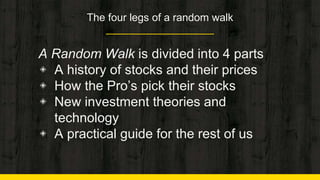

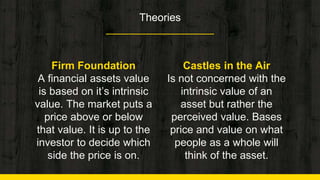

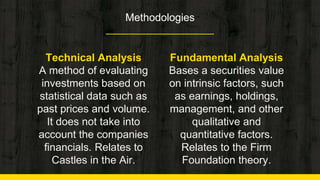

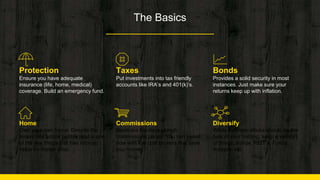

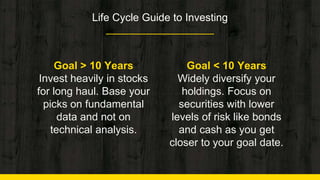

This document summarizes key points from the book "A Random Walk Down Wall Street" by Burton G. Malkiel. The book is divided into four parts that discuss the history of stock prices, how professional investors pick stocks, new investment theories and technology, and practical investment advice. It covers various investment theories like the firm foundation theory and the castles in the air theory. It also discusses different analysis methods used by professionals like technical analysis and fundamental analysis. The document emphasizes the importance of diversification and provides basic investment advice like having insurance, investing in tax-advantaged accounts, including bonds in a portfolio, owning a home, keeping commissions low, and adjusting investment strategies based on investment goals and time horizons.