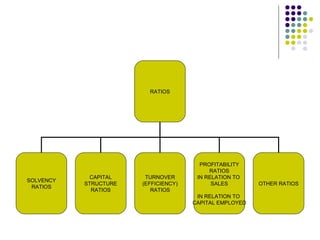

The document discusses various types of financial ratios used in ratio analysis. It describes solvency ratios like current ratio and liquid ratio that measure a company's ability to meet short-term obligations. Capital structure ratios like debt-equity ratio measure financial leverage. Turnover/efficiency ratios like inventory turnover ratio measure how efficiently a company uses its resources. The document provides formulas and explanations for calculating these key financial ratios.