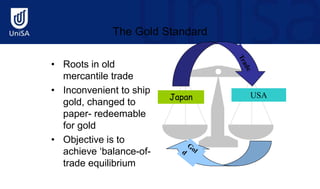

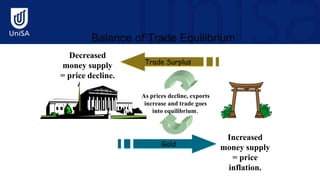

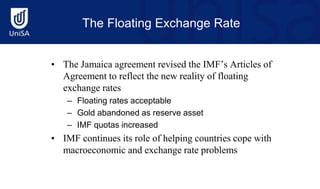

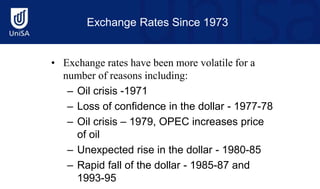

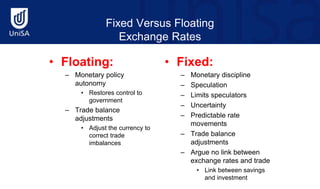

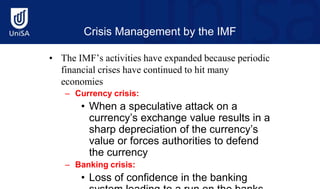

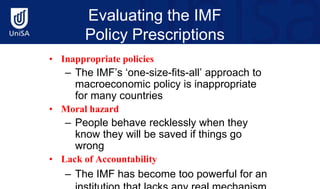

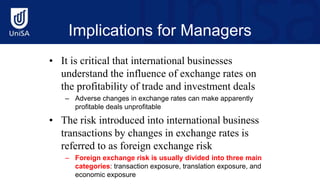

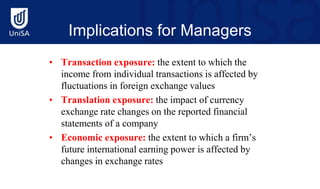

This document provides an overview of international finance and currency exchange. It defines key terms like foreign exchange markets, exchange rates, and foreign exchange risk. It describes the functions of foreign exchange markets in converting currencies and providing insurance against risk. It also discusses the International Monetary Fund and its role in providing stability and flexibility to global currency systems. Managers are advised to understand how exchange rate fluctuations can impact the profitability of international business deals.