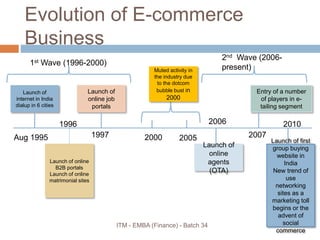

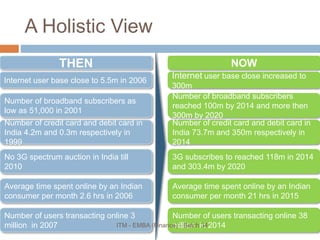

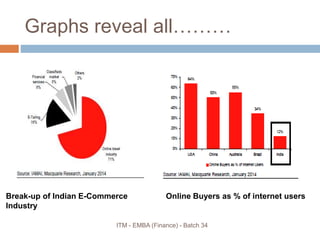

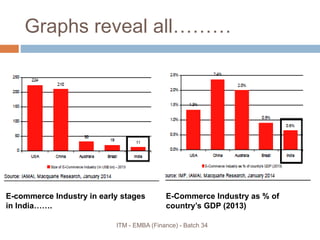

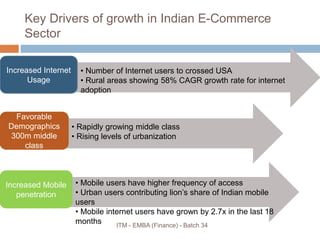

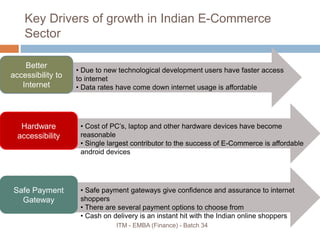

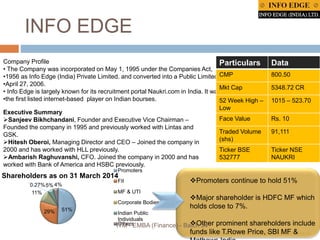

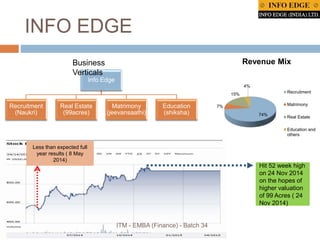

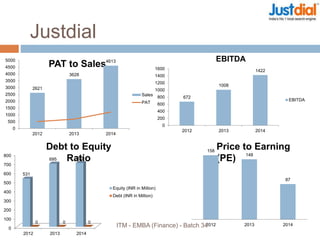

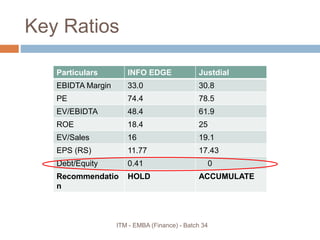

The document discusses the evolution of e-commerce in India and provides an overview of the e-commerce sector. It analyzes key drivers of growth for the sector such as increased internet usage and favorable demographics. The document also discusses major companies in the e-commerce space, including Info Edge and Just Dial, providing details on their business models, financial performance, and SWOT analyses. Graphs and comparisons with global markets are presented to showcase India's potential for future e-commerce growth.