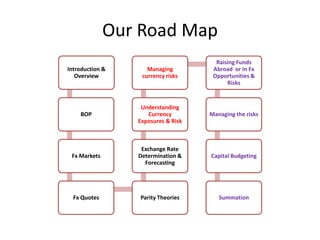

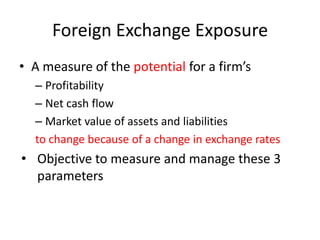

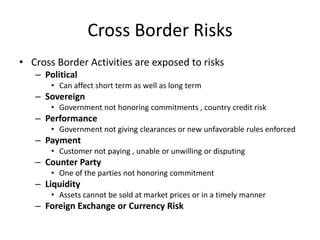

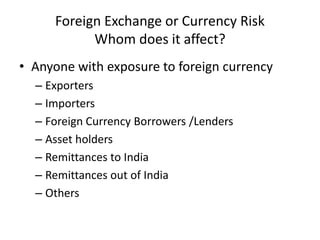

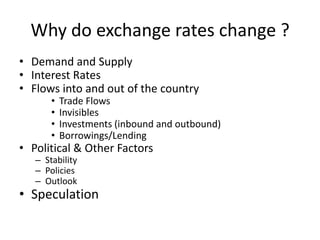

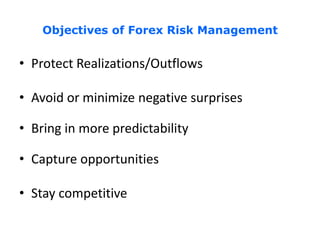

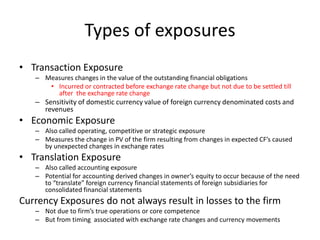

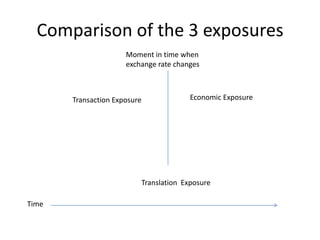

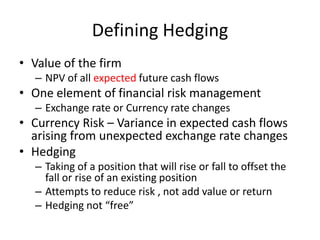

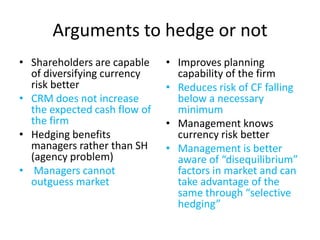

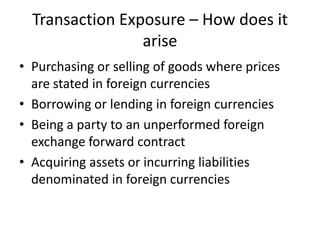

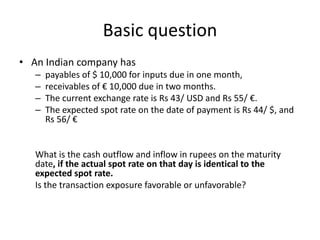

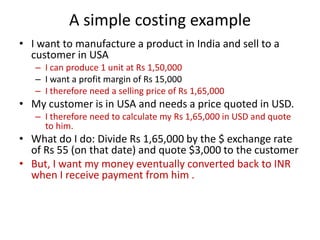

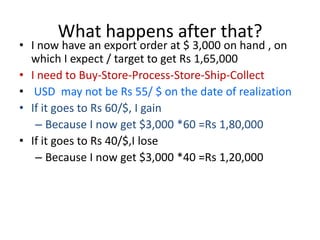

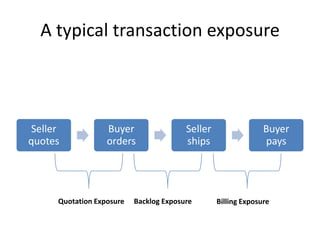

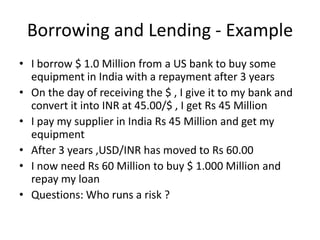

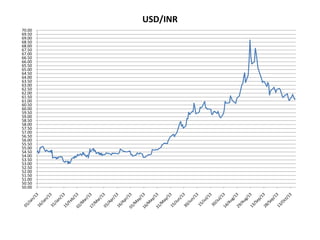

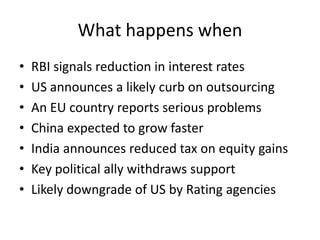

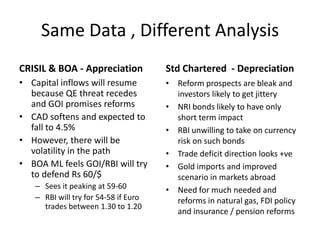

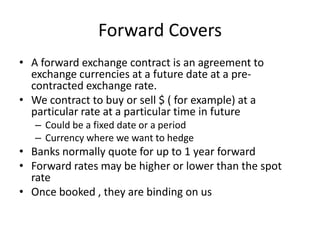

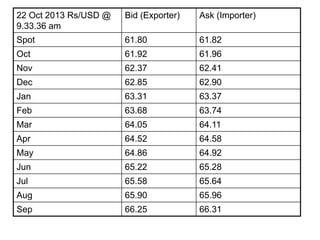

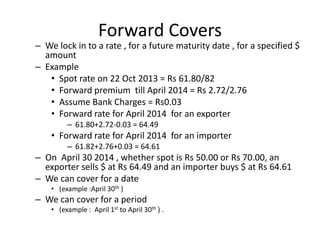

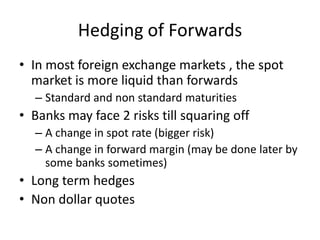

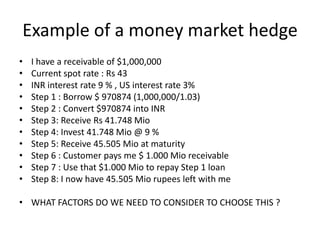

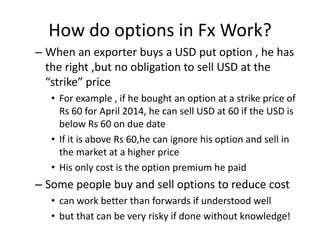

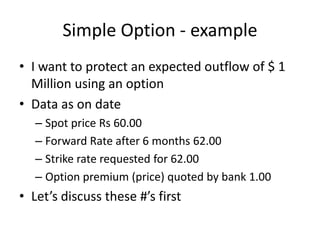

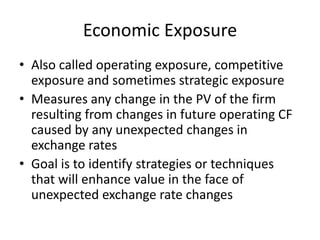

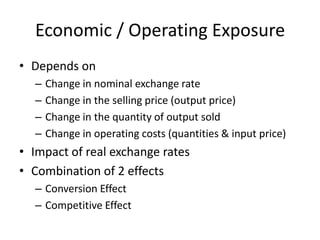

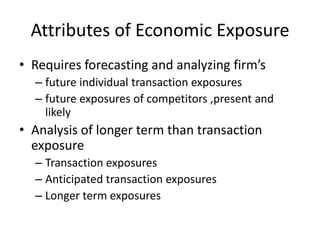

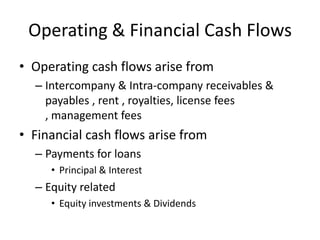

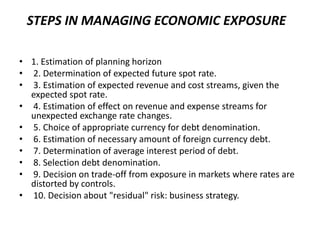

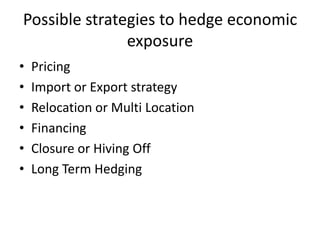

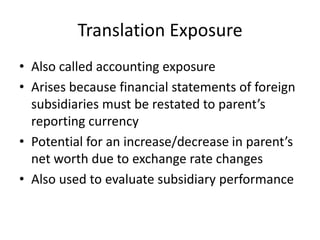

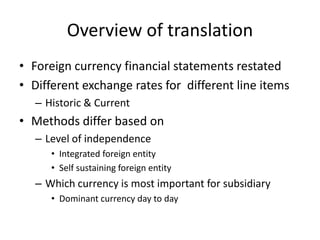

This document provides an overview of managing foreign exchange exposures and exchange rate fluctuations. It discusses the different types of currency exposures that companies face, including transaction, economic, and translation exposures. Transaction exposures arise from outstanding foreign currency obligations before exchange rates change. The document outlines how changing exchange rates can affect companies and provides examples of currency risk from imports, exports, and foreign borrowing. It also discusses factors that influence exchange rate movements and the objectives of foreign exchange risk management.