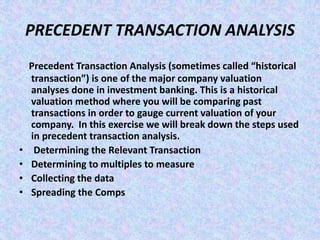

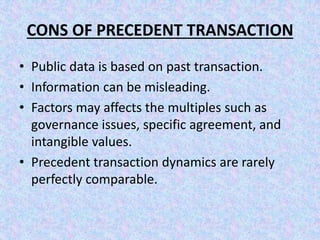

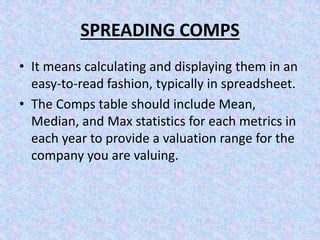

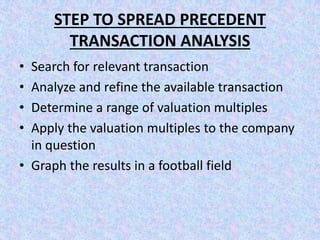

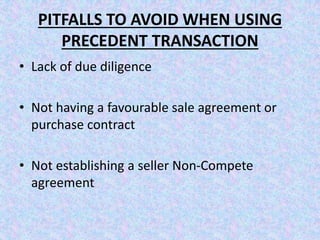

This document discusses the precedent transaction analysis valuation method. It involves selecting comparable past transactions and analyzing their valuation multiples to determine a range for valuing a company. Key steps include determining relevant precedent transactions, analyzing multiples like EV/Sales and P/E ratios, and spreading the comps in a table with mean, median and maximum metrics to estimate the company's valuation. Pros are that it relies on public data, but cons include that past transactions may not perfectly reflect current company dynamics.