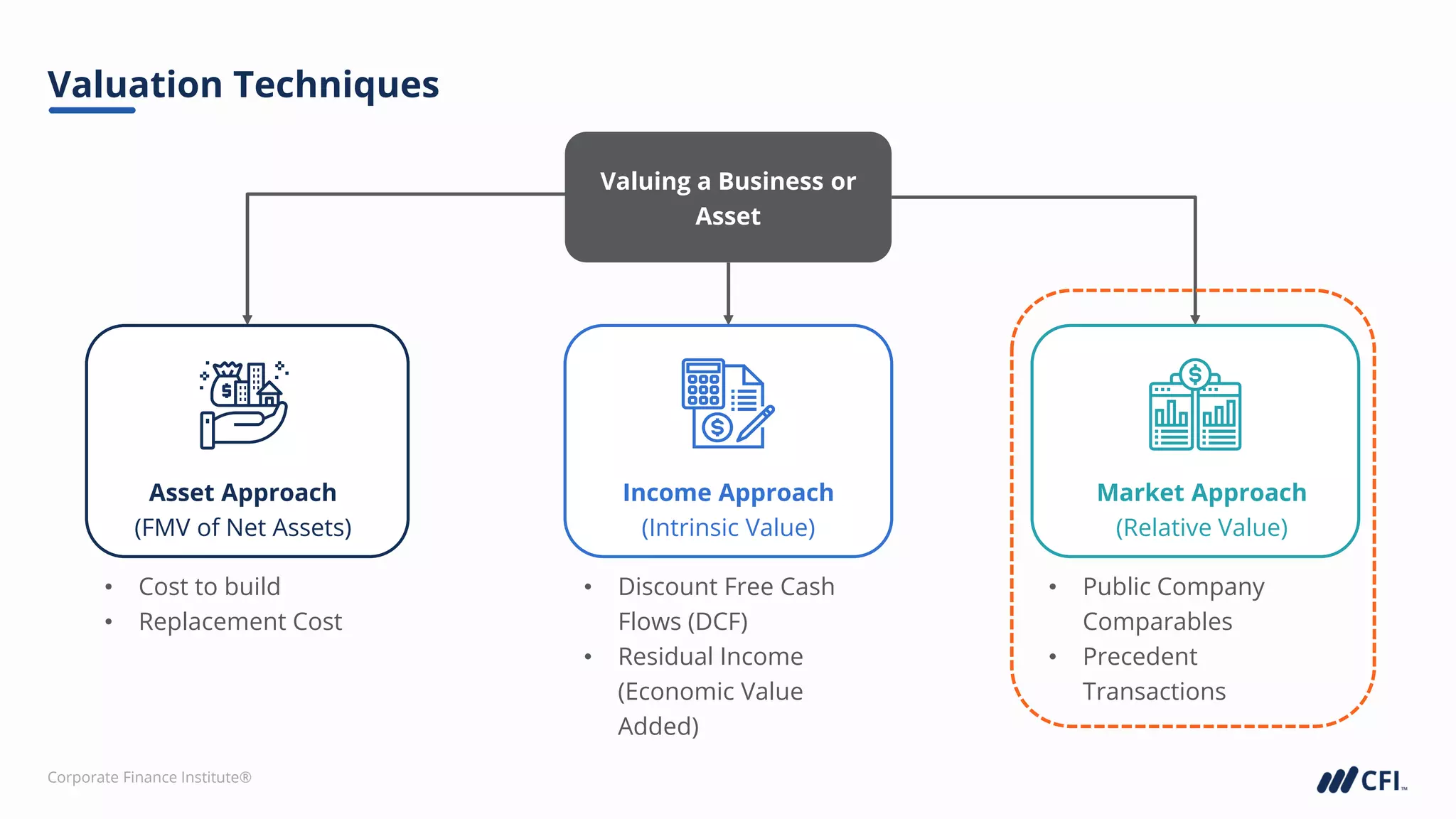

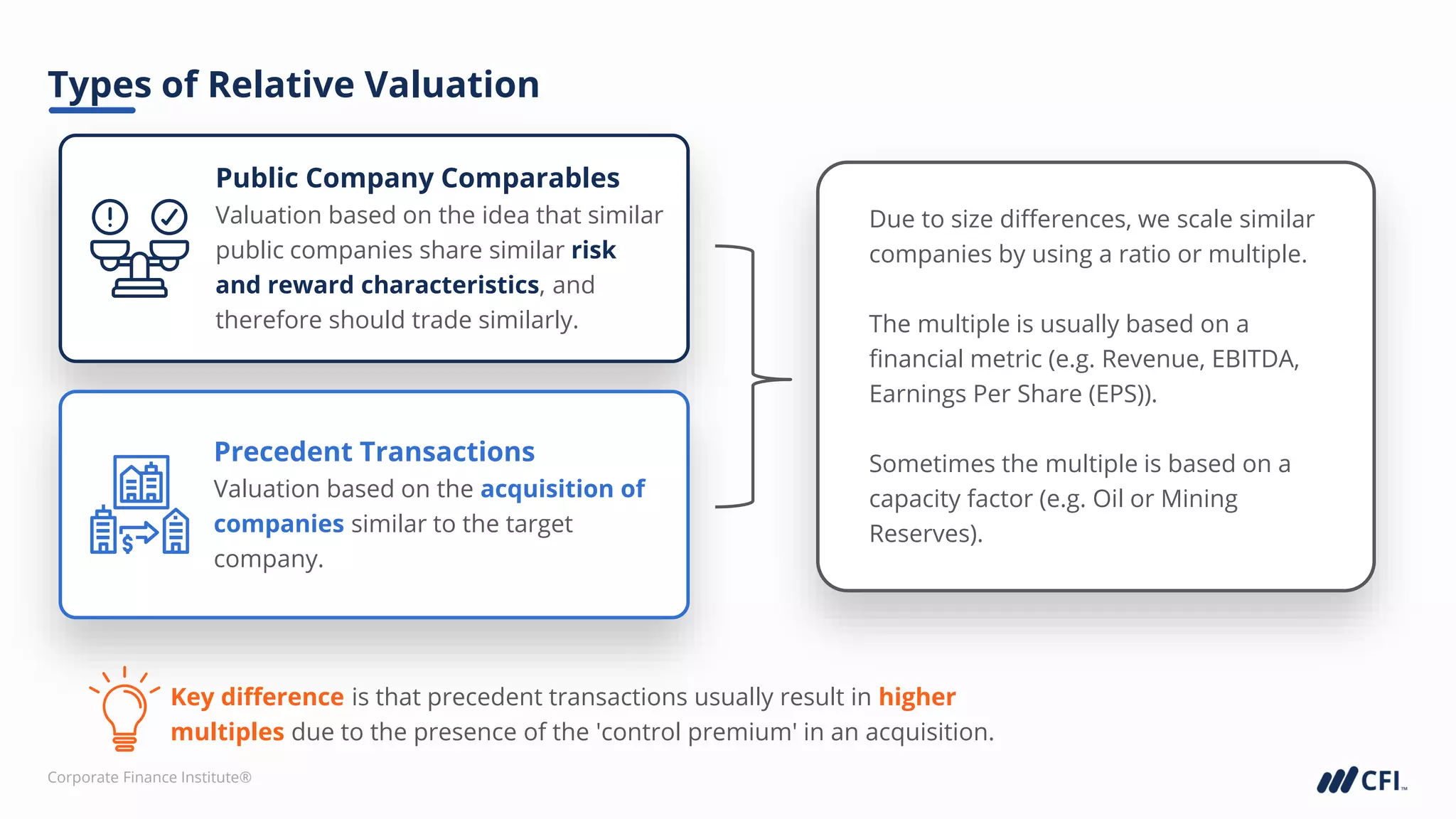

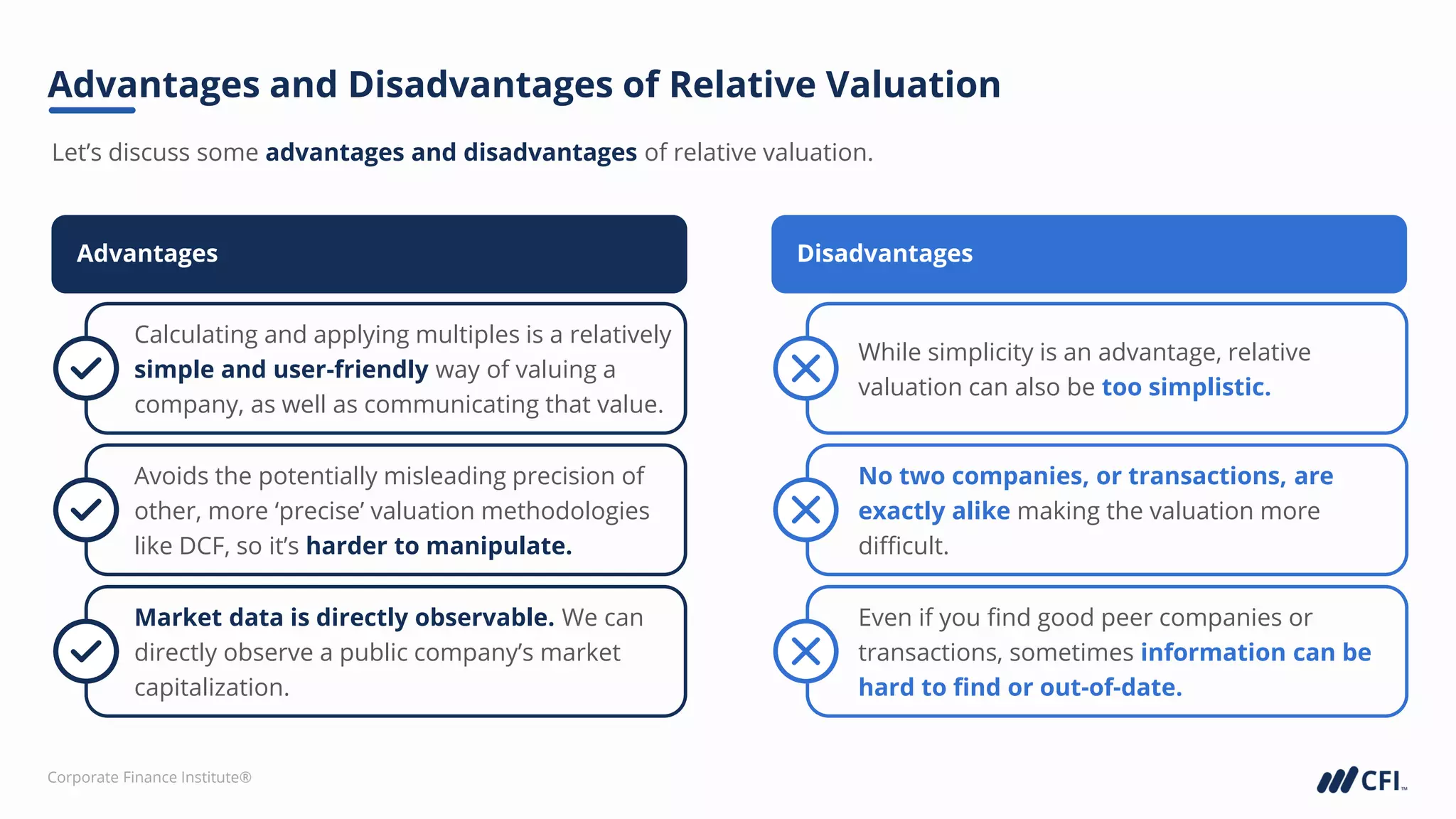

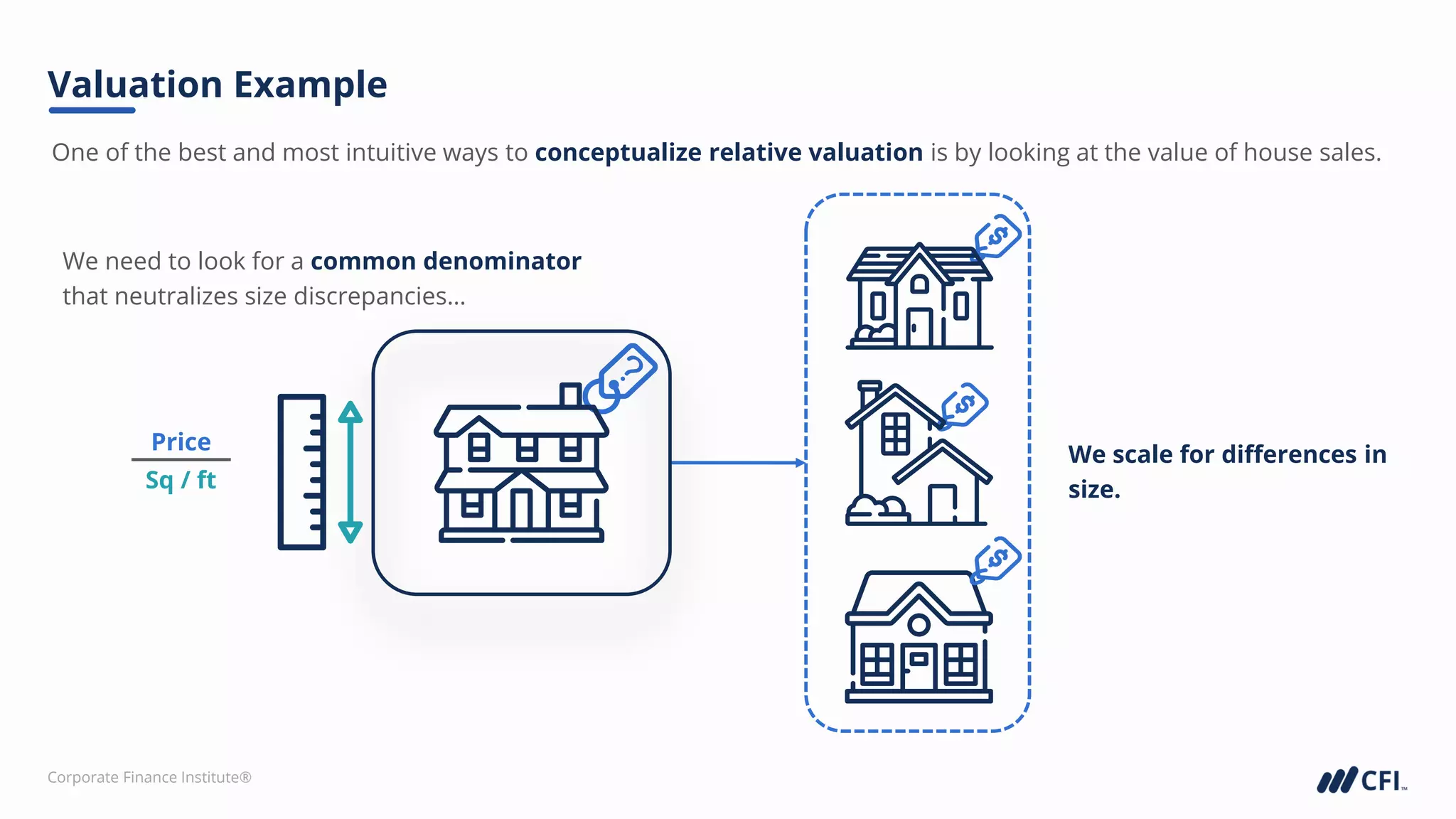

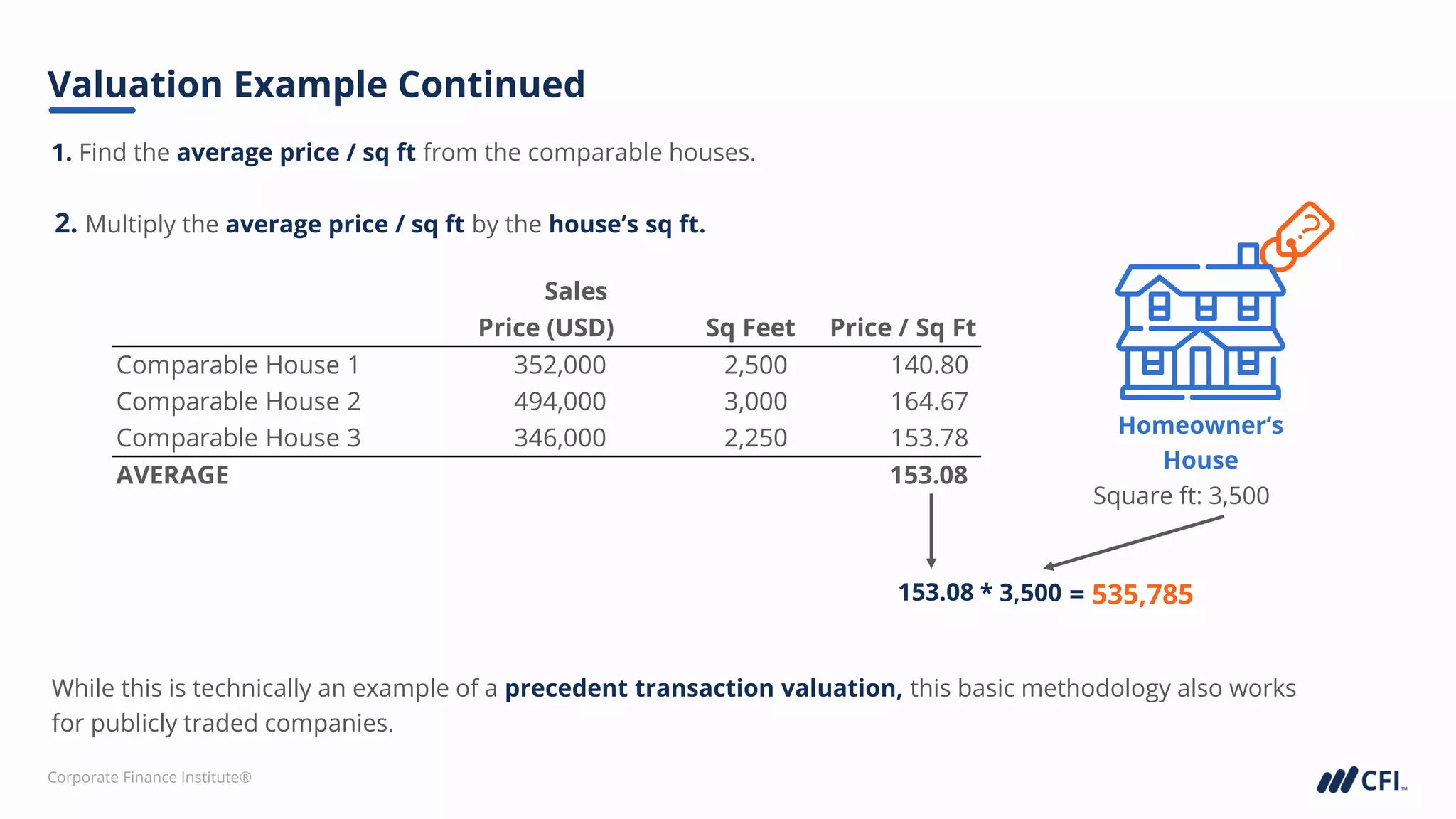

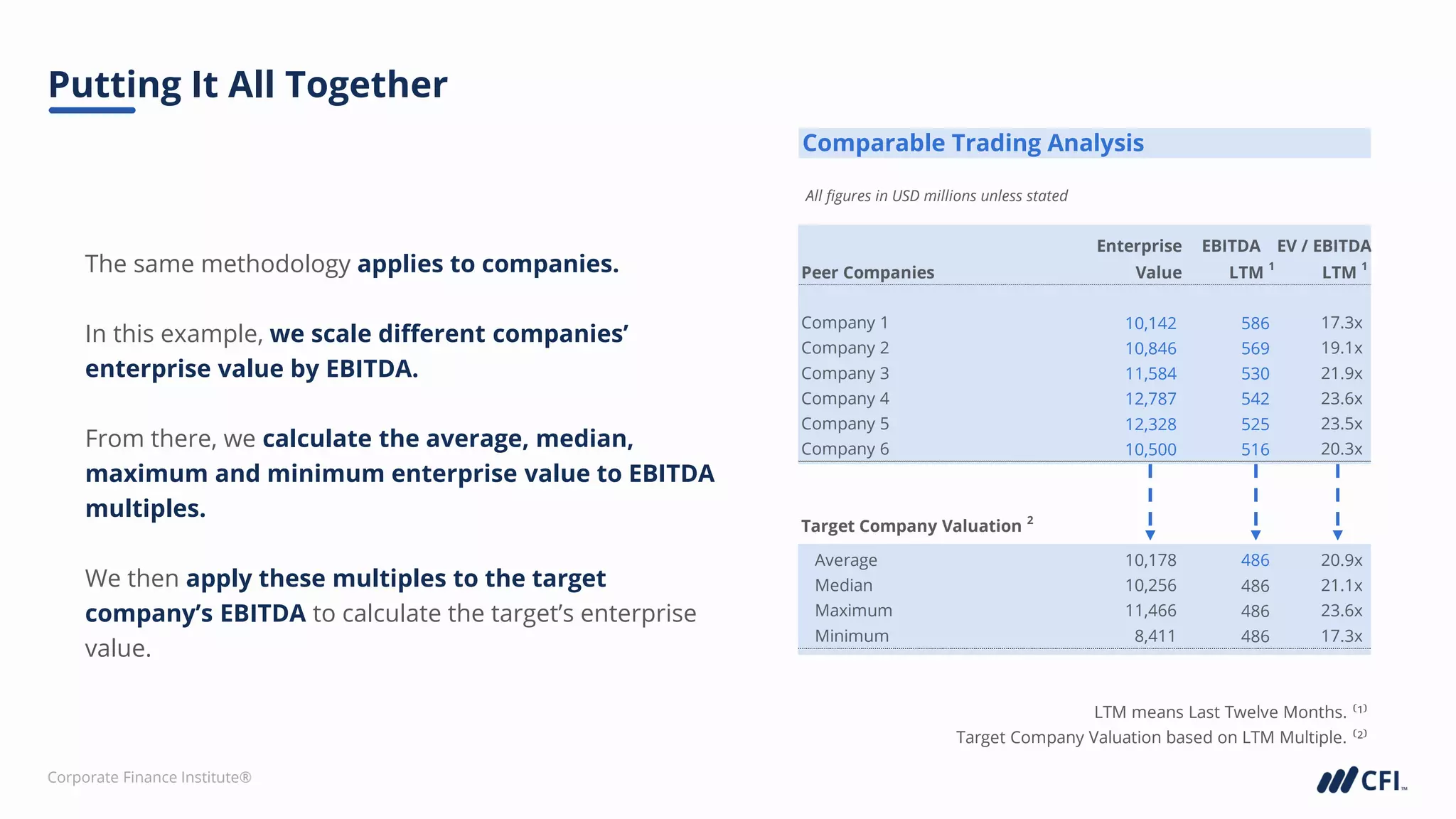

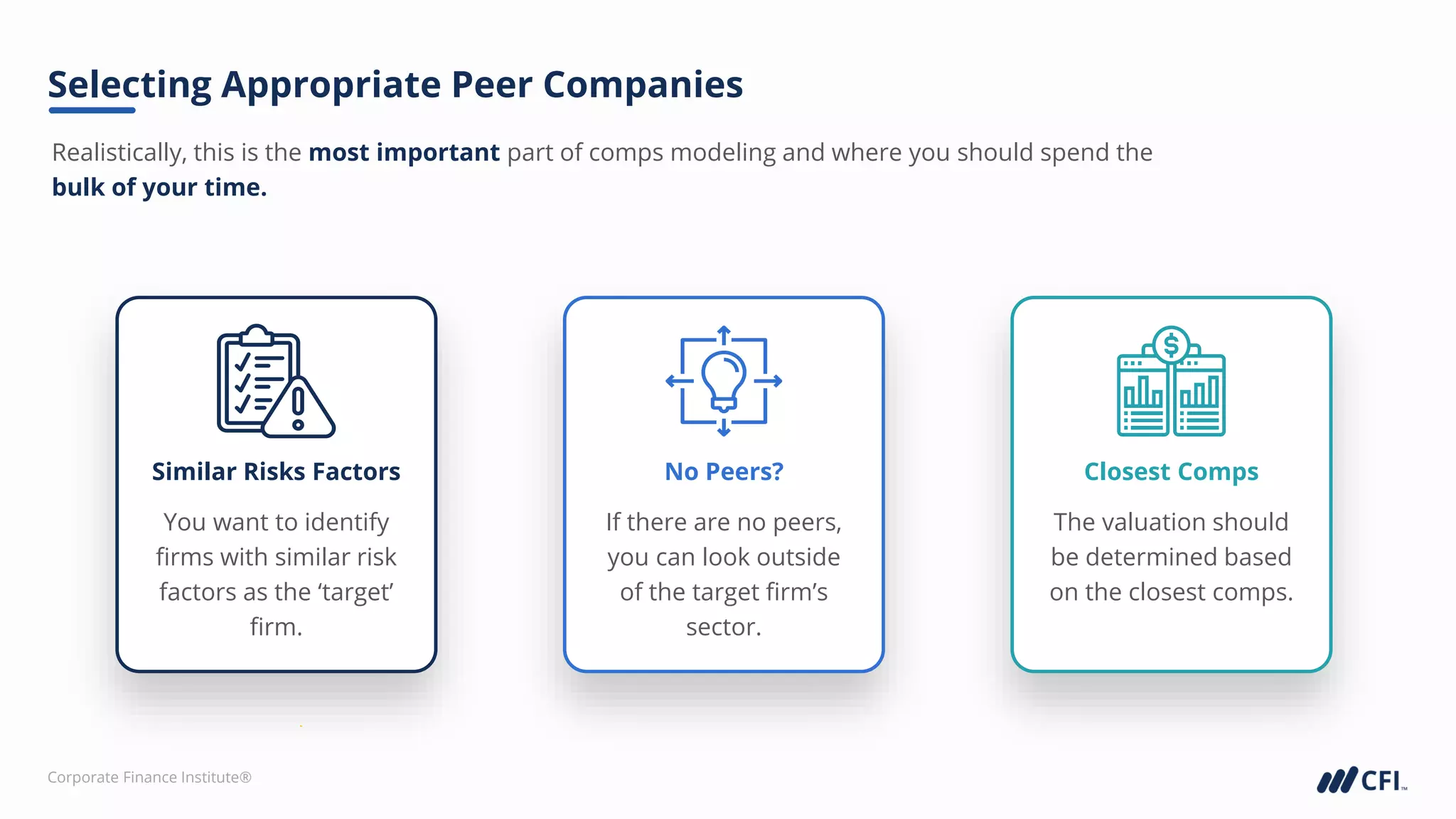

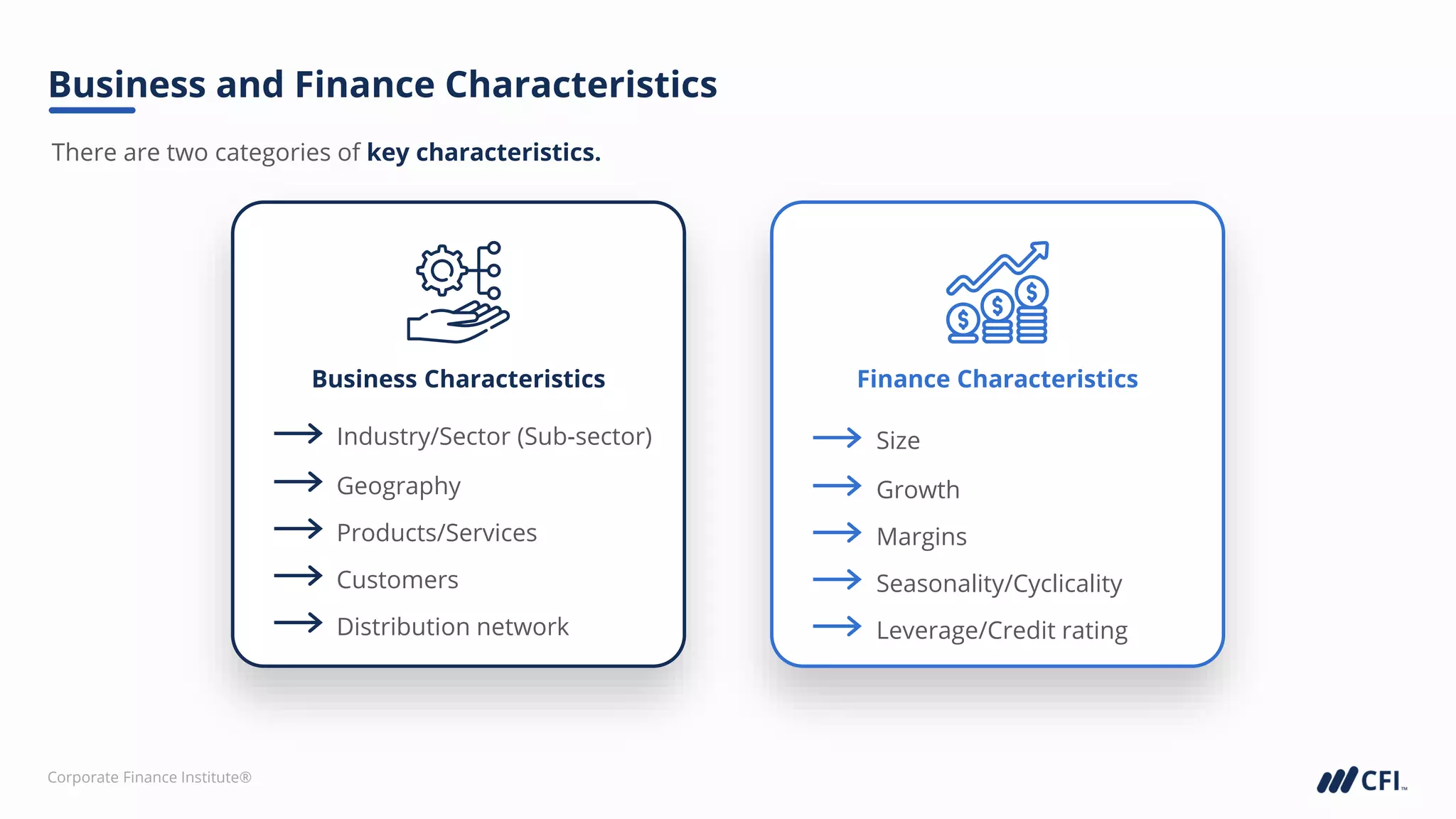

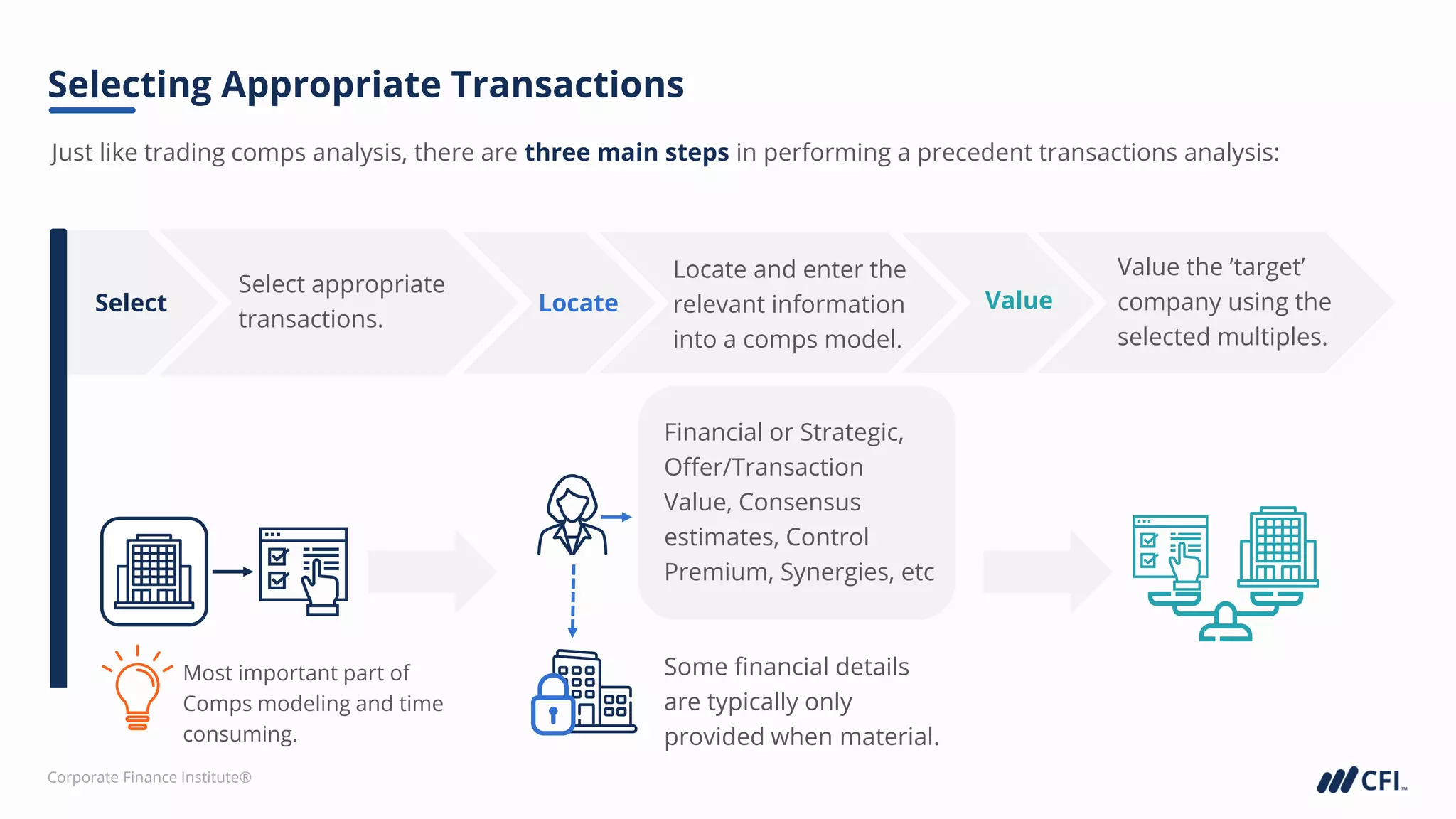

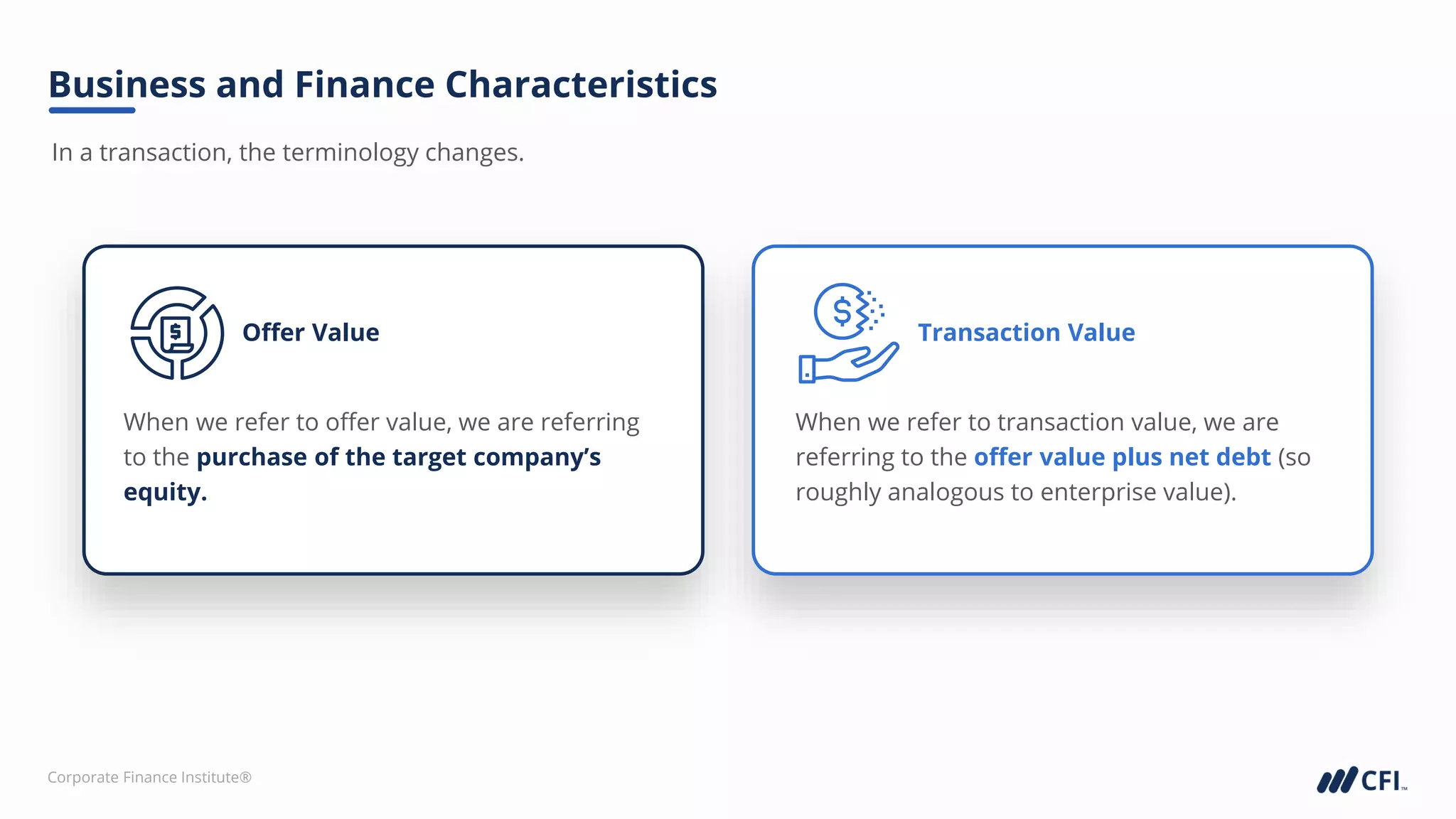

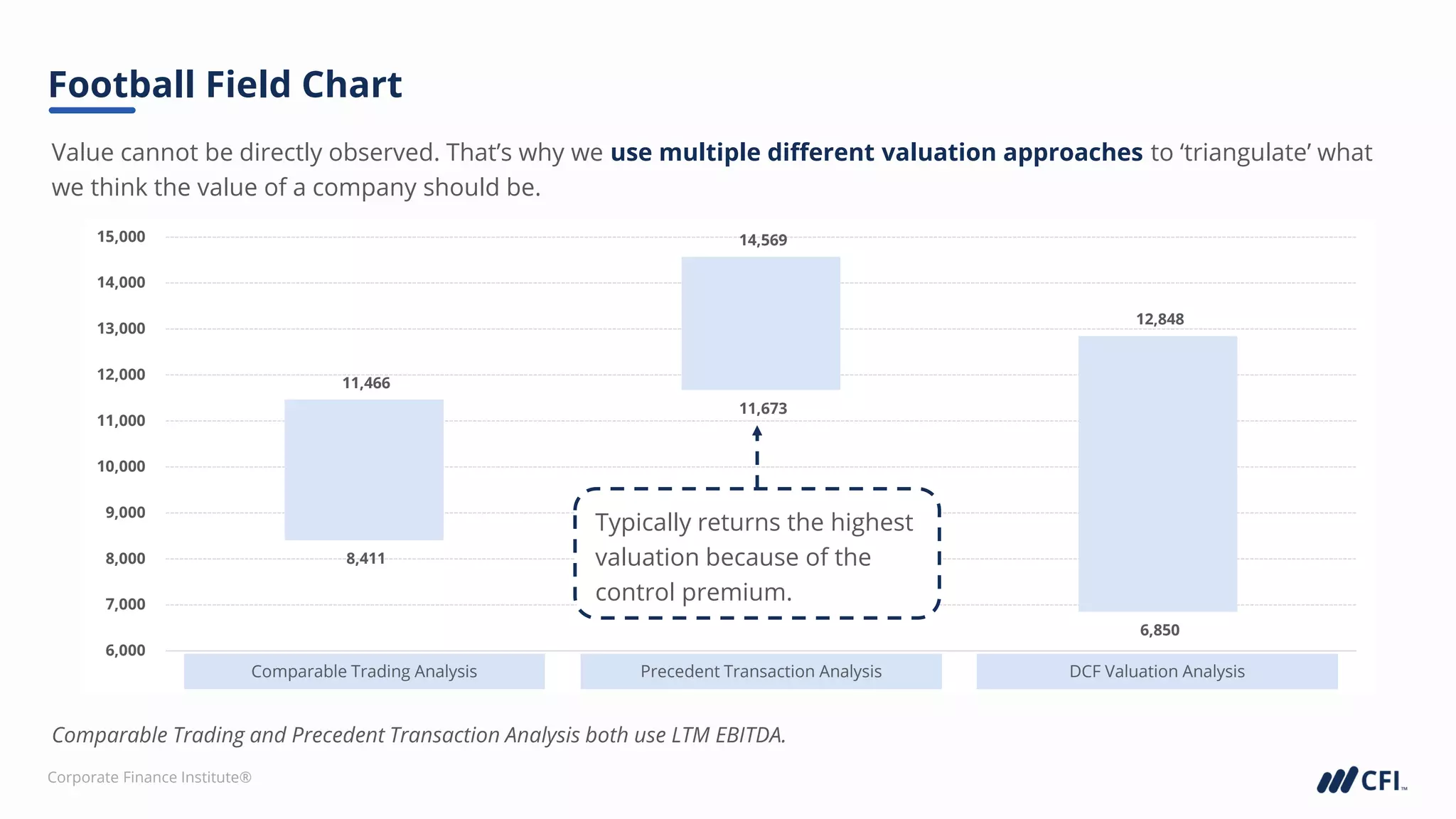

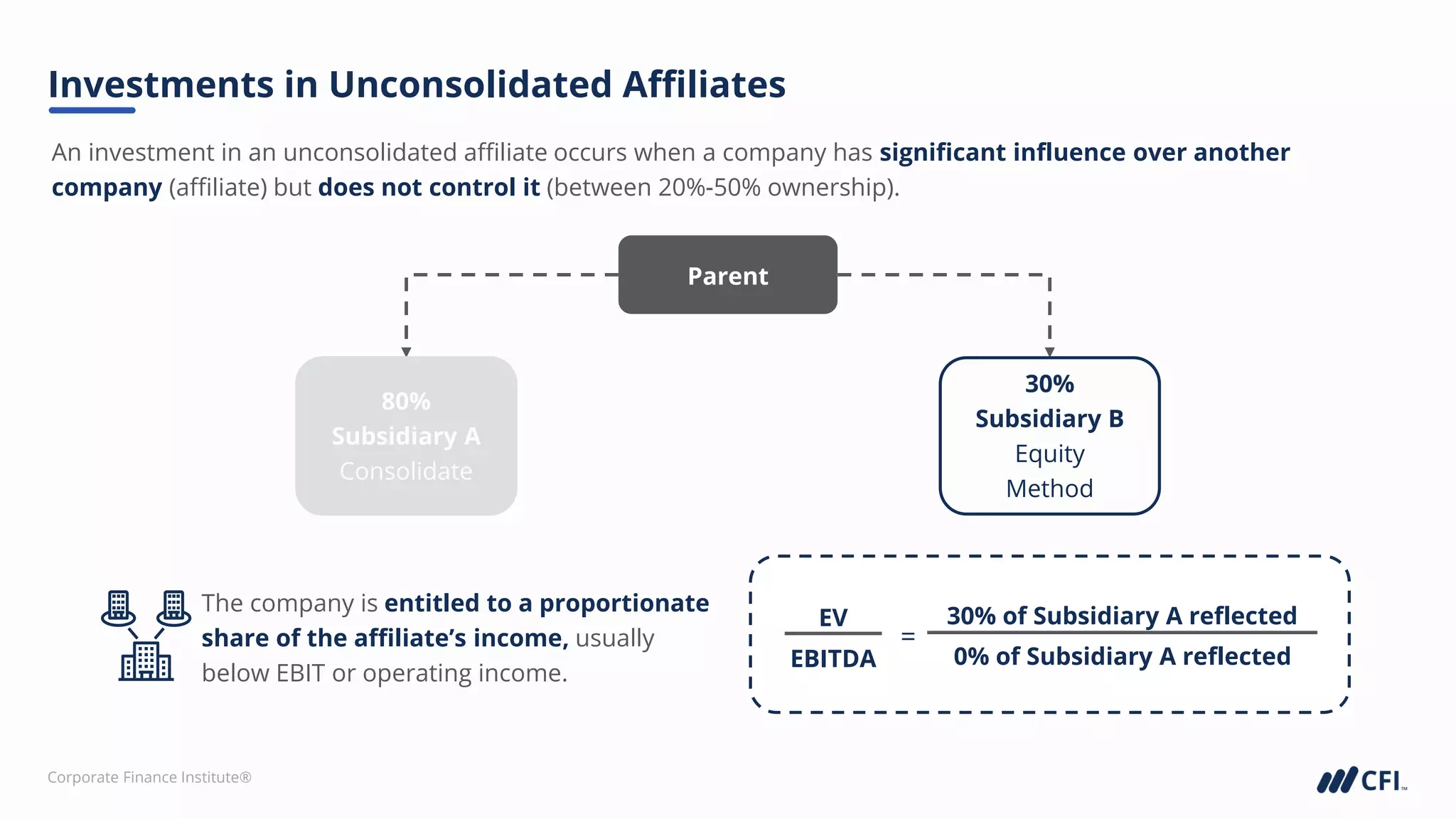

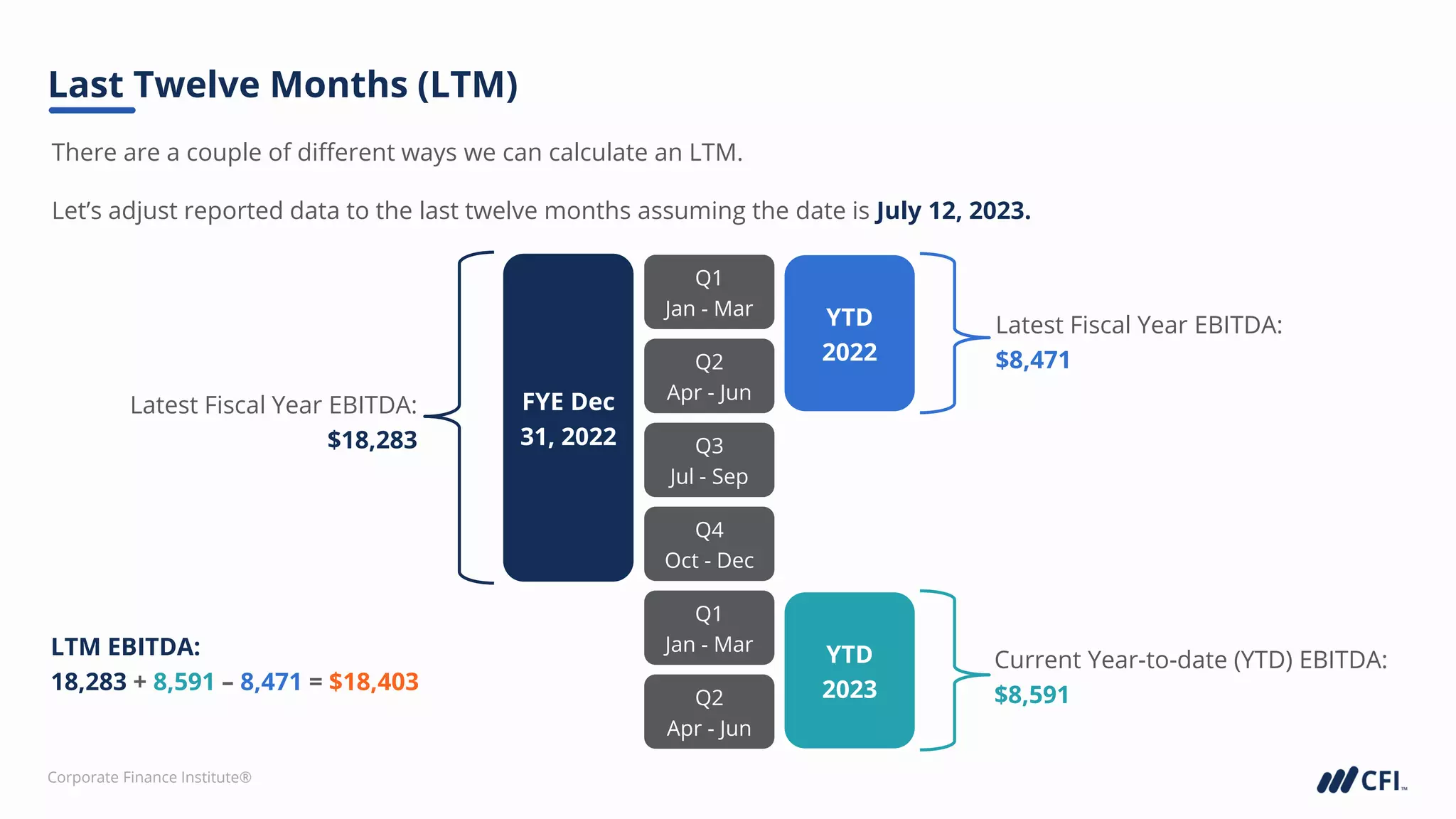

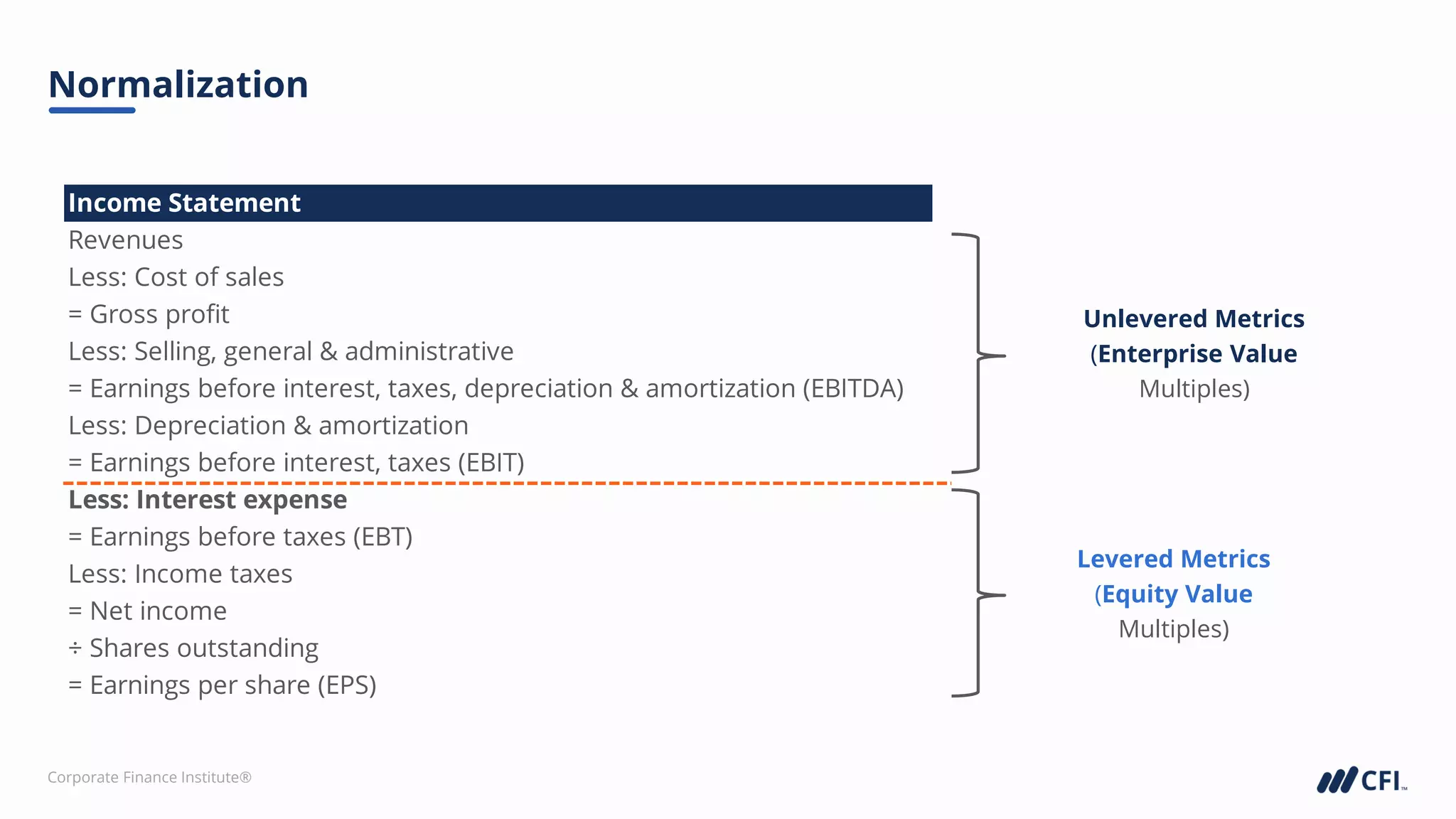

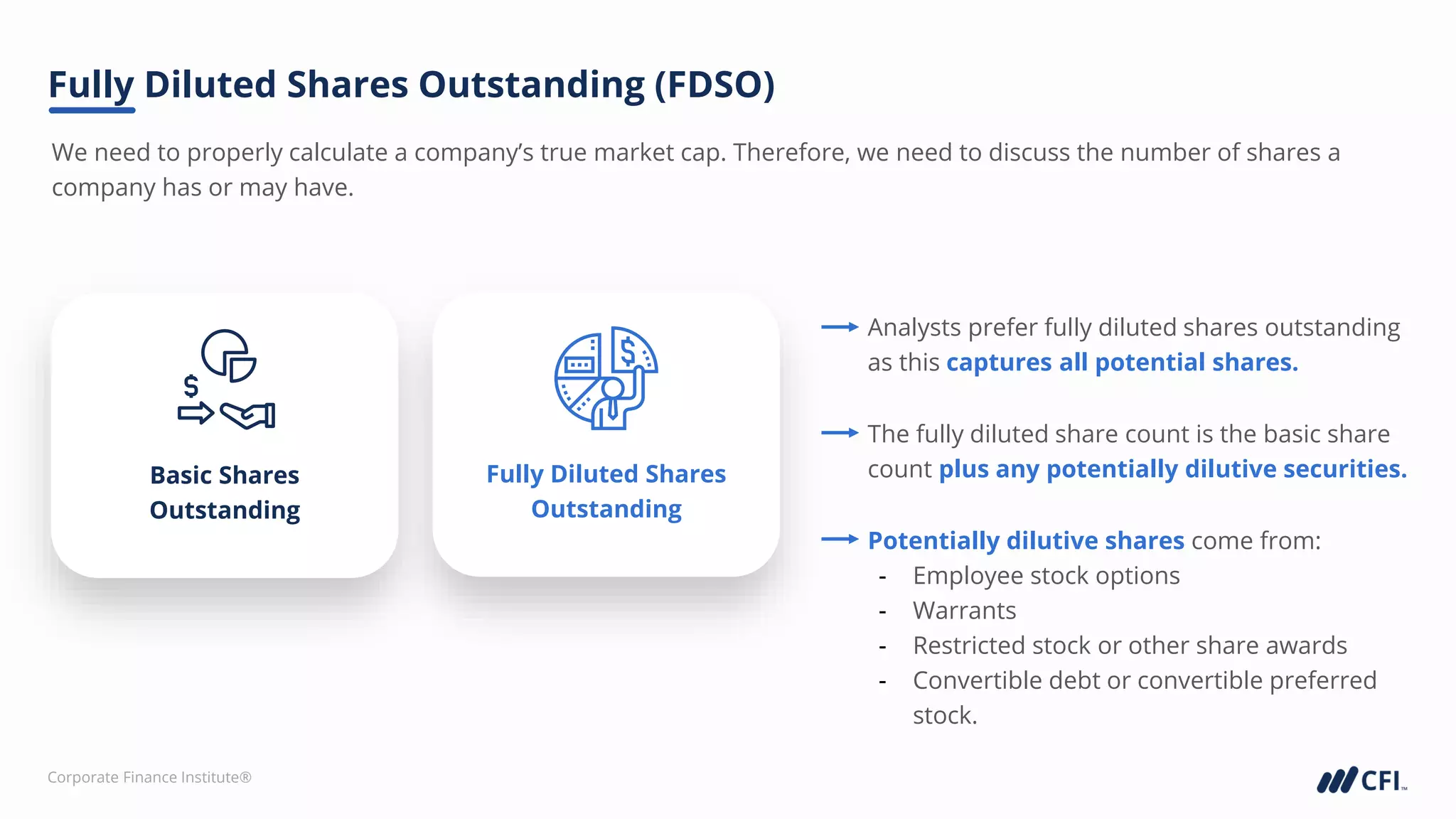

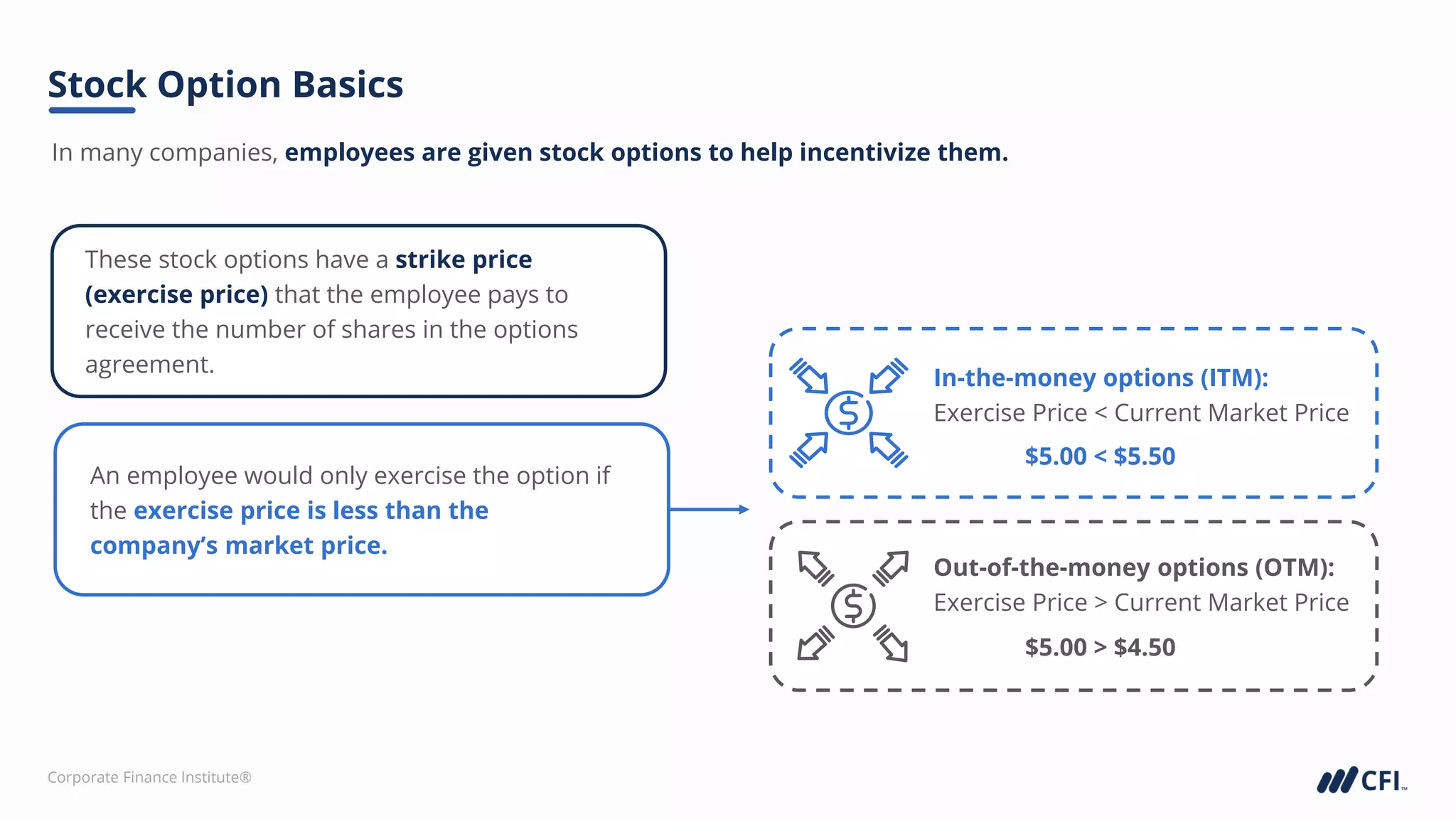

This document provides an introduction to comparable valuation analysis. It discusses the key aspects of relative valuation using comparable companies and precedent transactions. The document outlines the learning objectives, defines relative valuation, and discusses the advantages and disadvantages of the approach. It provides examples of how to select comparable companies and transactions based on business and financial characteristics. The document also shows how to perform the actual valuation by locating relevant data, calculating valuation multiples, and applying those multiples to the target company.