Embed presentation

Downloaded 162 times

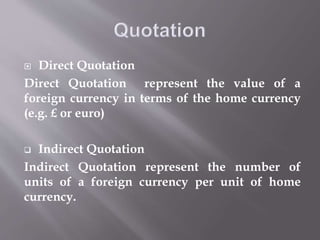

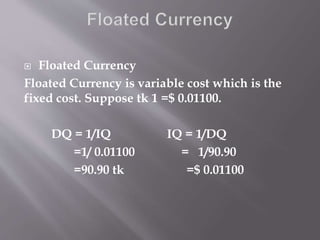

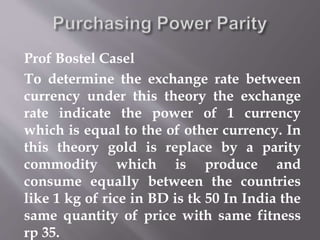

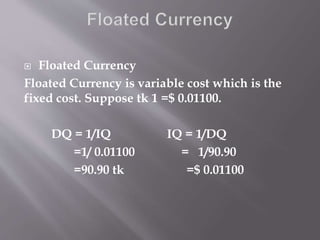

The document discusses purchasing power parity (PPP) as an economic theory and method for determining the value of currencies relative to one another. It explains the functions of PPP exchange rates, including their consistency over time and their trend correlation with actual exchange rates. Additionally, it distinguishes between absolute and relative parity and outlines the concepts of direct and indirect quotations in currency exchange.