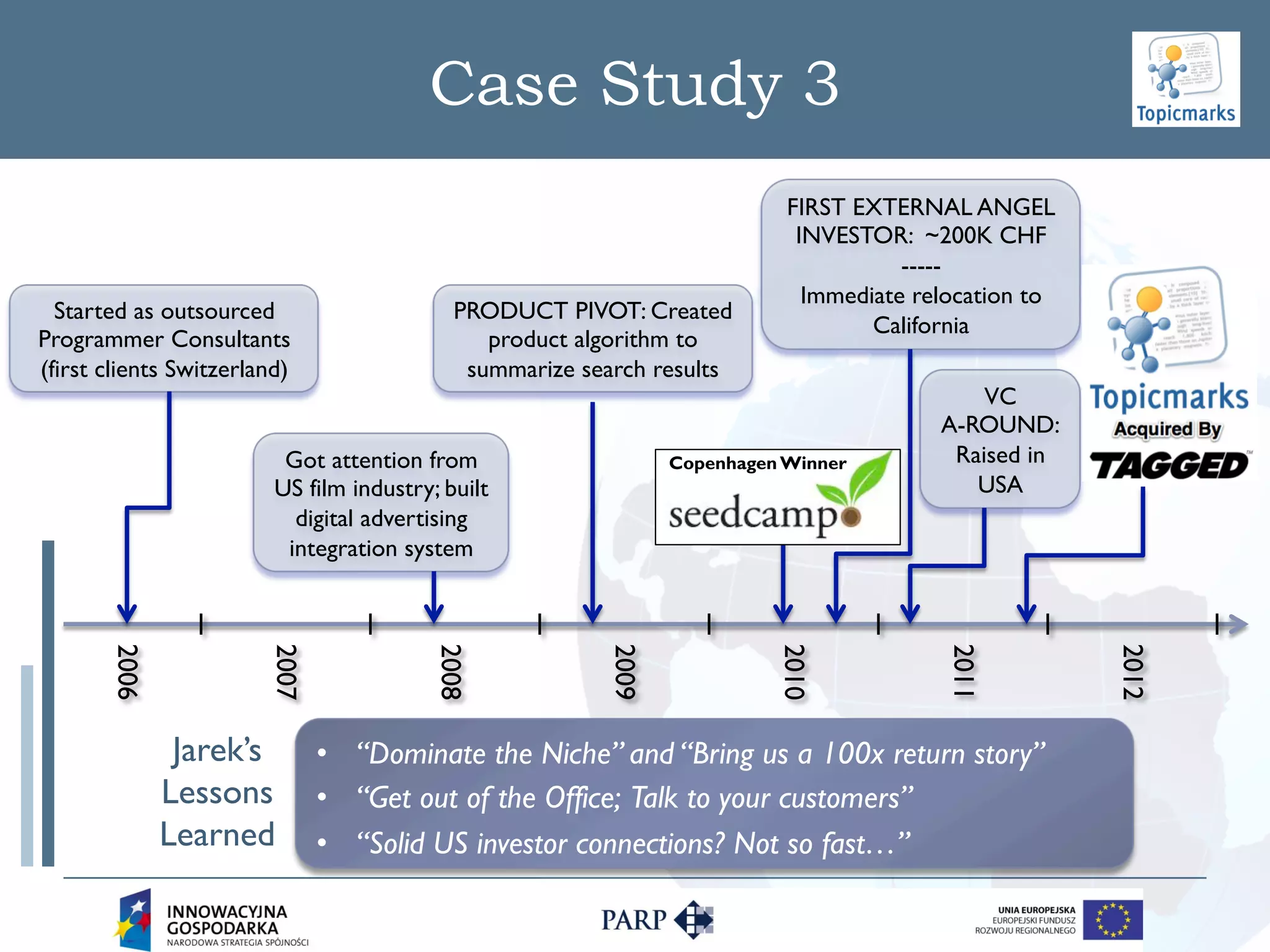

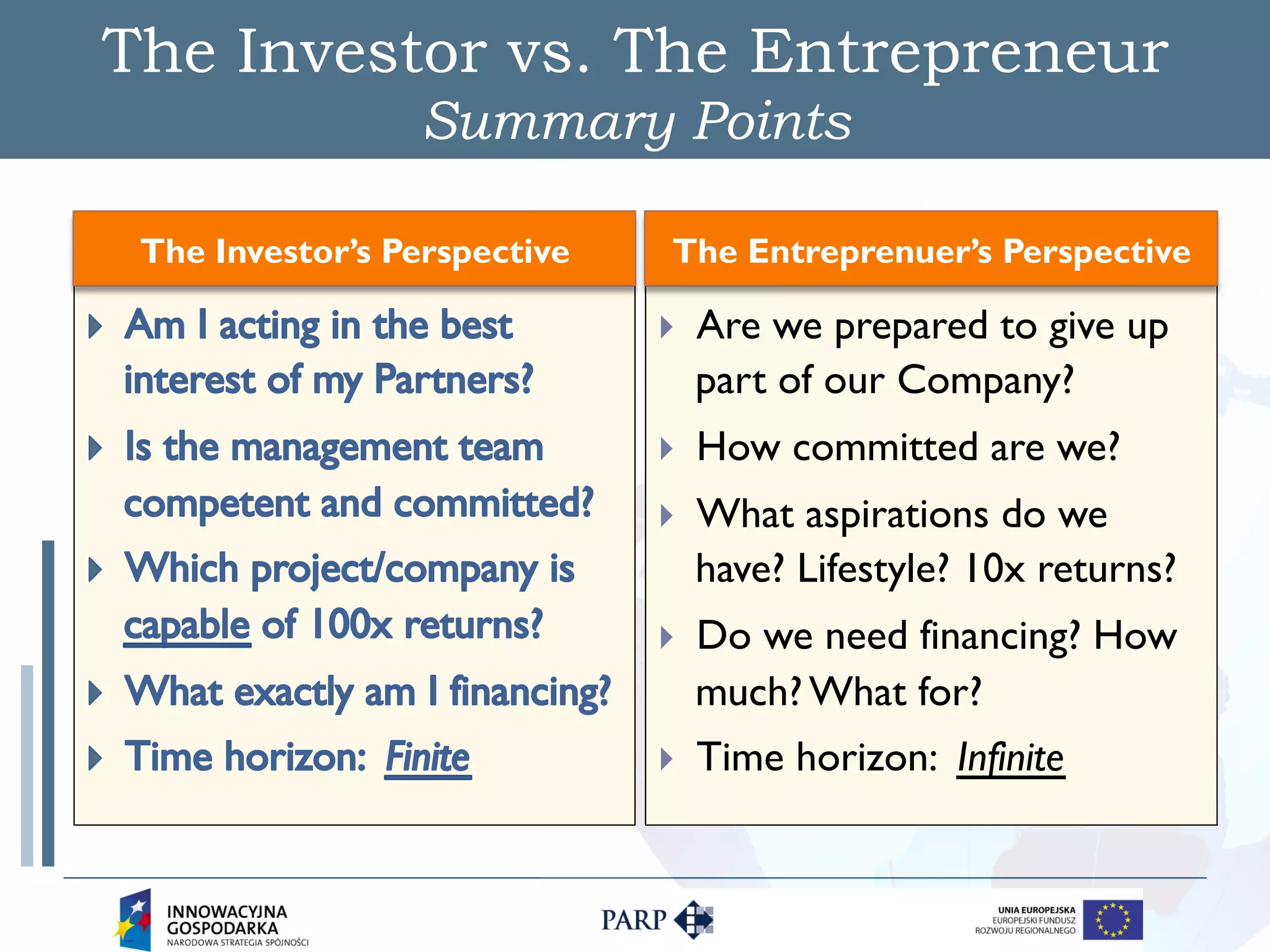

GLOBAL GROUP Ventures provides venture consulting and private equity services focused on Central and Eastern Europe. Ken Globerman gave a presentation on entrepreneurship from an investment perspective. He discussed GLOBAL GROUP's work since 2010 advising various organizations. Globerman also analyzed Poland's developing early-stage investment ecosystem and the gap in available funding there. The presentation covered topics such as the venture capital investment cycle, historical fund performance, and case studies of startups that received funding.