1) The document discusses various stock market indices in Pakistan including the KSE 30 Index, KSE 100 Index, and KMI 30 Index.

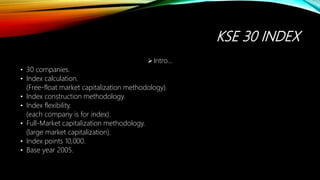

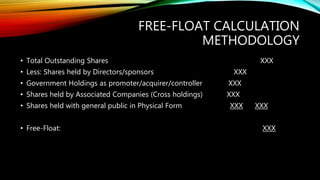

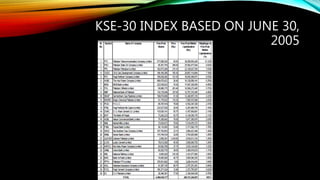

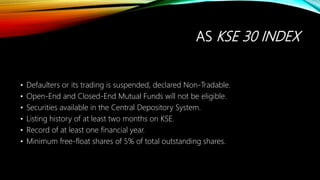

2) It explains the methodology for calculating the KSE 30 Index, including the use of free-float market capitalization and liquidity metrics to select the top 30 companies.

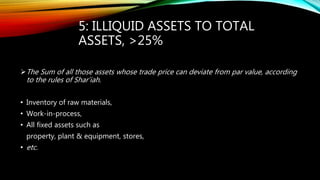

3) The eligibility criteria for inclusion in the indices are also summarized, such as minimum free-float of shares, listing history, and being compliant with Shariah principles for the KMI 30 Index.