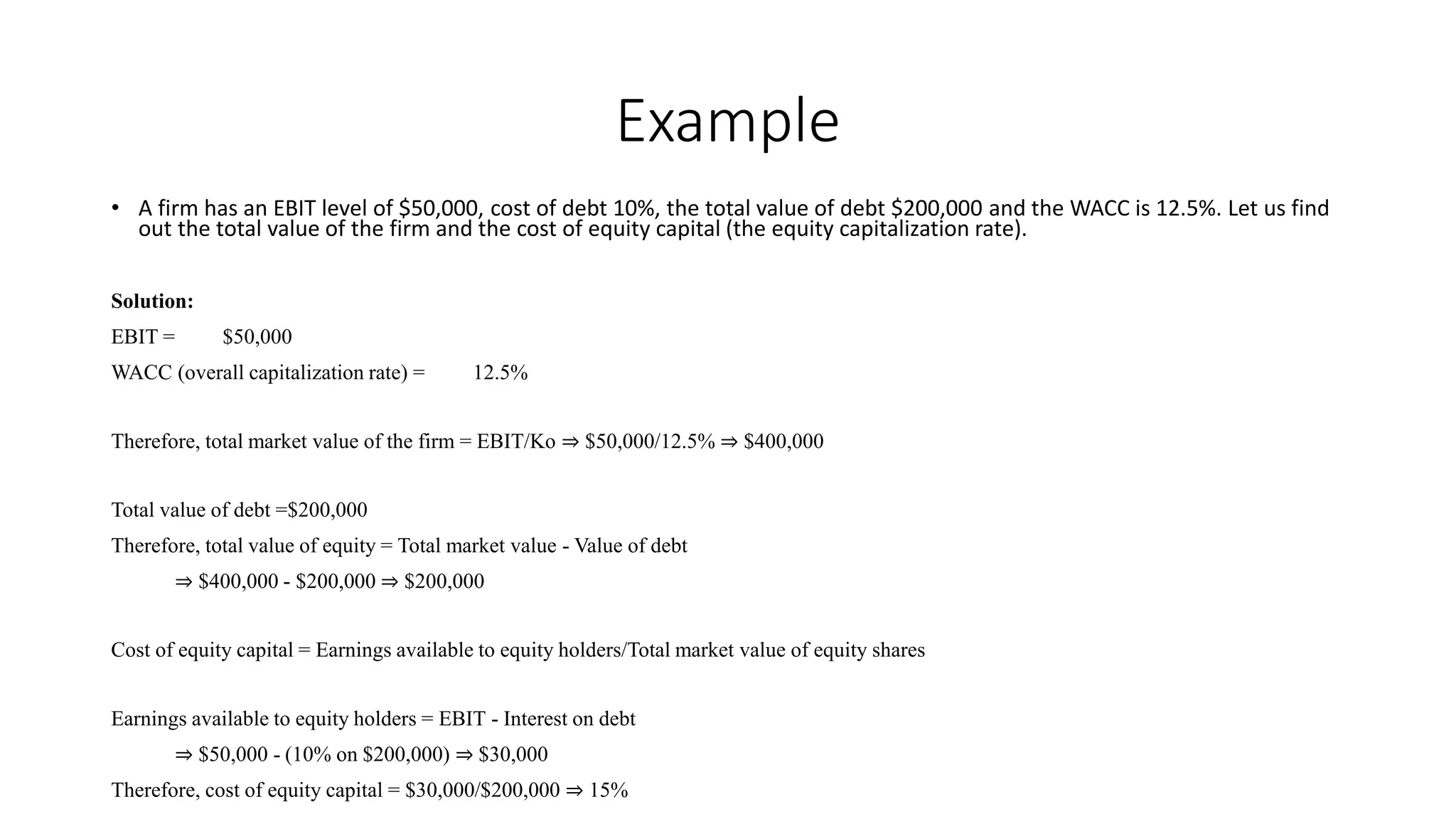

The Net Operating Income Approach suggests that a firm's capital structure and use of leverage is irrelevant to the total value or market price of the firm. It also claims that the overall cost of capital remains constant regardless of leverage. Key assumptions are that there are no taxes, debt costs remain constant, and the overall cost remains constant. An example shows that even if leverage increases from $200k to $300k debt, the total firm value, stock price, and overall cost of capital remain the same at $400k, proving the approach's claim of irrelevance.