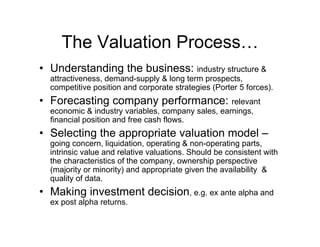

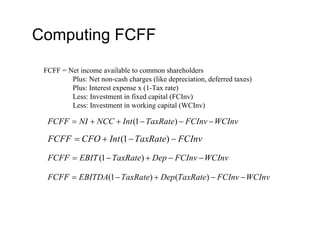

This document discusses various equity valuation approaches and methods. It begins by outlining the valuation process of understanding the business, forecasting performance, and selecting an appropriate valuation model. It then describes absolute valuation methods like discounted cash flow analysis using free cash flow to the firm (FCFF) or free cash flow to equity (FCFE). Relative valuation methods discussed include comparing price/earnings (P/E), price/book value (P/B), and enterprise value/EBITDA multiples to industry peers. The document also briefly discusses the residual income model and notes factors to consider in choosing the most appropriate valuation model.